MEAPT Startups Raise $5.87B YTD: May 2025 Sees More Mega-Rounds and Investor Focus

15 June 2025•

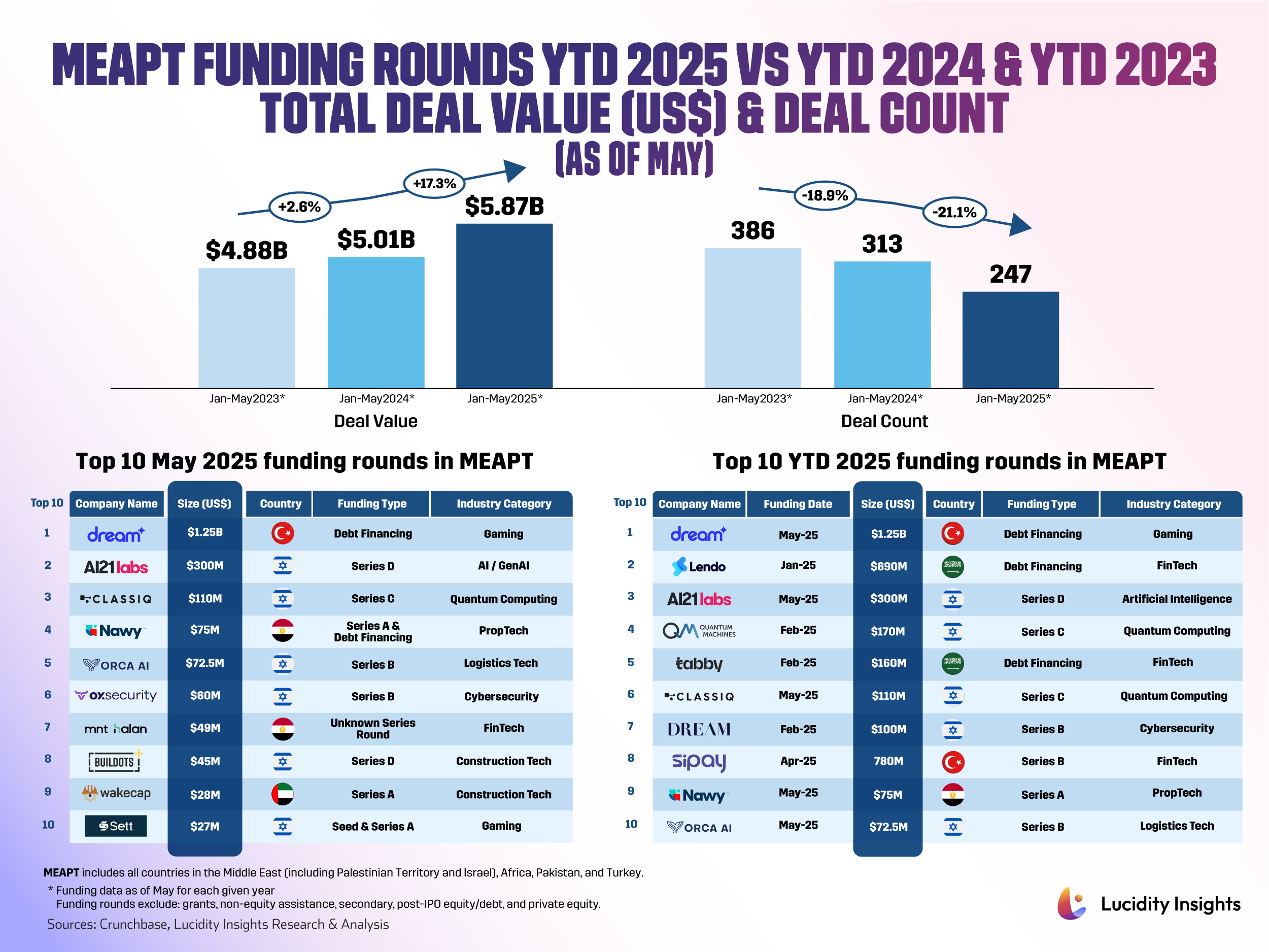

As of May 2025, MEAPT startups have secured US $5.87 billion in year-to-date funding, marking a 17.3% rise over the US $5.01 billion raised during the same period in 2024, after a modest 2.6% increase from the US $4.88 billion seen in 2023. Despite this rise in total VC funding, the number of deals has fallen by nearly 20% for the second year in a row with only 247 deals closed so far in 2025.

A defining feature of this month’s VC activity is the dominance of mega-rounds (deals > US $100 million). Of the top 10 funding rounds in the MEAPT region this year, 3 occurred in May—underscoring the month’s outsize impact on 2025’s capital inflow. Leading the charge was Turkey’s Dream Games, which raised a colossal US $1.25 billion in debt financing as the largest single round not just this month but for the year so far. This deal alone has accounted for nearly a quarter of MEAPT’s 2025 funding YTD! Israel followed with 2 mega-rounds of its own: AI21 Labs’ US $300 million Series D and Classiq Technologies’ US $110 million Series C. From this we see that Turkey and Israel have asserted themselves as the MEAPT region’s most prominent fundraising hubs so far in 2025. Turkey’s Dream Games and Sipay contributed a combined US $1.328 billion, while Israel’s stronghold in deep tech—AI, quantum computing, and cybersecurity—is reflected in its share of five of the top ten YTD rounds.

Sectoral Trends, Macroeconomic Headwinds, and Investor Discipline

The top 10 YTD 2025 rounds reveal a distinct barbell dynamic. On one end, deep tech, where capital is chasing breakthrough potential in a high-risk environment. And on the other, debt-financed, revenue-generating fintech models that promise near-term cash flows. AI21 Labs and Quantum Machines (Israel) and Tabby (Saudi Arabia) are emblematic of this divide, showing how investors are either betting on long-term innovation or anchoring portfolios in defensible, monetized platforms.

The investor pullback in deal count is not occurring in a vacuum. Global financial conditions remain tight. While inflation has moderated in some MEAPT markets, high interest rates in developed economies are still deterring capital flow into riskier frontier markets. According to the IMF’s April 2025 Global Financial Stability Report, “global financial stability risks have increased significantly. This assessment is supported by three key forward-looking vulnerabilities: (i) valuations remain high in some key markets; (ii) some highly leveraged financial institutions and their nexus with banking systems; and (iii) risks of market turmoil and challenges to debt sustainability for highly indebted sovereigns” (IMF, 2025).

Looking Ahead

As H1 2025 nears its end, the central question remains whether this small bump in funding volume can be sustained without a corresponding recovery in deal count. If current patterns hold, capital will continue to cluster around fewer winners, leaving early-stage startups scrambling for visibility. Whether MEAPT VC activity stabilizes or contracts further will depend heavily on macro shifts—rate cuts in the US, a softer dollar, and domestic reforms to bolster startup ecosystems across the globe.

Let’s take a look at the top 10 funding rounds of May 2025 in MEAPT.

1. Dream Games (Turkey) | Gaming | US $1250 Million Debt Financing

Founded in 2019 by Soner Aydemir, Serdar Yilmaz, Eren Yanik, and Mark Muller, Dream Games is a mobile gaming company best known for its first mobile puzzle game, Royal Match, where users progress through levels to help a king decorate his castle. Royal Match has become one of the top-grossing mobile games globally, consistently ranking in the top 10 in major markets such as the US and UK, generating approximately US $20 million per month from in-game purchases with 6 million monthly active users.

Dream Games recently secured US $1.25 billion in debt financing as part of a larger $2.5 billion fundraising round led by Blackstone-managed funds and other private credit lenders, bringing its total cumulative funds raised to US $3 billion. The primary purpose of the funds is to buy out existing investors, allowing the founders to retain a 70% ownership stake in the company. This move also nearly doubles Dream Games’ valuation from US $2.75 billion to $5 billion.

2. AI21 Labs (Israel) | AI | US $300 Million Series D

Founded in 2017 by Amnon Shashua, Yoav Shoham, and Ori Goshen, AI21 Labs was an early entrant in the generative AI space. Shashua, best known as the co-founder of autonomous driving company Mobileye, has long emphasized the need to build “trustworthy AI” rather than chasing viral chatbot moments. AI21’s models and tools are already used by enterprise clients including Capgemini and Wix, the Israeli web development firm, which says it powers hundreds of AI applications through AI21’s systems.

AI21 Labs recently raised a US $300 million Series D funding round with backing from Google and Nvidia, bringing the company’s total capital raised to $626.5 million. AI21 Labs plans to use the funding to expand its enterprise AI offerings, such as scaling its large language model (LLM) suite, including the Jamba series, which is optimized for long-context understanding and enterprise-grade applications.

3. Classiq Technologies (Israel) | Quantum Computing | US $110 Million Series C

Founded in 2020, Classiq Technologies has developed deep technology and built a leading quantum software product that unleashes this new wave of computing power. Classiq serves enterprises across industries, including BMW, Citi, Deloitte, Rolls-Royce, Mizuho and Toshiba. The company collaborates with leading entities such as Microsoft, AWS and NVIDIA, and is also deeply embedded across academia, forming part of the official curriculum in many top-tier universities. Classiq has tripled its customer base and revenues year over year and is used by dozens of the top enterprise teams and hundreds of academic institutions worldwide, enabling the creation of quantum applications.

Classiq recently raised US $110 million in Series C funding led by Entrée Capital in the largest ever for a quantum software company, bringing Classiq’s total funding to US $171.8 million. This positions the company to meet growing demand by significantly scaling its go-to-market, customer success and R&D teams. Classiq will expand its global footprint to broaden its leading role in national quantum initiatives and as a cornerstone of the quantum ecosystem.

4. Nawy (Egypt) | Proptech | US $75 Million Series A & Debt Financing

Founded in Egypt in 2019 by Mostafa El-Beltagy, Abdel-Azim Osman, Ahmed Rafea, Mohamed Abou Ghanima, and Aly Rafea, Nawy has rapidly grown into Africa’s largest real estate technology company. Its platform transforms how people buy, sell, invest, finance, and manage properties. The company closed 2024 with more than $1.4 billion Gross Merchandise Value (GMV) and a monthly user base exceeding one million. Over the past four years, Nawy's revenue in U.S. dollar terms has grown more than 50-fold, even as the Egyptian pound lost 69% of its value.

Nawy just raised US $75 million between a Series A round and debt financing led by Partech. Nawy will use the equity funding to scale operations, enhance technology stack, and accelerate regional expansion, while the debt financing is dedicated exclusively to fueling the company’s rapidly growing mortgage offer.

5. Orca AI (Israel) | Logistics Tech | US $72.5 Million Series B

Founded in 2018 by CEO Yarden Gross and CTO Dor Raviv, Orca AI is revolutionizing the traditionally opaque, conservative shipping industry with AI-powered decision making and autonomous shipping capabilities. The company has the world's largest marine visual dataset, built from over 80 million nautical miles. Powered by advanced AI and computer vision, this dataset forms the foundation for unmatched situational awareness capabilities in ocean navigation, helping captains and crew members identify risks and targets that cannot be spotted with the human eye. By delivering AI-based alerts and recommendations, Orca AI is able to significantly reduce the probability of collisions that have a severe economic and human impact, so crews can focus their attention on the most critical parts of their voyages.

Orca AIrecently closed an investment of US $72.5 million in Series B funding led by Brighton Park Capital, bringing its cumulative funds raised to US $111.1 million. The investment will enable Orca AI to further its autonomous platform, add new capabilities and enter new categories, including defense and security. The funding will also strengthen the company's position as the market leader in autonomous shipping.

6. OX Security (Israel) | Cybersecurity | US $60 Million Series B

Founded by Lior Arzi (CPO) and Neatsun Ziv (CEO), OX Security's platform enables precise, evidence-based risk prioritization throughout the software development lifecycle, highlighting the real-world impact of vulnerabilities and empowering teams to focus exclusively on critical threats. By eliminating the noise of non-critical issues, OX dramatically improves organizations' risk posture while saving millions in wasted developer hours. Today, OX is trusted by over 200 organizations, including Microsoft, IBM, eToro, and SoFi. The company, which enables organizations to focus developers on the 5% of Application Security risks that matter, hit $10 million in sales and more than tripled its customer base over the past year.

OX Security recently rasied US $60 million in Series B funding led by DTCP, bringing OX's total raised to US $94 million. The new funding will be used to accelerate product innovation, expand the company's global footprint, and continue helping enterprises move from reactive security to measurable risk reduction.

7. MNT-Halan (Egypt) | FinTech | US $49 Million Unknown Series Round

Founded in 2017 by Mounir Nakhla and Ahmed Mohsen, MNT-Halan made its debut as a ride-hailing platform centered in Zamalek, Giza and now describes itself as Egypt’s largest non-bank lender to the unbanked. MNT-Halan offers loans, BNPL options, e-commerce, and more through its payment-processing software Halan Neuron, as well as its digital cards and wallets. Today, MNT-Halan boasts over 1.5 million monthly active users, six million customers, four million financial clients, and 2.5 million borrowers.

MNT-Halan recently raised US $49 million through a corporate bond issuance, bringing its cumulative funding to over US $676 million. The funds will be used to: expand MNT-Halan’s loan book in Egypt, fuel growth into new markets like Pakistan, where the company plans to open 100 branches and extend digital lending services, as well as enhance financial inclusion for unbanked populations using AI-driven credit infrastructure.

8. Buildots (Israel) | ConstructionTech | US $45 Million Series D

Founded by Roy Danon (CEO), Yakir Sudry (CTO), and Aviv Leibovici (CPO), Buildots uses advanced AI and computer vision technology provides predictive analytics to help construction teams cut delays by up to 50% and unlock millions in cost savings. In 2025, Buildots is on track to quadruple its North American presence, building upon its current client base, which includes top general contractors and project owners like The Turner Corp., STO Building Group Inc., JE Dunn Construction Group, Samet Corporation, Mortenson, Ledcor, and Pomerleau. The company has also established strategic agreements with leading UK contractors, including Sir Robert McAlpine, as well as implementations with Wates, Kier, Multiplex and IHP. In Europe, it works with VINCI Construction, NCC, Hochtief, GCC, Bouygues Construction and more.

Buildots recently announced the completion of a US $45 million funding round led by Qumra Capital, bringing Buildots' total funding to US $166 million. With triple-digit revenue growth projected for another year, Buildots continues to gain momentum as it reshapes how construction is managed. As part of the collaboration, Boaz Dinte, Managing General Partner at Qumra Capital, will join Buildots as a board member. The company is also expanding its platform to cover more stages of the construction lifecycle, using historical data to benchmark and optimize future project performance – a capability that this latest funding round will accelerate at scale.

9. WakeCap Technologies (UAE) | ConstructionTech | US $28 Million Series A

Founded in Saudi Arabia, WakeCap focuses on leveraging wearable technologies and the Internet of Things (IoT) to gather and analyse real-time data from construction sites. The company’s innovative solutions aim to enhance safety standards and operational efficiency, positioning it at the forefront of the digital transformation of the construction industry. WakeCap specialises in developing wearable technology solutions that enable contractors and project managers to monitor workers and field operations in real-time, helping to reduce risks and improve operational efficiency on large-scale construction projects.

WakeCap has announced the closure of a US $28 million funding round at the Saudi-US Investment Forum, bringing its cumulative funds raised to US $30.5 million. With the new funding, WakeCap aims to expand its operations within Saudi Arabia and across regional and international markets. The company plans to enhance its data analytics capabilities and further integrate digital solutions in an industry that remains one of the least digitally transformed.

10. Sett (Israel) | Gaming | US $27 Million Seed & Series A

Founded in 2022 by Amit Carmi (CEO) and Yoni Blumenfeld (CTO), Sett is tackling the rapidly expanding mobile gaming market. Sett's Agentic AI platform enables gaming companies to generate diverse, data-driven video ads and in-game content at scale. Unlike its competitors, its AI is trained on data from live campaigns, competitor activity, and consumer trends, enabling it to produce creative assets optimized for performance and ROI. This includes not only high-performing video ads that maximize return on ad spend (ROAS) for mobile marketers' user acquisition but also personalized mini-games and in-game assets.

Sett recently emerged from stealth with a US $15 million Series A funding round led by Bessemer Venture Partners following a US $12 million seed round backed by F2 Venture Capital, Bessemer, and gaming industry leaders as angel investors, bringing Sett's total funding to US $27 million. Sett is already working with top gaming companies, including Playtika, SuperPlay, Candivore, and Cyplay. The company plans to double its team by the end of 2025, focusing on hiring the very best AI and engineering talent in Israel.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)