Sub-Saharan Africa Startup Funding Falls 50% in 2025: May YTD Trends & Top Deals

20 June 2025•

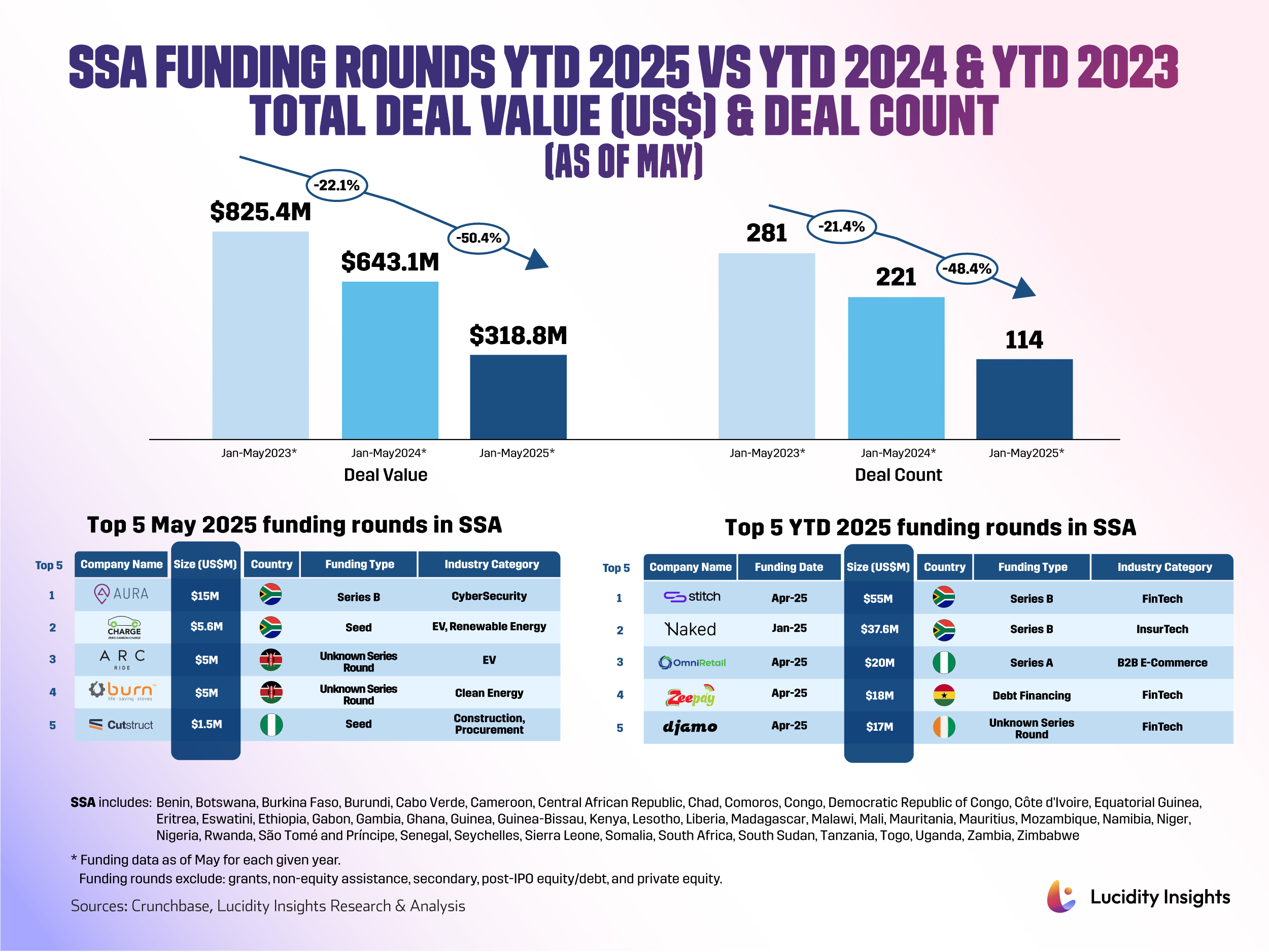

Sub-Saharan Africa’s venture capital environment continues its downward trajectory, with year-to-date (YTD) funding totals just US $318.8 million as of May 2025 for a drop over 50% from the US $643.1 million recorded in May 2024, after a 22% fall from the US $825.4 million recorded at the same time in 2023. Deal activity has also thinned dramatically, with only 114 deals logged by the end of May - cut nearly in half for two consecutive years now.

After a modest correction in 2024, 2025 has ushered in a sharper decline in investor appetite, both in value and volume. Building on last year’s 22.1% decline, the 50.4% drop in funding value this year reflects an increasingly cautious environment, where capital is both scarce and selectively deployed. Mega-rounds have become virtually extinct. Not a single deal has crossed the US $100 million threshold this year so far, in contrast to the same period in 2023 and 2024 which featured mega-rounds by Kenya’s M-KOPA, South Africa’s Showmax, and Nigeria’s Moove.

Meanwhile, deal count contraction suggests investors aren’t just writing smaller cheques—they're writing fewer altogether. The number of deals has almost halved in just one year, with May 2025’s 114 rounds a far cry from the 221 recorded in 2024 and 281 in 2023.

Despite the funding drought, South Africa continues to dominate SSA’s investment landscape. The country is home to the largest two funding rounds both in May alone and YTD. As for sectoral trends, FinTech still accounts for three of the top five YTD deals, but there’s a quiet pivot underway. Clean energy and electric vehicles are emerging as favored alternatives, perhaps reflecting a recalibration toward long-term, impact-driven returns as global sustainability goals trickle into investor mandates.

Macroeconomic Context & Outlook

According to the World Bank, economic growth in SSA is expected to inch up from 3.5% in 2024 to just 3.7% in 2025—a recovery dampened by “a deteriorating external environment and persistent domestic headwinds” (World Bank Global Economic Prospects, June 2025). High government debt levels and elevated interest rates have limited fiscal flexibility, while reduced aid inflows are forcing austerity measures. Per capita income growth remains too low to lift populations out of extreme poverty, and youth unemployment continues to rise as job creation fails to keep pace with rapid demographic growth. These structural weaknesses combined with climate shocks, rising sovereign spreads, and instability in some markets have tilted investor sentiment toward risk aversion. Capital is now flowing to fewer startups, with an emphasis on sustainable unit economics, proven demand, and essential services.

The SSA’s startup ecosystem thus remains in survival mode as founders are being forced to stretch runways, prioritize profitability, and delay expansions. For now, the message is clear: disciplined capital, fewer bets, and a focus on resilience will define SSA’s venture capital playbook in the months ahead.

Let’s take a look at the top 5 funding rounds of May 2025 in SSA.

1. Aura (South Africa) | CyberSecurity | US $15 Million Series B

Founded in 2017 by Warren Myers, Ryan Green, and Adam Pantanowitz, AURA Services is a marketplace that enables anyone to access the closest vetted private and public security and medical response unit to their location – anywhere, anytime – using a connected device. Now headquartered in the Netherlands, the startup will soon be expanding to the US where it has also kicked off its on-demand private security response model.

Aura just raised a EUR13.5 million (US$15.1 million) Series B funding round led by the Cathay AfricInvest Innovation Fund (CAIF) and Partech, bringing its cumulative fundraising to US $20 million. This will fund its expansion into the US and the development of a global “clearing house” to dispatch emergency response without borders.

2. Zero Carbon Charge (South Africa) | Electric Vehicles, Renewable Energy | US $5.6 Million Seed

Founded by Andries Malherbe and Joubert Roux, Zero Carbon Charge has developed a decentralized energy generation model that produces power directly at the point of consumption and sale, ensuring a sustainable and reliable energy supply for electric mobility. It has built a national network of solar-powered ultra-fast electric vehicle (EV) charging stations, each site fully off-grid, powered by solar energy and supported by battery storage – eliminating reliance on Eskom, and addressing range anxiety for EV drivers across the country.

Zero Carbon Charge just announced a ZAR100 million (US$5.6 million) equity investment from the Development Bank of Southern Africa (DBSA), which it said marks a significant endorsement of its mission to build climate-resilient infrastructure and accelerate South Africa’s transition to a net-zero transport economy. The seed funds will enable the rollout of Zero Carbon Charge’s ultra-fast charging stations every 150 km along all national roads.

3. ARC Ride (Kenya) | Electric Vehicles | US $5 Million Unknown Series Round

Founded in 2020, ARC Ride is an e-mobility battery-as-a-service (BaaS) provider addressing the challenge of slow EV adoption and limited access to charging facilities and appropriate financing solutions in Kenya by providing affordable and user-friendly BaaS solutions. The company has already installed 170 charging stations in Nairobi. This reduces the upfront cost of electric two-wheelers (E2Ws) and enables quicker battery swaps.

ARC Ride recently raised US $5 million in financing from British International Investment (BII), the UK’s development finance institution and impact investor to provide affordable, reliable and clean e-mobility solutions for rapidly developing cities in Kenya. BII’s financing will enable ARC Ride’s initial rollout of 5,000 E2Ws and accelerate the expansion of E2W BaaS infrastructure. By building Africa’s first and largest automated battery swapping network, it is also establishing the industry standard for battery swapping of E2Ws both for ARC Ride and other manufacturers, which is important for more EV adoption. It will directly result in over 100,000 metric tonnes of CO2 per year being saved as electric mobility replaces petrol motor bikes.

4. BURN (Kenya) | Clean Energy | US $5 Million Unknown Series Round

Founded in 2011 by Peter Scott, BURN is a Kenyan clean cooking appliance maker. Operating across nine countries, BURN manufactures the ECOA Cooker entirely in Kenya, aiming to reduce indoor air pollution, cut cooking times, and lower household energy costs. The company has already supplied over five million clean cookstoves in Africa, tackling health, environmental, and economic issues associated with traditional fuels like wood and charcoal.

BURN recently closed a US $5 million venture round led by EDFI ElectriFI, bringing its total raised to US $50.5 million. The funding will reduce household energy costs and eliminate an estimated 1.4 million tons of CO₂ emissions over the product’s lifetime through BURN’s IoT-enabled ECOA Induction Cooker (ECOA IDC) as over 100,000 Kenyan households will transition to clean, electric cooking.

5. Cutstruct (Nigeria) | Construction, Procurement | US $1.5 Million Seed

Founded in 2019 by Henry Osoisi Atang-Agama, John Oamen, and Modele Ajayi-Bembe, Cutsruct is a construction software platform making procurement simpler, faster, and more efficient across Nigeria. With Cutstruct, developers can rely on one trusted partner and leading construction materials marketplace for all materials, from cement and steel to roofing sheets and tiles.

Cutstruct recently raised US $1.5 million in a seed round led by CRE Venture Capital, bringing the company to a total of US $2.4 million in fundraising to date. The funds will be for scaling, “to make construction smarter, faster, and better,” said Jessica Oguh, Media & Communications at Cutstruct. “We believe builders should be able to focus on building, not chasing vendors or worrying about delays.”

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)