The Mining Controversy

04 June 2022•

Cryptocurrency mining has been a hot topic in the crypto space, often credited with forcing government to look at regulating the crypto-industry sooner than they would have, had “crypto mining” not existed.

The problem lies in the energy intensiveness of crypto-mining, which is the process used to validate the blockchain ledger in the proof-of-work (PoW) consensus, used by the Bitcoin blockchain, which in turn rewards the miners with Bitcoin. And with Bitcoin being the most expensive cryptocurrency (1 BTC = US $46,000 on 1 January 2022) on the market, combined with making up roughly 40% of all cryptocurrency market capitalization, Bitcoin mining is a lucrative and major business activity around the world today. If you don’t want to pay $46,000 USD for a Bitcoin, then the only way to “earn” Bitcoin is to mine it at a more efficient cost.

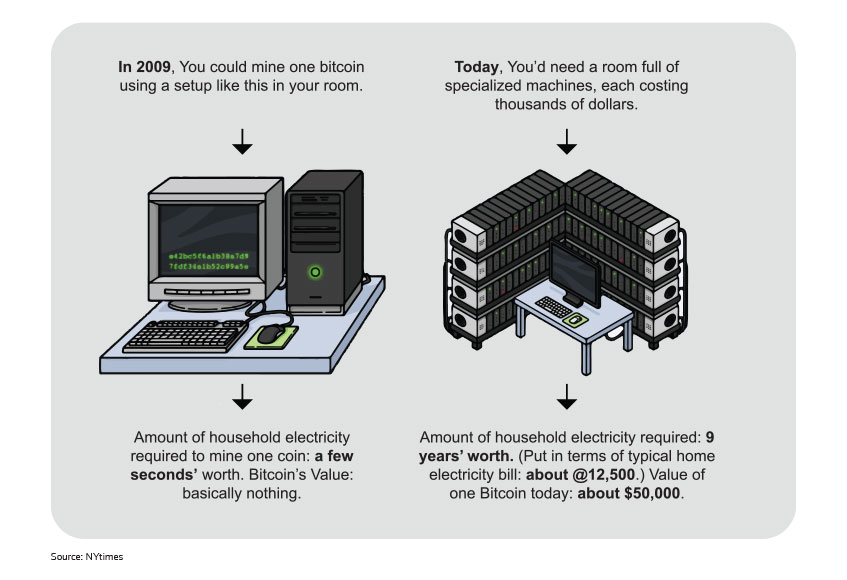

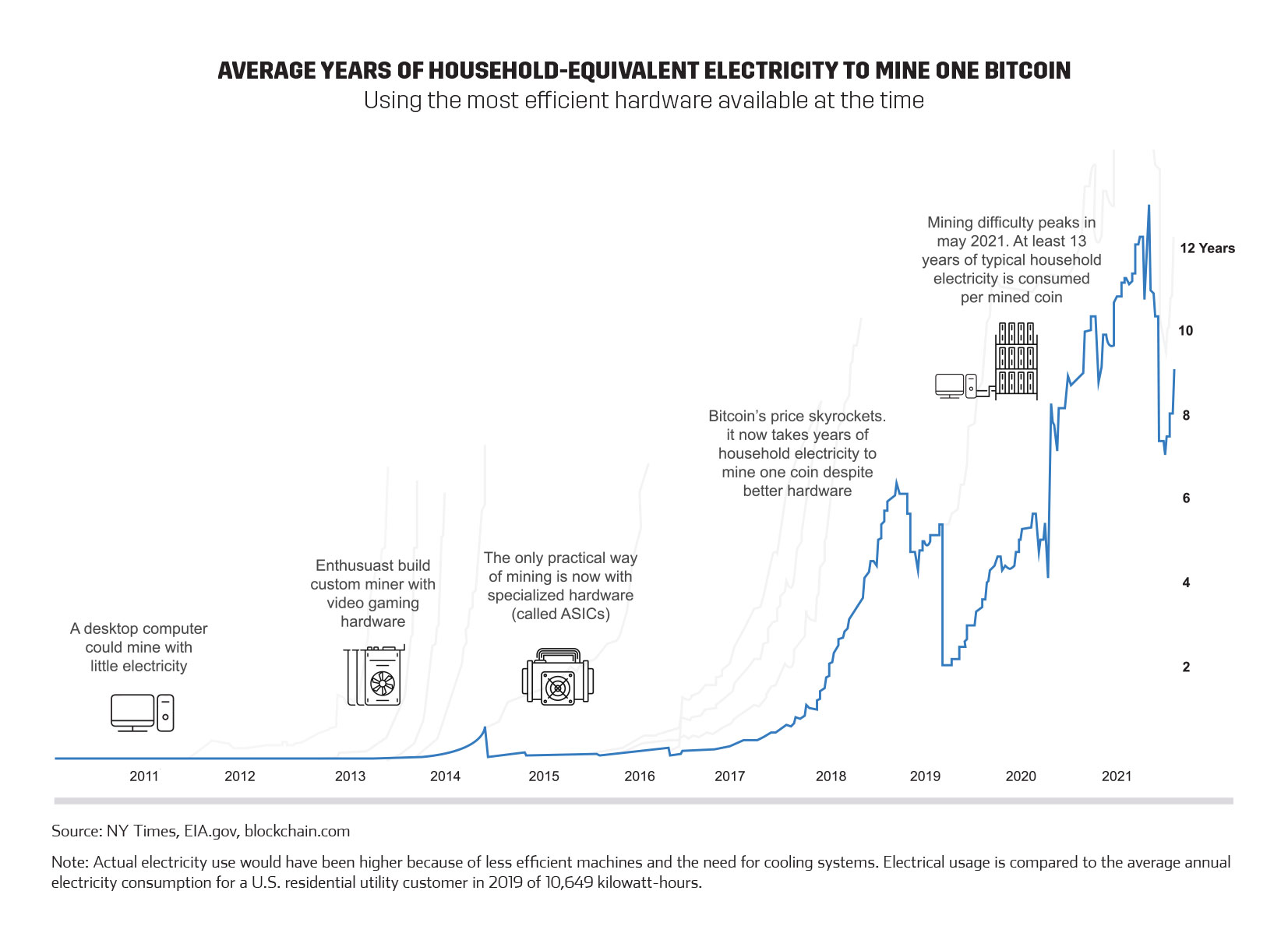

Mining has only become more lucrative since Bitcoin climbed from $30,000 at the beginning of 2021 to $63,000 at its peak in November 2021. If your electricity bill to mine one Bitcoin can be kept below the cost of one Bitcoin, and you can get your hands on a competitive Bitcoin mining rig (a high-speed computer system which can cost you anywhere from $1,000 to over $20,000 each), then it makes sense to get into the mining business. But as the NY Times summarizes in their article “Bitcoin Mining Uses More Electricity Than Many Countries. How Is That Possible” (September 2021), today’s bitcoin mining operations are major data centers, with heavy duty computing equipment that would utilize 9 to 13 years’ worth of electricity to mine a single Bitcoin (approximately US$12,500 for 1 BTC in New York State). Financially, your profit margin is substantial, if you are spending $12,500 on energy plus several thousand dollars on a mining rig, so long as Bitcoin remains priced above $20,000 USD it is likely worth the hassle; especially as winning against all the other miners and validating one block of bitcoin transaction, which happens roughly once every 10 minutes, rewards the winning miner with 6.25 bitcoins – each bitcoin which was valued at anywhere between $30K to $63K in 2021.

It’s no wonder analysts have valued the global crypto hardware market (just the hardware!) to grow by an additional US $2.8 billion between 2020 to 2024, amounting to be a US $4.5 billion industry alone. Today, most Bitcoin mining machines are highly specialized, live in big spaces – like giant data centers – with enough cooling power to keep the hardware running constantly without overheating. On top of that, because Bitcoin Mining is a race with only one winner, everyone wants the newest and most powerful hardware – leading to the generation of significant e-waste. Just think of all the miners that are using electricity and computing power every minute to validate the Bitcoin blockchain, 24/7, whether they win or lose out to a more powerful rig. It isn’t just the winning rig that is working hard to unlock those Bitcoin rewards, spending all that computational energy, that money on their energy bill to fuel their rigs and their cooling systems. This is what makes the Proof-of-Work consensus mechanism expensive and inefficient.

From an environmental and a resource-limitation point of view though, crypto-mining is just obscenely wasteful. The Bitcoin mining industry uses 91 terawatt-hours of electricity annually, more than the total electricity used by the single nation of Finland, with a population of 5.5 million. It’s also more than 7x the amount of electricity used by Google’s global operations! That amount of electricity, which constitutes 0.5% of total global energy usage today, has increased by ten-fold in just the past 5 years, and analysts fear it will only get worse. Such inefficient use of electricity for miners to get rich, doesn’t sit well with a lot of people.

China’s September 2021 decision to ban cryptocurrency altogether and make anything crypto-related a crime, is thought to be strongly driven by the unit economics of the energy intensiveness of crypto-mining. China’s commitment to reach its peak carbon emissions by 2030 and to go carbon neutral by 2060 is a key ambition for this aspiring world leader, and was clearly being threatened by China’s Bitcoin mining industry. China once housed up to 75% of all global Bitcoin mining operations, but Miners were swift in relocating their operations. Miners moved to the cheap-but-troubled Texas electricity grid (the US is now home to 35% of all Bitcoin mining operations), the coal-rich and cheap electricity grids of Kazakhstan (18%) which produce nearly 90% of its energy via fossil fuels, and to Russia (11%) which has 60% of its electricity mix generated from fossil fuels.

The USA was a natural relocation destination for mining operations for a few reasons. First and foremost, Texas has some of the cheapest energy in the world; fortunately, Texas leads the US in wind-powered generation and produced 28% of the country’s wind power electricity in 2020. In addition to cheap electricity, there was a sizeable supply of turn-key mining infrastructure in the country built-up by many deep-pocketed investors who had quietly accumulated and built crypto mining sites across the country during the less-expensive crypto winter years; this made it easy for crypto miners to spring-up overnight in 2021 as Bitcoin’s price surged.

Russia legally recognized cryptocurrencies in 2020, but soon after banned their use for transactions. In January 2022, Russia’s Central Bank released a report proposing an all-out ban on both crypto mining and crypto trading, citing threats to financial stability, citizen’s wellbeing and its monetary policy sovereignty (more on this in the regulatory chapter).

Kazakh officials are working to crack-down on “illegal” and unregistered bitcoin miners working in the country without the necessary permits, but seems pro-crypto for the time being. The power of the Kazakh mining operations was felt worldwide in January 2022 when civil unrest in the country had the government implement a nation-wide internet blackout, which stopped mining operations for days. This in turn sent the price of Bitcoin down, as nearly 1/5th of its miners went offline in one fell swoop.

In other countries, like Iran, the surge in demand caused by crypto miners was so great, that the grid failed, causing power outages across the country. As rolling blackouts spread throughout the country, Iranian officials were forced to ban crypto-mining for periods of time (in both the heat of summer and the middle of winter) when HVAC warming and cooling units in homes and industry would put more pressure on the grid. Iranian officials have stated that licensed mining operations have gone through the checks and balances, but many of the illegal mining operations are the ones that are not energy efficient in the country, and they seek to shutdown these illegal operations.

%2Fuploads%2Fcrypto-universe%2Fcover1.jpg&w=3840&q=75)