MEAPT VC Trends: March 2025 Analysis on Funding

10 April 2025•

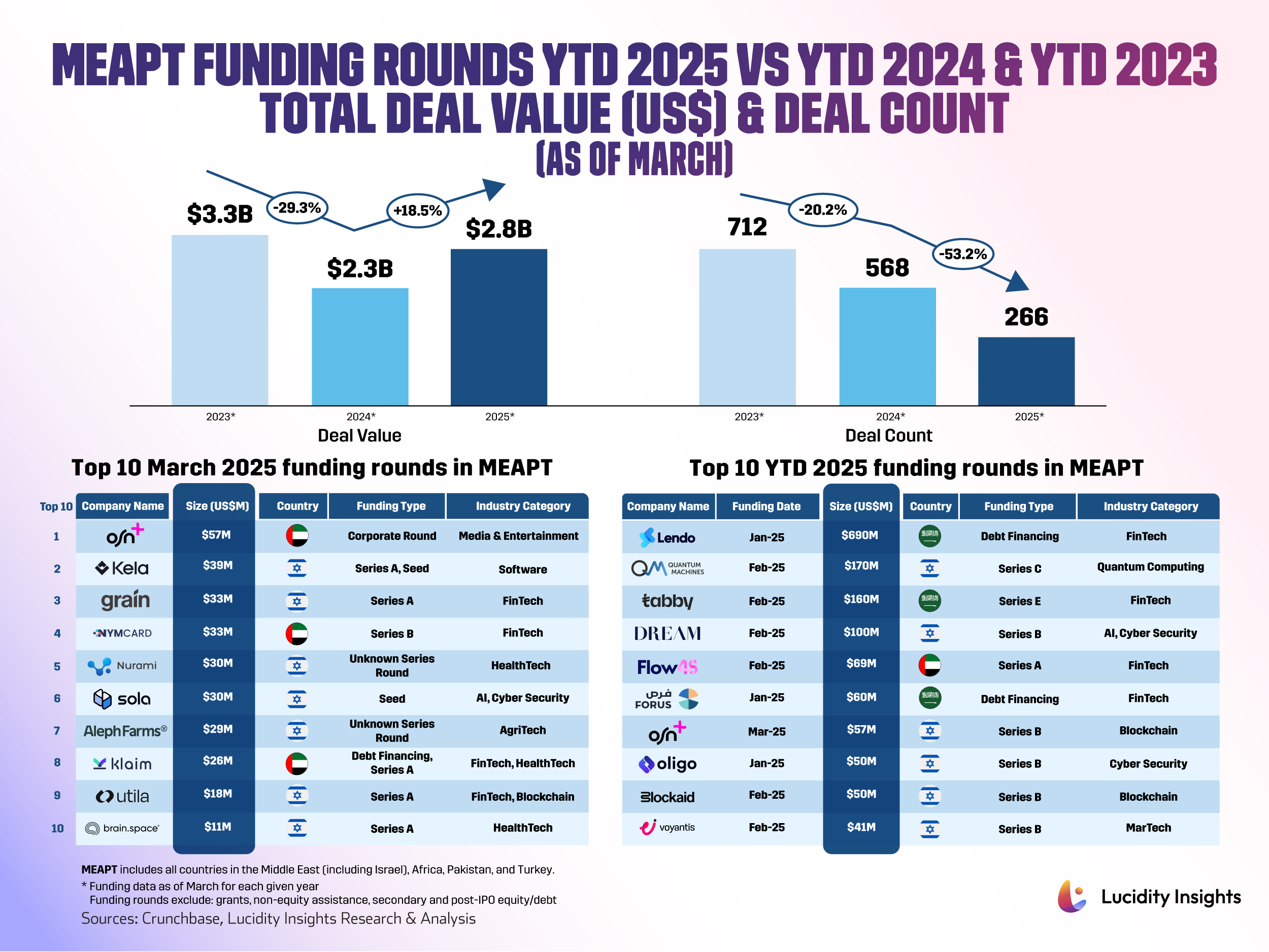

The venture capital landscape across the Middle East, Africa, Pakistan, and Turkey (MEAPT) has seen a rollercoaster of fluctuations in VC investment figures over the past few years. March marks the third consecutive month where 2024 year-to-date (YTD) total deal value lagged behind 2023 levels, only to be surpassed by 2025 totals—a pattern that has been visible across the entire first quarter of 2025. In 2023, MEAPT VC funding had reached a YTD total deal value of US $3.29 billion by March. That momentum faltered significantly in 2024, with YTD values plunging by 29.3% to just US $2.326 billion. As of March 2025, however, the region has rebounded with US $2.756 billion in VC funding—up 18.5% compared to the same period in 2024. Though funding was up this month compared to the same time last year, March 2025 saw no funding rounds at or greater than US $100 million, a sharp contrast to March 2024 which featured 4 mega-rounds and March 2023 which also witnessed 2 mega-rounds.

Deal count, on the other hand, tells a different story. While total funding value has started to bounce back in 2025, the number of deals has continued to decline steadily year-over-year. This marks the third month in a row—January, February, and now March—where deal volume has dropped year over year, going from 712 in March 2023, to 568 in March 2024, and now down to 266 in March 2025. As a result, average deal size has risen significantly: from approximately US $4 million by each March 2023 and March 2024, before surging to over US $10 million by March 2025.

FinTech has dominated the MEAPT funding top 10 this month, with all 10 coming out of the UAE and Israel. Government-led initiatives have continued to lay the groundwork for long-term VC growth across MEAPT, which may explain the shift towards fewer, but larger funding rounds. In particular, Saudi Arabia’s Vision 2030—which prioritizes economic diversification and innovation—has been a steady force in drawing capital into tech and infrastructure. Across the UAE, free zones like Hamriyah Free Zone Authority and Sharjah Airport International Free Zone attracted over 1,600 international companies in 2024 alone. These zones offer major advantages— such as 100% foreign ownership—which remain a powerful magnet for international investors seeking an entry point into the MEAPT ecosystem.

In addition to structural reforms, major events are giving renewed energy to the region’s venture scene. LEAP 2025, held in Riyadh, drew a record 200,000 attendees and 1,900 investors from around the world, fostering an ecosystem primed for cross-border collaboration. The event culminated in the announcement of US $25 billion in new investments, aimed at accelerating the Saudi tech economy, with an estimated US $820 million in economic impact—a signal of confidence that’s hard to ignore.

While deal volume remains low, this strategic influx of capital and international exposure is contributing to the concentration of larger, high-value deals in 2025. Analysts suggest that this trend may be supported by improving global macroeconomic conditions, including declining interest rates and easing inflation, which could help stabilize investor risk appetite. The early signs of a selective VC funding resurgence in MEAPT appear to reflect this shift—where investors are returning, but with sharper focus and higher standards. As we continue to monitor VC activity in the months ahead, we wait to see whether this trend evolves into a sustained recovery for the MEAPT region.

Let’s take a look at the top 10 funding rounds of March 2025 in MEAPT.

#1 - OSN+ (UAE) | Media and Entertainment | US $57 Million Corporate Round

OSN+ is the subscription video-on-demand streaming service rebranded by Orbit Showtime Network in 2022 and led by Lebanese CEO Joe Kawkabani. Available across MENA, OSN+ saw a 40% year-on-year increase in engagement in 2022, merged with music provider Anghami in 2024, and is currently one of the top three paid streaming apps in Egypt, Saudi Arabia, and the UAE.

In March 2025, OSN+ secured US $57 million in a corporate round led by Warner Bros Discovery for a 30% stake. The deal comes as WBD has said it has a “clear path” to reach 150 million global subscribers by the end of 2026 and that it anticipates the streaming segment will deliver a profit of approximately US $1.3 billion in 2025.

#2 - Kela Technologies (Israel) | Software | US $39 Million Series A, Seed

Founded in July 2024 by Alon Dror, Kela Technologies provides a secure, open platform designed to integrate commercial and military systems for Western defense. The platform leverages advanced AI models, sensors, and edge devices to enhance operational capabilities and address modern warfare challenges.

In March 2025, Kela Technologies secured US $28 million in a Series A round led by Lux Capital and US $11 million in a Seed round led by Sequoia Capital. The funds will be used to accelerate the development and deployment of Kela's platform, expand its workforce, and enhance its AI-driven command systems.

#3 - Grain (Israel) | FinTech | US $33 Million Series A

Founded in 2022 by Dor Golan, Aharon Navon, Michal Beinisch, and Nir Galon, Grain specializes in foreign exchange (FX) optimization, providing automated solutions to manage and hedge currency risks for businesses. Grain’s technology integrates seamlessly into B2B software platforms, online marketplaces, and payment providers, leveraging AI-driven automation to dynamically adjust currency pricing based on real-time market conditions and the end user’s profile, enabling businesses to minimize FX-related revenue losses.

In March 2025, Grain secured a US $33 million Series A funding round led by Bain Capital Ventures, bringing its total funding to US $51 million. The investment, which follows an $18 million Seed round raised in 2022 but only now disclosed, underscores the growing demand for automated FX risk management solutions as global commerce faces increasing volatility.

#4 - NymCard (UAE) | FinTech | US $33 Million Series B

Founded in 2018 by Omar Onsi and Ayman Chalhoub, NymCard runs the only issuer processor in MENA that fully owns its processing and switching technology, rather than licensing from third parties. Its localized, full-stack infrastructure, nCore, gives clients a competitive edge, enabling them to design, launch, and scale payment programs with unmatched flexibility. Built on modular APIs, nCore allows businesses to seamlessly manage card issuance, transaction processing, lending infrastructure, and real-time payments—all within a fully integrated financial stack that ensures speed, control, and efficiency.

In March 2025, NymCard secured US $33 million in its latest Series B funding round led by QED Investors, bringing its total amount raised to US $69.1 million. This marks QED Investors’ most significant investment in the region and the first one in the Gulf, underscoring the growing global confidence in MENA’s expanding fintech ecosystem. With this investment, NymCard is deepening its presence across 10+ markets in MENA, strengthening its payment infrastructure solutions to better serve banks, enterprises, fintechs, telecom providers, and more across its three core verticals: Card Issuing Processing, Embedded Lending, and Money movement.

#5 - Nurami Medical (Israel) | HealthTech | US $30 Million Funding Round

Founded in 2014 by Nora Nseir and Dr. Amir Bahar, Nurami Medical develops products for neurological surgeries, specifically addressing cerebrospinal fluid leakage. Nurami recently received regulatory approval for a nanofiber-based surgical patch designed to support post-surgical recovery by naturally degrading and integrating into the body.

In March 2025, Nurami raised US $30 million in its latest funding round led by Ribbit Capital, bringing its total funds to US $39.4 million. The funds will help expand its workforce and scale operations, including the construction of a commercial manufacturing facility, research and development lab, and clean rooms for producing its first FDA-approved product.

#6 - Sola Security (Israel) | AI, Cyber Security | US $30 Million Seed

Founded in May 2024 by Guy Flechter and Ron Peled, Sola Security is a self-serve platform built to democratize cybersecurity. Sola Security lets businesses build functional security apps from start to finish, without needing deep technical expertise or bloated budgets. Users can deploy ready-made security tools from the Sola App Gallery or build custom security solutions using Sola's AI-powered no-code studio.

In March 2025, Sola Security announced its launch with a US $30 million seed round led by S Capital and veteran venture capitalist Mike Moritz, bringing its total funds raised to US $58 million. With these funds, Sola will redefine how organizations build and deploy security tools by eliminating complexity, cutting costs, and putting power back into the hands of security professionals at every level, enabling them to create tailored solutions with its no-code, AI-powered platform.

#7 - Aleph Farms (Israel) | AgriTech | US $29 Million Venture - Series Unknown

Founded in 2017 by Neta Lavon, Shulamit Levenberg, and Didier Toubia, Aleph Farms is a cellular agriculture company that produces cultivated meat. The company focuses on growing high-quality animal products, such as beef steaks, directly from cow cells without the need for slaughter.

In March 2025, Aleph Farms secured US $29 million in a venture funding round led by existing investors through a Simple Agreement for Future Equity (SAFE) and additional funds from other investors, bringing its total funds raised to US $148.4 million. The funds will be used to expand production capacity, scale up the pilot facility in Israel, and develop intermediate-scale production sites in Europe and Asia.

#8 - Klaim (UAE) | FinTech, HealthTech | US $26 Million Debt Financing, Series A

Founded in 2020 by Ghafoor Ahmad and Karim Dakki, Klaim revolutionizes the healthcare industry by providing healthcare providers with access to working capital through the purchase of their submitted claims, which allows providers to receive payments within 24 hours instead of waiting for the typical 60 to 90 days. In 2024, Klaim announced a strategic milestone in its expansion into Saudi Arabia through a collaboration with Tharawat Tuwaiq Financial Company, an asset manager and financial advisor licensed by the Saudi Capital Market Authority (CMA).

In March 2025, Klaim secured US $10 million in Series A equity funding led by CDG Invest and Mad'a Investment Company as well as an additional US $16 million financing fund led by Tharawat Holding, bringing its total funding to US $59.8 million. Klaim will use the funding to expand its footprint in the UAE, deploy capital in Saudi Arabia, Oman, and other regions, and continuously refine its technology to better serve healthcare providers.

#9 - Utila (Israel) | FinTech, Blockchain | US $18 Million Series A

Founded in 2022 by Bentzi Rabi and Sam Eiderman, Utila provides a digital asset management platform for institutions to securely store, transfer, and manage digital assets. The platform uses Multi-Party Computation (MPC) technology to enhance security and control across multiple blockchains and wallets.

In March 2025, Utila secured US $18 million Series A funding round led by Nyca Partners, bringing its total funds to US $29.5 million. The funds will be used to scale global operations, bolster cryptographic research, and enhance the next-generation security infrastructure for institutional clients, supporting Utila's expansion into new markets and improve its MPC wallet technology.

#10 - Brain.space (Israel) | HealthTech | US $11 Million Series A

Founded in 2018 by Yair Levy, Brain.space is a neurotechnology company that provides real-time brain data collection and analysis tools. Their technology integrates human intelligence with machine learning to quantify cognitive and emotional states, aiming to revolutionize applications in consumer technology, healthcare, defense, and aerospace. Brain.space conducted a brain-monitoring experiment aboard the International Space Station as part of the Rakia Mission in 2022, collaborated with Google through its AI Startups Fund and AI Startups Lab program, and officially launched from stealth mode in March 2025.

In March 2025, Brain.space secured US $11 million in a Series A funding round led by Toyota Ventures, bringing its total funds raised to US $23 million. The funds will be used to expand Brain.space’s data collection infrastructure, refine its Large Mental Models (LMMs), and accelerate commercialization efforts.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)