Late-Stage Dominance & FinTech Strength in MEAPT H1 2025: June

10 July 2025•

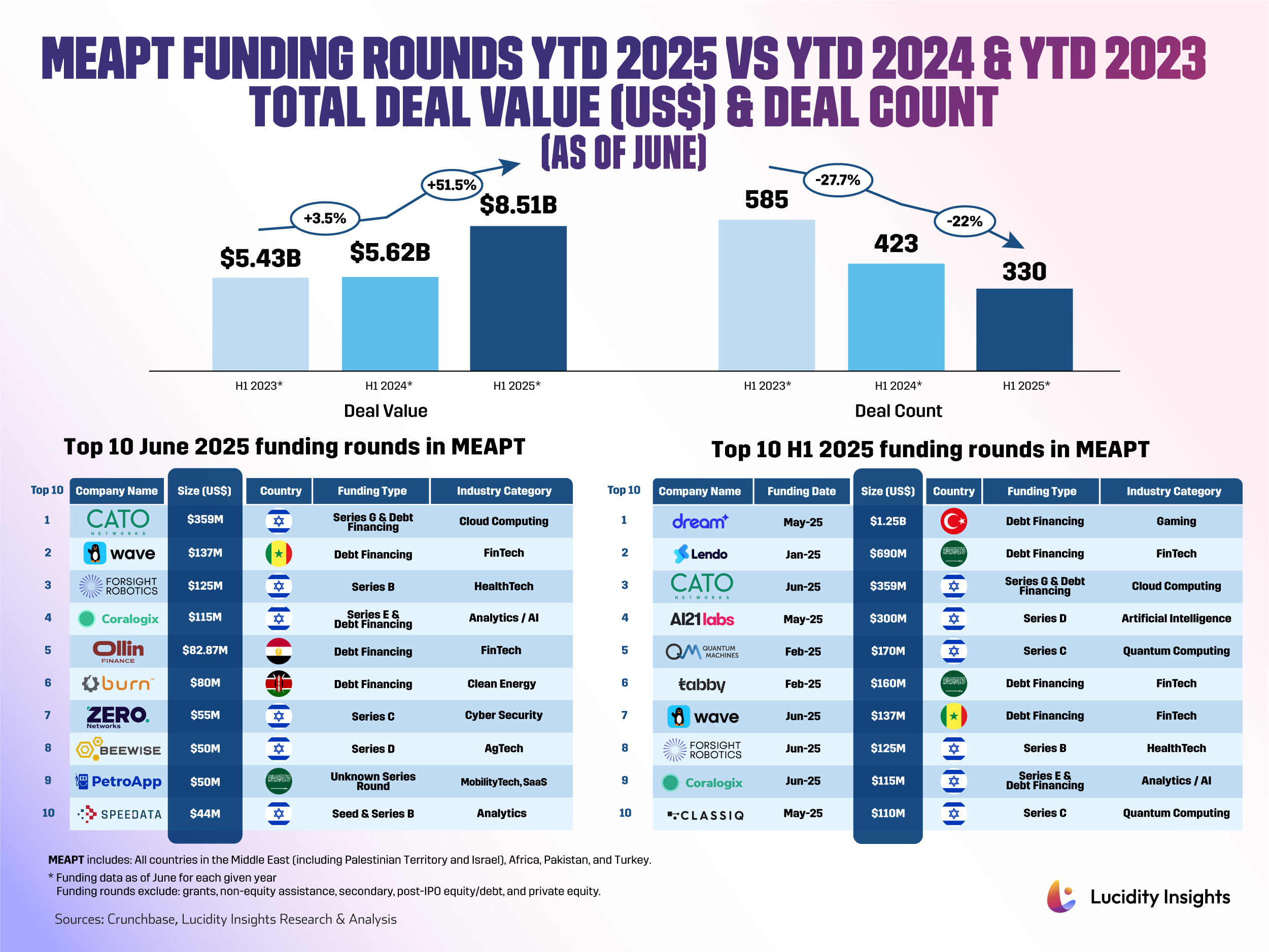

As the first half of 2025 comes to a close, a tale of two VC trends is unfolding across the Middle East, Africa, Pakistan, and Turkey (MEAPT). On one side, capital inflows have surged. On the other, deal activity continues to decline. Year-to-date (YTD) funding in H1 2025 reached US $8.51 billion, a 51.5% increase from the same period in 2024. But this influx of capital has been accompanied by a sharp contraction in deal count, which dropped to 330 rounds—a continued slide from 423 deals in H1 2024 and 585 in H1 2023.

Also Read: VC Tide Turns: MEAPT Raises $8.51B but Fewer Deals in H1 2025

June alone accounted for four mega-rounds (deals exceeding US $100 million), all of which now rank among the ten largest MEAPT deals of the year. While investors appear increasingly willing to deploy large sums, they are placing fewer bets overall. Recent momentum has been driven by late-stage confidence. Rather than a broad-based recovery, what’s emerging is a top-heavy market dominated by large, mature companies while early-stage deal flow continues to thin.

Sectoral, Geographic, and Macroeconomic Trends

From a sector perspective, FinTech has remained particularly strong throughout the year, with multiple high-value debt rounds reflecting growing demand for non-dilutive capital amid tighter equity markets. Meanwhile, Artificial Intelligence and Cloud Computing continue to benefit from enterprise digital transformation, drawing investor appetite for both foundational models and enabling infrastructure across the region.

While Israel remains the undisputed capital of venture-backed innovation in MEAPT, deal activity in select African markets is starting to gain ground. Notably, Senegal’s Wave Mobile Money—which raised US $137 million in June—became the only African startup to make it into the region’s top ten year-to-date funding rounds, signaling renewed interest in West Africa’s FinTech landscape.

These trends are unfolding against a complex macroeconomic backdrop. Although global interest rates remain elevated and the US dollar continues to strengthen, MEAPT’s performance suggests that capital is still finding its way into high-confidence opportunities. According to the IMF’s April 2025 Global Financial Stability Report, frontier markets are facing continued liquidity constraints driven by rate tightening and dollar strength (IMF, 2025). This helps explain the falling deal count: investors are de-risking by concentrating capital into late-stage, revenue-generating companies while avoiding earlier-stage ventures.

Outlook on a Top-Heavy Market

Looking ahead to the second half of the year, the key question is whether early-stage activity will rebound—or continue to lag behind. The sheer volume of capital raised in June is encouraging, but the absence of broad-based deal flow points to a fragile foundation. If global liquidity conditions tighten further, MEAPT may see even more consolidation around a few high-profile players, leaving the broader startup ecosystem undercapitalized.

However, if macro conditions stabilize and exit activity accelerates—particularly through IPOs on exchanges like Tadawul or Borsa Istanbul—investor confidence could begin trickling down to earlier-stage startups. For now, H1 2025 tells a story of selective resurgence: capital is flowing, but only to the boldest and best-positioned companies.

Let’s take a look at the top 10 funding rounds of June 2025 in MEAPT.

#1 - Cato Networks (Israel) | Cloud Computing | US $359 Million Series G & Debt Financing

Cato Networks Ltd. provides a comprehensive and integrated solution for enterprise communication and security through the world's first Secure Access Service Edge (SASE) platform. Their platform, known as Cato SASE Cloud, combines SD-WAN (Software-Defined Wide Area Network) and network security into a global, cloud-native architecture, leveraging a converged software stack, global cloud distribution, and common policy and data management to reduce complexity, risks, and costs.

In June 2025, Cato announced its Series G funding round, raising US $359 million led by new investors including Vitruvian Partners and ION Crossover Partners. The investment brings Cato's valuation to more than US $4.8 billion and total funding to more than US $1 billion, a significant milestone in the company's mission to redefine enterprise security for the digital and AI era. With the additional funds, Cato will continue to challenge the industry's perception of SASE and AI security, expand to additional use cases, and increase the total addressable market (TAM) of the company.

#2 - Wave Mobile Money (Senegal) | FinTech | US $137 Million Debt Financing

Founded by Drew Durbin and Lincoln Quirk in 2018, Wave has rapidly grown into a dominant player in West Africa’s digital finance ecosystem as one of Africa’s highest-valued FinTech startups. Operating in eight countries, the company now serves over 20 million monthly active users through a network of more than 150,000 agents and a team of 3,000 employees. Unlike traditional telecom-led mobile money services—which often charge between 5% and 10% per transaction—Wave offers free deposits and withdrawals via its mobile app and charges a flat 1% fee for peer-to-peer transfers. For bill payments, the company shifts transaction fees to the businesses rather than the end users, making it more accessible for low-income individuals. For two consecutive years—2023 and 2024—Wave has been the only African company featured on Y Combinator’s prestigious list of the top 50 highest-earning startups, underscoring the strength and scalability of its business model.

In June 2025, Wave secured US $137 million in debt financing led by Rand Merchant Bank (RMB) to strengthen its working capital and accelerate its expansion across both existing and new markets. The funding will be used to scale its mobile money operations and extend affordable financial services to underserved populations across the continent, the company announced in a statement. With this latest round of funding, Wave is well-positioned to deepen its impact across Africa, continuing to drive financial inclusion and economic empowerment through innovative, low-cost digital financial services.

#3 - ForSight Robotics (Israel) | HealthTech | US $125 Million Series B

Founded in 2020 by Prof. Moshe Shoham, Dr. Daniel Glozman, and Dr. Joseph Nathan, ForSight Robotics is a pioneer in ophthalmic robotic surgery. Its ORYOM™ Platform is engineered for highly precise and consistent ophthalmic procedures, beginning with cataract. Utilizing AI-based algorithms, advanced computer vision, and micromechanics, the robotic surgery platform aims to deliver unprecedented dexterity and maneuverability while providing surgeons with an improved ergonomic experience. The ORYOM™ Platform can reach any point within the human eye, allowing surgeons to navigate complex angles and ensuring access to both anterior and posterior segments, setting the stage for glaucoma and retinal surgical treatment.

In June 2025, ForSight completed a US $125 million Series B round led by Eclipse, bringing its total funding to US $195 million. The investment accelerates the next growth phase for the ORYOM™ Platform, the world’s first robotic surgery platform for cataract and other eye diseases designed to enhance surgical precision, increase patient access to high-quality treatment, and decrease the physical burden on surgeons, as the company prepares to launch first-in-human clinical trials this year.

#4 - Coralogix (Israel) | Analytics / AI | US $115 Million Series E & Debt Financing

Coralogix offers a full‑stack observability platform, delivering real-time analytics, log monitoring, APM (Application Performance Monitoring), SIEM (Security Information and Event Management), RUM (Real User Monitoring), and infrastructure monitoring—all without traditional data indexing. It recently launched its AI Center, becoming the first "cross‑stack" observability provider that unifies monitoring of AI performance, quality, security, and compliance. That’s followed by the introduction of Olly, Coralogix's enterprise-grade AI agent that offers conversational insights and root-cause analysis in real time.

In June 2025, Coralogix raised US $115 million in Series E and debt financing led by NewView Capital, bringing its total funds raised to US $350.8 million. Proceeds from this round will be channeled into scaling the global rollout of Olly, accelerating enterprise adoption, and expanding engineering capabilities in India, with investments planned for offices in Gurugram, Bengaluru, and Mumbai over the next few years.

#5 - Ollin Finance (Egypt) | FinTech | US $83 Million Debt Financing

Founded in 2015 by Hatem Samir, Ollin is a consumer-focused FinTech platform offering a wide range of non-banking financial services. Ollin was launched as a consumer arm of GlobalCorp to expand into retail finance, developed a fully integrated digital platform for loan origination and servicing, and has become a key player in Egypt’s non-banking consumer finance sector operating as a subsidiary of GlobalCorp for Financial Services, a major Egyptian NBFS institution. Its key offerings include an integrated loan application platform, vendor payment services, installment management, and digital customer support.

In June 2025, Ollin secured EGP4.2 billion, around US $83 million, in debt financing through cooperation agreements with 14 banks. This funding enhances the company’s capacity to meet rising demand in Egypt’s real estate finance market and strengthens its financial position, aligning with GlobalCorp’s broader strategy to diversify its funding sources and solidify its market standing.

#6 - BURN (Kenya) | Clean Energy | US $80 Million Debt Financing

Founded in 2011 by Peter Scott, BURN is a Kenyan clean cooking appliance maker. Operating across nine countries, BURN manufactures the ECOA Cooker entirely in Kenya, aiming to reduce indoor air pollution, cut cooking times, and lower household energy costs. The company has already supplied over five million clean cookstoves in Africa, tackling health, environmental, and economic issues associated with traditional fuels like wood and charcoal.

In June 2025, BURN raised US $80 million in debt financing led by the Trade and Development Bank Group under its ASCENT platform, bringing its total funds raised to US $130.5 million. This funding will will help BURN bring clean cooking appliances to over 429,000 households by scaling operations in Mozambique, the Democratic Republic of the Congo (DRC), and Zambia.

#7 - Zero Networks (Israel) | Cyber Security | US $55 Million Series C

Founded in 2019, Zero Networks provides an agentless, automated microsegmentation platform—a foundational element of zero-trust architecture—designed to stop ransomware and lateral attack movement by dynamically discovering assets, enforcing least-privilege network access, and integrating multifactor authentication at the network layer. Since 2023, Zero Networks has experienced explosive growth: tripling its customer base, doubling its headcount, and achieving over 300% revenue growth.

In June 2025, Zero Networks announced a US $55 million Series C round led by Highland Europe, bringing its cumulative fundraising to US $100 million. The fresh capital will be used to expand the sales, marketing, R&D, and customer support teams, and to accelerate global go-to-market efforts across North America, EMEA, and APAC.

#8 - Beewise (Israel) | AgTech | US $50 Million Series D

Founded by Saar Safra, Beewise tackles the global decline in bee populations using cutting‑edge technology. Beewise has pioneered the BeeHome™, an AI‑driven, solar‑powered robotic beehive that continuously monitors hive health, autonomously intervenes against threats like pests, disease, and extreme weather, and enables remote beekeeper oversight via software and mobile apps. Beewise offers pollination-as-a-service, leasing BeeHome units to growers and beekeepers. Its solutions support over 1,240 BeeHomes across 300,000+ acres annually, delivering precision treatments, climate control, and significant improvements in crop yields and biodiversity.

In June 2025, Beewise secured US $50 million in a Series D round co‑led by Fortissimo Capital and Insight Partners, bringing its total capital raised to nearly US $170 million. Beewise has allocates this funding to accelerate technological innovation, expand its global market presence, and deepen research efforts—all aligned with its mission to save bees and safeguard the global food supply.

#9 - PetroApp (KSA) | MobilityTech, SaaS | US $50 Million Unknown Series Round

Founded in 2018, PetroApp is Saudi Arabia’s first independent provider of digital fuel payment and fleet management solutions. It is transforming vehicle operations by eliminating cash transactions, reducing fraud, and improving cost control for corporate and government fleets. Beyond fuel, PetroApp also enables access to ancillary services—such as car washes, oil changes, tire and battery replacements—via a seamless, fully cashless platform. Today, PetroApp manages over 500,000 vehicles for 10,000+ corporate clients through a network of more than 5,000 fuel stations across Saudi Arabia, Egypt, Thailand, and Nigeria, and was recently accredited by the Expenditure and Projects Efficiency Authority (EXPRO) as a qualified provider for government sector services.

In June 2025, PetroApp raised a US $50 million investment round through the flagship blind-pool vehicle of Jadwa Investment, Jadwa GCC Diversified Private Equity Fund. “Jadwa’s institutional expertise will be critical in strengthening our foundation, accelerating growth, and expanding our leadership in Saudi Arabia and beyond. Together, we remain committed to setting new benchmarks in fuel and fleet management innovation, aligning with our customers’ evolving expectations and the broader objectives of Saudi Vision 2030,” said Abdulaziz Al Senan, Co-Founder and CEO of PetroApp.

#10 - Speedata (Israel) | Analytics | US $44 Million Series B

Speedata is an analytics startup whose first-of-its-kind Analytics Processing Unit (APU) is designed to accelerate big data analytic workloads by orders of magnitude across industries. Speedata's APU, powered by its custom-designed Callisto chip, removes long-standing bottlenecks that slow down even the most advanced data pipelines, delivering unprecedented acceleration for complex analytics workloads. The chip has already been tested by launch partners from sectors spanning finance, healthcare, insurance, and AdTech – enterprises that depend on mass-scale analytics for business-critical decision-making. For example, using the APU, a pharmaceutical workload was completed in 19 minutes, compared to 90 hours when using a non-specialized processing unit – a 280x faster result.

In June 2025, Speedata announced its US $44 million Series B funding round, bringing its total capital raised to US $114 million. The funding will be used to launch the APU-powered C200 PCIe hardware that will enable real-world deployment across enterprise-grade systems, as the company aims to have a server with its APU replace multiple racks of processors and deliver orders of magnitude acceleration for Spark ETL and analytics jobs while dramatically reducing the cost of running existing data pipelines.

%2Fuploads%2Fdubai-startup-guide-2024%2Fcover.jpg&w=3840&q=75)