Proptech in the Middle East & Africa: Market Trends, Challenges & Opportunities

27 March 2025•

What Is Proptech?

Proptech, short for property technology, is an innovative field that blends real estate with cutting-edge technology to optimize the way we buy, sell, and interact with property. This sector utilizes digital platforms, artificial intelligence, big data, and the Internet of Things (IoT) to make real estate transactions more efficient and user-friendly.

Proptech is rapidly becoming a transformative force in the global real estate market, offering solutions that streamline processes, enhance property management, and improve customer experiences. As a catalyst for change, Proptech not only modernizes traditional practices but also addresses broader economic and social challenges within the real estate industry.

Is a Proptech Revolution on Its Way in the Middle East and Africa?

The property sector is pivotal to the economic landscape in the Middle East and Africa (MEA) region, accommodating a population of 1.7 billion homeowners and tenants as of 2024. The MEA region is poised to transform its property sector, driven by technological advancements in Proptech which hold the potential to address the region's unique challenges—such as rapid urbanization, inefficient systems, and housing shortages—while capitalizing on emerging opportunities. This vast and virtually untapped market positions Proptech at the forefront of the region’s ongoing digitization and economic diversification efforts.

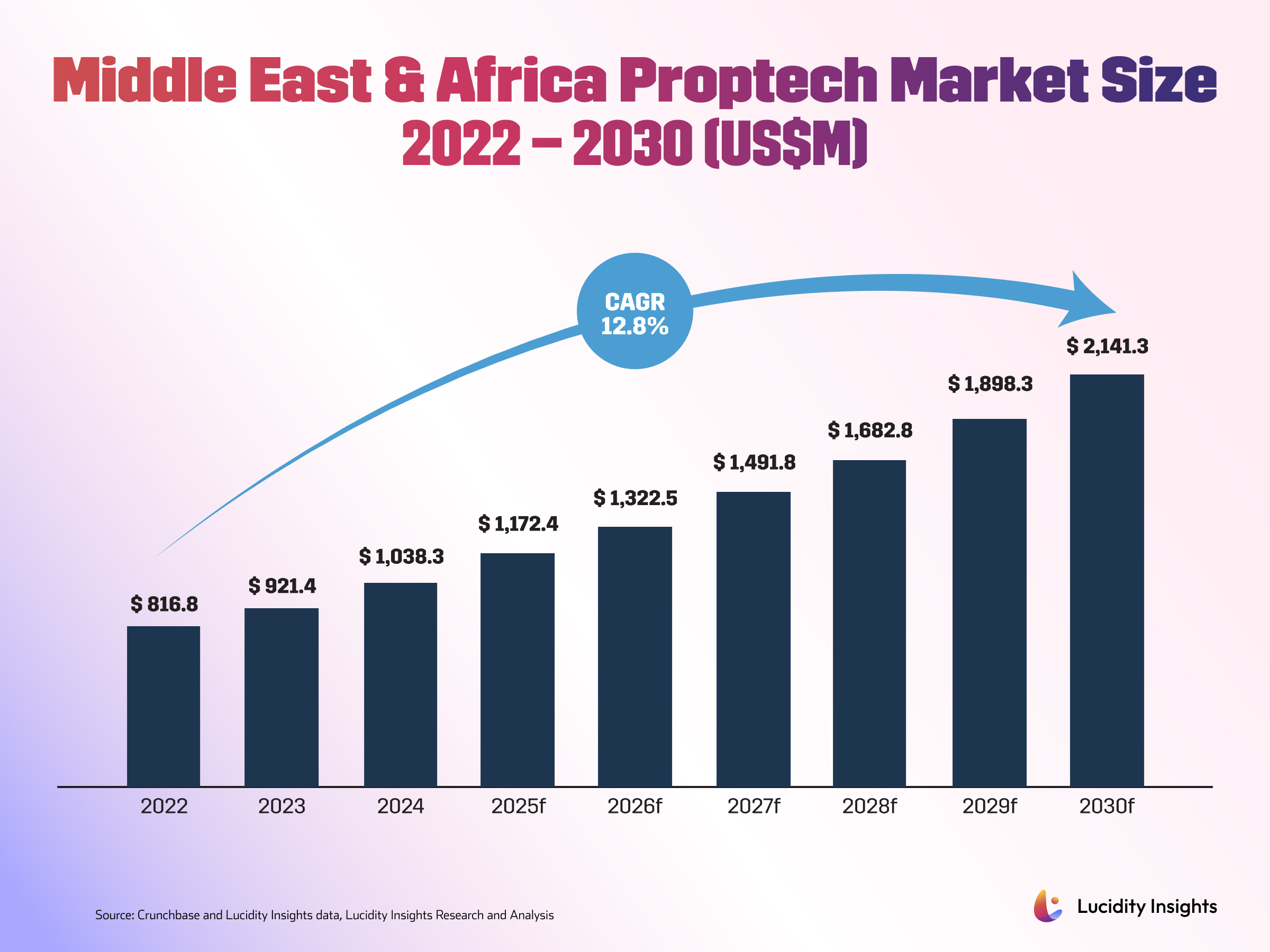

Middle East & Africa Proptech Market Size 2022 – 2030 (US$M)

The MEA Proptech market has been gaining impressive momentum, generating US $816.8 million in revenue in 2022, and is forecasted to have broken the US $1 billion market size in 2024. With a compound annual growth rate (CAGR) of 12.8% projected from 2022 to 2030, the market is set to expand significantly, reaching US $2.14 billion by 2030. This growth is fueled by increasing adoption of technology in property management, real estate transactions, and construction processes across the region. In 2022, the residential sector led the market in terms of revenue, showcasing strong demand for digital solutions in residential property transactions and management.

However, the commercial and industrial sectors are expected to be the fastest-growing segments throughout the forecast period. As businesses increasingly invest in digital solutions to streamline operations, optimize building management, and enhance tenant experiences, Proptech innovations will play a vital role in transforming the region’s property landscape.

Proptech Trends Across the Middle East & Africa

Each region within the MEA presents its own unique set of challenges and regulatory frameworks, making the area a hub for innovation. The Gulf Cooperation Council (GCC) countries have experienced consistent growth in the property sector over the past decade. As of 2024, the total value of planned or ongoing real estate projects in the Gulf stands at US $1.7 trillion. Real estate in these markets accounts for over 10% of the national GDP. However, the sector faces significant inefficiencies, largely due to the complexity of its value and supply chains, as well as longer-than-average licensing timelines.

In contrast, Sub-Saharan Africa is grappling with rapid urbanization, where cities are expanding much faster than the supporting infrastructure, including housing. The region’s population is currently growing three times faster than the global average, with half of the world’s population growth between 2022 and 2050 expected to occur in Sub-Saharan Africa. According to a report published by the African Development Bank, this has already resulted in a housing deficit estimated at around 51 million units.

With 96% of Sub-Saharan Africa’s population living on just 6% of the land, Proptech offers a transformative opportunity to rethink how space is developed and utilized. Addressing this housing shortage could unlock significant economic benefits for the region. It is estimated that closing the housing gap in Sub-Saharan Africa could generate US $5 trillion in economic output and create 26 million jobs annually.

Across the MEA region, the property sector grapples with issues related to affordability, urban planning, and environmental impact. Sub-Saharan Africa’s housing crisis is compounded by inadequate infrastructure and planning, while the Gulf’s thriving real estate market struggles with inefficiencies from complex value chains.

Additionally, the property sector’s significant contribution to global CO2 emissions and its reliance on outdated, manual processes highlight the urgent need for digital transformation. Rising interest rates and inflation further challenge the sector, emphasizing the critical role that tech-driven solutions must play in enhancing efficiency, affordability, and sustainability.

%2Fuploads%2Fproptech-2024%2Fcover25.jpg&w=3840&q=75)