The 5 Most Funded PropTech Startups in ME&A in 2024

29 March 2025•

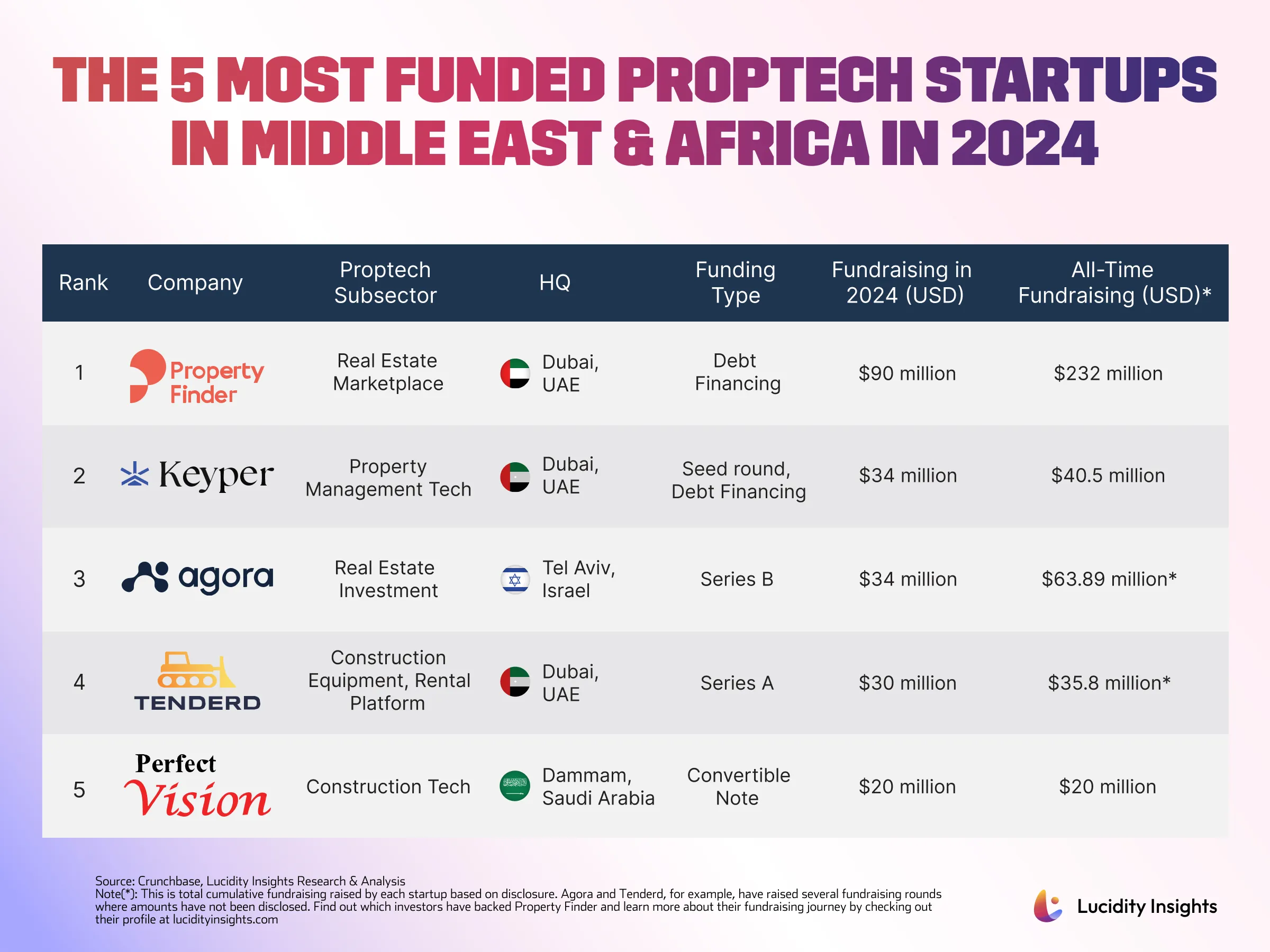

A growing number of startups are emerging, ready to challenge traditional practices in property commercialization, design, construction, and management. So far, investor interest has focused primarily on commercialization, with 46% of all deals targeting this area.

1. Property Finder

Headquarter: Dubai, UAE

Established: 2007

Proptech Sub-sector: Real Estate Marketplace

Growth Stage: Series B+

Fund Raised: $232M

Founded in 2007 by Michael Lahyani and Renan Bourdeau, Property Finder provides a platform for property listings, real estate search, and property management to help users find, buy, sell, and rent properties in MENA. Competing with platforms like Dubizzle and Bayut, Property Finder has expanded across the region, including Qatar, Bahrain, and Egypt, with a focus on Saudi Arabia and Turkey.

In May 2024, Property Finder secured US $90 million in debt financing from Francisco Partners, bringing its total fundraising to US $232 million. The funds were dedicated to repurchasing shares from its initial investor, BECO Capital, amidst ongoing domestic and international interest in the UAE's thriving real estate market. BECO Capital, which has previously invested in notable companies like Careem and Fetchr, has exited its investment in Property Finder with a significant return.

Find out which investors have backed Property Finder and learn more about their fundraising journey by checking out their Profile.

2. Keyper

Headquarter: Dubai, UAE

Established: 2022

Proptech Sub-sector: Rent-Now-Pay-Later (RNPL), Property Management Tech

Growth Stage: Seed+

Fund Raised: $40.5M

Founded in 2022 by Omar Abu Innab and Walid Shihabi, Keyper is a Rent Now Pay Later (RNPL) startup that aims to revolutionize real estate transactions and property management in the region by making them seamless and efficient. Keyper’s platform allows tenants to track expenses and pay rent online, while investors gain access to real estate portfolios and data-driven insights. In 2024, Keyper onboarded 3,000 residential units valued at US $2 billion, processed over US $10 million in annual rent payments, and facilitated over US $1 million in annual rent transactions.

In May 2024, Keyper raised US $4 million in seed funding, along with an additional US $30 million through Shariah-compliant debt financing, led by Dubai-based BECO Capital and Middle East Venture Partners. This brought the company’s total funding to US $40.5 million. The funds are being used to digitize the rental experience in the UAE and scale Keyper’s RNPL solution, enabling landlords to receive annual rents upfront while tenants enjoy the flexibility of paying in monthly installments via credit or debit cards and other digital payment methods.

Find out which investors have backed Keyper and learn more about their fundraising journey by checking out their Profile.

3. Agora

Headquarter: Tel Aviv, Israel

Established: 2019

Proptech Sub-sector: Real Estate Investment

Growth Stage: Series B

Fund Raised: $63.89M

Founded by Bar Mor, Lior Dolinski, and Noam Kahan in 2019, Agora provides a comprehensive investment management platform that helps real estate firms manage data, automate reporting, streamline fundraising processes, and provide bookkeeping and tax services. By 2024, Agora had more than doubled in valuation and tripled its revenue year-over-year, operating across North America, Europe, and Israel.

In May 2024, Agora raised US $34 million in its Series B funding round led by Qumra Capital for a total funding of US $63.9 million. The funds will be used to expand Agora's operations, allocate resources towards research and development, particularly in operational and financial services such as payments, tax, IRA investments, and liquidity solutions, with a portion going towards secondary deals.

Find out which investors have backed Agora and learn more about their fundraising journey by checking out their Profile.

4. Tenderd

Headquarter: Dubai, UAE

Established: 2018

Proptech Sub-sector: Construction Equipment Rental Marketplace

Growth Stage: Series A

Fund Raised: $35.8M

Founded in 2018 by CEO Arjun Mohan, Tenderd operates in heavy industries like construction, energy, marine, and logistics. Its marketplace enables companies to supply and rent construction machinery, while also providing customers with AI-generated insights to optimize asset utilization and reduce emissions.

In June 2024, Tenderd raised US $30 million in Series A funding led by A.P. Moller Holding, bringing its total funding to US $35.8 million. By leveraging sector-specific data, Tenderd is developing AI models tailored to industry needs, setting itself apart from generic models and driving transformative change. Tenderd is using these funds to accelerate technological advancements and expand globally, particularly through integrating AI into operations across construction, mining, and industrial sectors.

Find out which investors have backed Tenderd and learn more about their fundraising journey by checking out their Profile.

5. Perfect Vision

Headquarter: Dammam, Saudi Arabia

Established: 2017

Proptech Sub-sector: Construction Tech

Growth Stage: n/a

Fund Raised: $20M

Founded by Saleh Awad in 2017, Perfect Vision specializes in IoT and AI for various industries, including construction, oil and gas, and electronics, enhancing safety, logistics, and operational efficiency through its advanced tech solutions. Operating primarily in Saudi Arabia, Perfect Vision also had a presence across the rest of the Middle East, Africa, and Europe.

In October 2024, Perfect Vision raised US $20 million in a convertible note. The funds will be used to scale their operations in the Industrial Internet of Things (IIoT) and Artificial Intelligence of Things (AIoT) spaces, particularly focusing on enhancing their smart factory model and expanding their safety and logistics solutions, while protecting the environment and driving human progress in line with the KSA’s Vision 2030 plan.

Find out which investors have backed Perfect Vision and learn more about their fundraising journey by checking out their Profile.

%2Fuploads%2Fproptech-2024%2Fcover25.jpg&w=3840&q=75)