MEAPT April 2025 Funding: Year-to-Date Trends & Top Funding Rounds

21 May 2025•

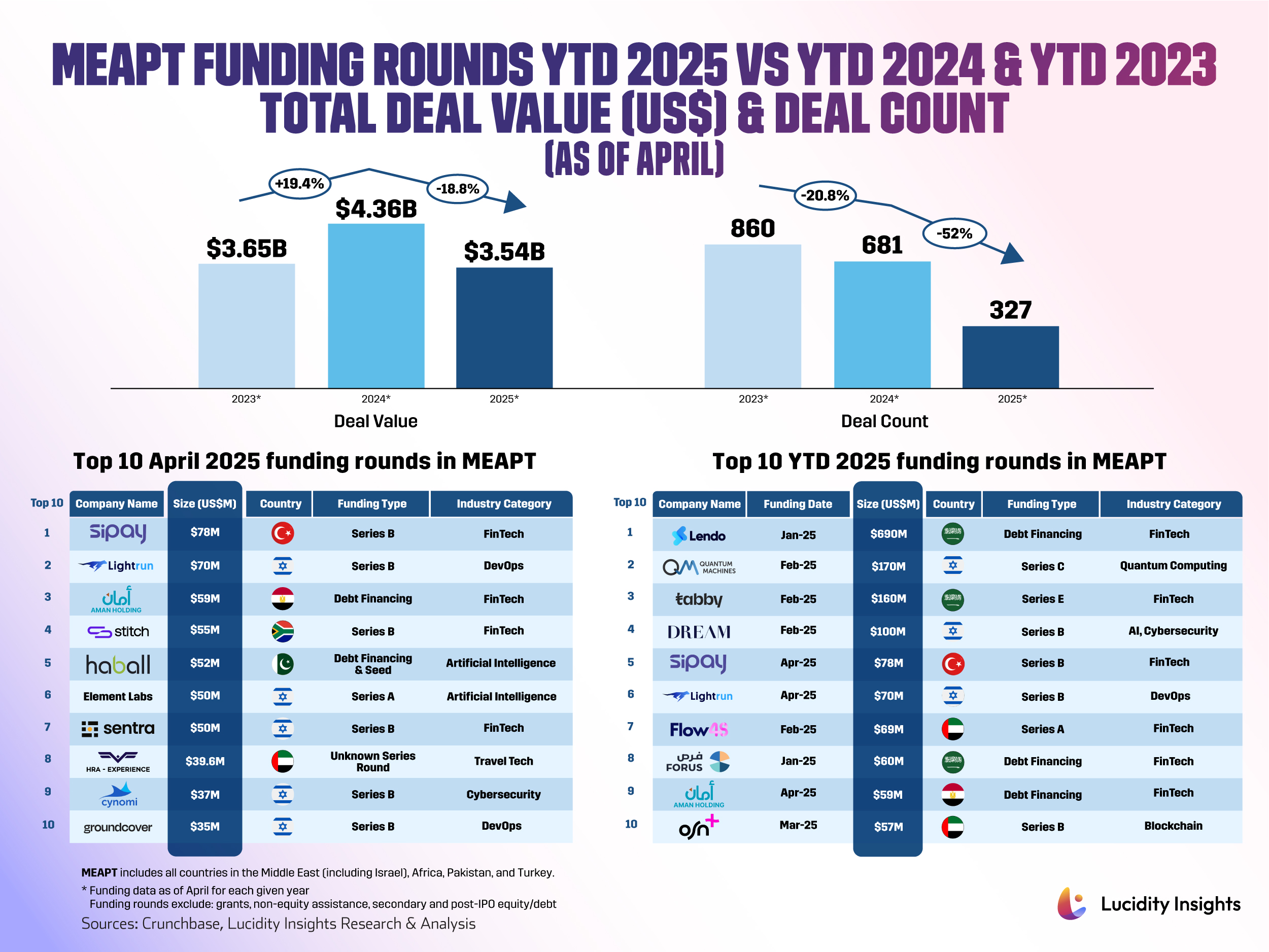

The venture capital funding landscape of the Middle East, Africa, Pakistan, and Turkey (MEAPT) region has hit a stark inflection point. After three months of incremental year-over-year (YOY) growth, April 2025 marks the first month year-to-date (YTD) venture funding has dropped from the same time last year. Total VC funding through April 2025 stands at US $3.54 billion—a decline of 18.8% from the US $4.36 billion raised by this time in 2024 and down 3% from 2023’s US $3.65 billion. Moreover, YTD deal number has steadily declined YOY, from 860 by April 2023 to 681 by April 2024 and just 327 by April 2025 in a trend consistent with Q1 monthly deal numbers.

This fall in VC activity is underscored by the absence of any mega‑rounds (deals > US $100 million) in April 2025. While Turkey-based FinTech Sipay's US $78 million Series B led this month’s deals—outpacing April 2023’s top round of just US $35 million by Victory Farms in Kenya—both figures pale in comparison to the US $1.5 billion raised by the UAE’s G42 in April 2024, a major outlier that significantly inflated last year’s YTD funding total.

Excluding G42’s mega-deal, April 2024’s YTD total would have dropped sharply to US $2.86 billion, meaning April 2025’s US $3.54 billion would have outperformed it by a wide margin. This reframes the perceived funding decline and underscores how the region’s VC metrics can be heavily skewed by a handful of exceptional late-stage rounds. Nonetheless, average deal size has continued its upward trajectory amid fewer rounds, growing from US $4.2 million by April 2023 to US $6.4 million by April 2024 and US $10.8 million by April 2025.

Geographic, Sectoral, and Funding-Stage Shifts

Though Israel remains a funding powerhouse in the region, Turkey has topped April’s funding leaderboard while Egypt and Pakistan broke into the top 10 for the first time this year in a diversification of VC hotspots beyond the traditional UAE-Israel-KSA axis. FinTech and Artificial Intelligence continued to attract significant funding in April, however this month marked a notable shift as DevOps made it into the top ranks not once, but twice—signaling growing investor interest in developer-centric infrastructure solutions.

Though sovereign wealth funds and state-backed VC initiatives in Saudi Arabia and the UAE have continued to inject capital, especially into Series A and B rounds which dominated this month, there appears to be a tightening of late-stage capital across the globe. With fewer exits especially outside of North America as the IPO market remains largely closed, investors are hesitant to commit large sums to late-stage rounds where liquidity is typically expected sooner. Geopolitical tensions, currency volatility, and regulatory uncertainty further dampen investor confidence in late-stage deals but have also made local startups more attractive to foreign investors seeking lower entry valuations albeit increased operational risks.

Looking Ahead

As we enter Q2, the region faces a critical test. While headline numbers seem to suggest a downturn this month, the MEAPT VC landscape in 2025 may actually be undergoing a strategic recalibration rather than a collapse. The presence of mega-deals in previous years skews comparisons, but the rise in average deal size and the emergence of new sectors and geographies may hint at a more selective and maturing investment environment. Will limited capital and economic uncertainty slow things down further, or can a more cautious investment approach still support innovation across emerging markets? Funding trends in the months ahead will tell whether the market is finding its footing or slipping further.

Let’s take a look at the top 10 funding rounds of April 2025 in MEAPT.

#1 - Sipay (Turkey) | FinTech | US $78 Million Series B

Founded in 2019 by Nezih Sipahioğlu, Sipay is a fintech platform that has positioned itself as the “Stripe for emerging markets” enabling seamless financial operations for a wide range of users. The company offers financial services tailored to both businesses and consumers including digital wallets, embedded finance solutions, foreign exchange transactions, investment tools, loyalty programs, and white-label financial infrastructure. Headquartered in Turkey, Sipay has built strong partnerships with major Turkish banks and e-commerce platforms such as Trendyol, Hepsiburada, and QNBpay.

In April 2025, Sipay raised US $78 million in Series B funding led by Elephant VC from the US, bringing its total funds raised to US $93 million. Sipay plans to use the funds to expand beyond Turkey, focusing on emerging markets. It will launch services like cross-border remittances, which are not yet offered by competitors like Stripe in these regions.

#2 - Lightrun (Israel) | DevOps | US $70 Million Series B

Founded in 2019 by Ilan Peleg and Leonid Blouvsh, Lightrun has established itself as a pioneer in the field of Developer Observability, offering a platform that enables developers to add logs, metrics, and traces to live applications in real time. Instead of merely monitoring for production issues, Lightrun’s platform uses AI to detect, diagnose, and even suggest code fixes—turning runtime incidents from days-long emergencies into minute-long events. Its revenue has grown 4.5× year over year, the team has doubled in size, and the customer roster now includes heavyweights such as Citi, Salesforce, Microsoft, SAP, AT&T, Priceline, and the NYSE.

In April 2025, Lightrun secured US $70 million in a Series B round led by Accel and Insight Partners, bringing its cumulative fundraising to US $115 million. The funding marks a critical moment as the company moves from traditional observability into the emerging domain of autonomous remediation.

#3 - AMAN (Egypt) | FinTech | US $59 Million Debt Financing

AMAN Project Finance is a specialized subsidiary of AMAN Holding, a major player in Egypt’s financial services sector offering a range of digital and microfinance solutions. AMAN Project Finance was established to specifically address the growing demand for Sharia-compliant financing and structured financial solutions for businesses and infrastructure projects in Egypt. The subsidiary is part of AMAN’s strategic push to offer comprehensive, ethical, and inclusive financial services that align with Egypt’s national goals for economic empowerment and digital transformation, as it plays a key role in delivering Islamic finance products, particularly sukuk-based debt instruments, to support the capital needs of SMEs and large-scale development initiatives.

In April 2025, AMAN secured US $59 million in debt financing through a Sharia-compliant sukuk issuance structured and managed by Bokra, marking one of the largest private sector sukuk deals in Egypt. The funds are being directed toward expanding AMAN’s Sharia-compliant lending portfolio, with a focus on supporting SMEs—a critical segment for Egypt’s economic development.

#4 - Stitch (South Africa) | FinTech | US $55 Million Series B

Founded in 2019 by Kiaan Pillay, Junaid Dadan, and Priyen Pillay, Stitch has emerged as a key player in Africa’s digital payments sector specialized in open banking and payment infrastructure. The company’s technology enables businesses to securely connect with users’ financial accounts, streamlining transactions for e-commerce and enterprise clients. With the acquisition of Exipay earlier this year — rebranded as Stitch In-Person Payments — the fintech has expanded into physical payment solutions, a strategic move to serve corporate clients requiring hybrid digital and cashless transaction systems.

In April 2025, Stitch raised US $55 million in a new funding round from existing investors including Raba Partners, bringing its cumulative funding to US $101 million. Stitch’s ability to secure capital underscores its potential to address payment inefficiencies and interoperability challenges even as African startups face tighter global venture capital conditions. The company is focused on deepening its presence in South Africa and selectively expanding into other high-potential markets.

#5 - Haball (Pakistan) | AI | US $52 Million Debt Financing & Seed

Founded in 2017 by Omer bin Ahsan, Haball is at the forefront of digitizing Pakistan’s deeply analog B2B economy, where paper-based transactions and manual payment cycles have long been the norm. With a mission to bridge the financing gap in Pakistan’s supply chains where less than 5% of SMEs have access to formal credit, Haball provides shariah-compliant financing to nearly 8,000 small and medium-sized enterprises (SMEs) as well as multinationals, in addition to digital invoicing, payment collection, and tax compliance services.

In April 2025, Haball raised US $52 million in its latest funding round which included $5 million in equity led by Zayn VC and $47 million in debt financing by Meezan Bank. The funds will support Haball’s growth plans for Pakistan and its expansion into the Middle East, starting with Saudi Arabia this year.

#6 - Element Labs (Israel) | AI | US $50 Million Series A

Founded by Avigdor Willenz, David Dahan, and Ran Halutz in 2024, Element Labs aims to revolutionize the AI hardware landscape by creating high-performance, energy-efficient chips that can be deployed in small and local data centers, reducing reliance on massive centralized infrastructure. This approach not only enhances processing speed and efficiency but also brings AI capabilities closer to end-users, enabling real-time applications in industries such as healthcare, finance, and autonomous systems.

In April 2025, Element secured a US $50 million Series A round led by Fidelity Investments. The funding will be used to complete the development of its first chip series and begin production testing (tape-out) at TSMC, the same semiconductor foundry used by Willenz’s previous ventures, Annapurna Labs and Habana Labs.

#7 - Sentra (Israel) | FinTech | US $29 Million Series B

Founded in 2021 by Asaf Kochan, Ron Reiter, Yair Cohen, and Yoav Regev, Sentra has quickly become a leader in cloud-native data security, offering a platform that leverages artificial intelligence to automatically discover, classify, and protect sensitive data across public cloud environments. Sentra’s unmatched AI-powered classification delivers over 95% accuracy and adapts to business contexts using large language models (LLMs) while not only ensuring complete coverage of all cloud data but dramatically reducing the operational cost and the scope of data scanning.

In April 2025, Sentra secured US $29 million in a Series B round led by Key1 Capital, bringing its total funds raised to US $103 million. The funds will be used to fortify its position as a leader in the DSP space, grow its team of data security experts and continue to expand its platform to help organizations innovate confidently, knowing their cloud and AI workflows are secured with industry-leading protection.

#8 - HRA Experience (UAE) | TravelTech | US $39.6 Million Unknown Series Round

Founded by Adem Kiraz, HRA Experience is pioneering a Web3-powered global travel and payment ecosystem, aiming to merge blockchain technology with real-world mobility to create a seamless, borderless travel experience. The company integrates crypto payments, digital identity, and decentralized financial tools into a unified platform that caters to modern, globally mobile users.

In April 2025, HRA Experience secured US $39.6 million in an undisclosed series round. The capital will be used to accelerate the rollout of HRA’s core platforms, expand operations across Europe, and support ecosystem development.

#9 - Cynomi (Israel) | Cybersecurity | US $37 Million Series B

Founded in 2021 by David Primor and Roy Azoulay, Cynomi is democratizing access to high-level cybersecurity through its AI-powered virtual Chief Information Security Officer (vCISO) platform. The company currently supports MSPs, MSSPs, consultancies, and telcos, and saw 3x ARR growth during 2024 following a 4.5x increase the previous year.

In April 2025, Cynomi secured a US $37 million Series B funding round led by Insight Partners and Entrée Capital, bringing its total cumulative funds to US $60.5 million. Cynomi will use the funding to serve a broader range of service providers, including integrators and resellers, as well as scale its sales operations in the US and drive further expansion throughout Europe.

#10 - Groundcover (Israel) | DevOps | US $35 Million Series B

Founded by Shahar Azulay and Ariel Assaraf in 2021, Groundcover is replacing entrenched monitoring giants like Datadog, New Relic, and Grafana Cloud through its radically different architecture that gives customers control over where their data lives—without sacrificing the ease of a managed service. Groundcover uses eBPF, or extended Berkeley Packet Filter, a kernel-level technology that allows for high-performance, low-overhead monitoring to pull data directly from the Linux kernel. It has grown 500% in annual recurring revenue (ARR) since last year, with a customer base that includes Fortune 100 firms and fast-growing tech startups alike.

In April 2025, Groundcover raised US $35 million in Series B funding, led by Zeev Ventures, bringing its total funding to US $60 million. The funds will be used to accelerate Groundcover’s expansion in the US, scale operations, and enhance its observability platform as it builds deeper partnerships with AWS, Google Cloud, and other infrastructure providers.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)