January 2025: Spotlight on MENAPT's Leading Funded Startups

14 February 2025•

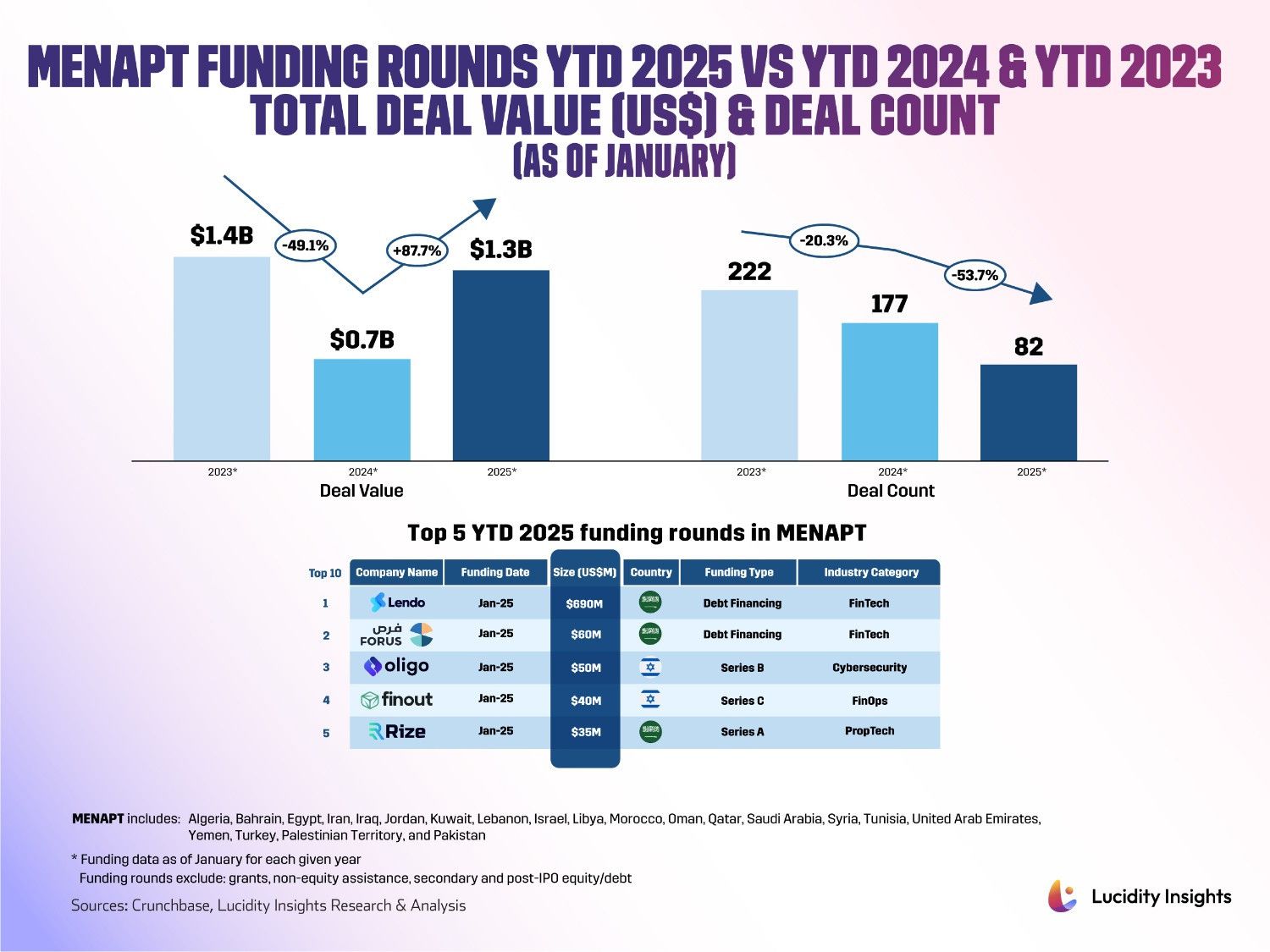

The venture capital landscape in the MENAPT region has exhibited interesting fluctuations in VC activity recently. Though we have seen consistent year-on-year declines in the number of deals across the region these last 3 years — from 222 in January 2023 to 177 in January 2024 and 82 in January 2025 — total funding amounts have not followed the same trajectory. After a nearly 50% decline from US $1.38 billion in January 2023 to US $703.3 million in January 2024, funding this year skyrocketed to US $1.32 billion, up a staggering 87.7% from the same time last year.

The downward trend seen between January 2023 and 2024 can be attributed to persistent economic uncertainty influenced by high inflation and interest rates across the region, which made capital more expensive and reduced the appetite for riskier venture investments. Regulatory hurdles such as foreign currency controls and economic instability in countries like Egypt and Pakistan have made investors skittish and dampened funding in certain markets. The inability to repatriate funds easily and volatility in exchange rates led many Pakistani startups to incorporate abroad since 2022/23, while Egypt’s repeated devaluation of the pound similarly caused some deal delays and valuation adjustments in local-currency terms. These issues are being addressed gradually—Pakistan’s central bank eased some restrictions, and Egypt is moving toward a more flexible exchange rate under IMF guidance—but they underscore the impact of macro-regulation on funding flows.

The pattern of investment in January 2025 further reveals a shift towards larger, less distributed mega-rounds, as a huge increase in funding amounts was countered by constricting deal numbers for the third year in a row. While January 2023 featured four mega-rounds with the largest deal at US $400 million and an average deal size of US $6.22 million, January 2024 saw two mega-rounds capping at US $200 million with an average of US $3.97 million, and January 2025 was dominated by a single mega-round of US $690 million in debt financing for Lendo in Saudi Arabia bringing its average deal size to over US $16 million. This shift towards fewer but larger deals indicates an increasingly concentrated investment approach, where capital is channeled into ventures that not only align with investor priorities but also demonstrate significant scale or strategic importance.

Sectors like fintech and cybersecurity continue to lead the space attracting VC investments, as investors channel funds into areas perceived to have stable demand and potential for growth. Fintech has seen substantial funding due to the high demand for digital financial services in the region, spurred by increasing digitalization aiming to reach a largely unbanked population. Cybersecurity investments are driven by heightened digital threat awareness and government investments in digital infrastructure amid rising tensions in the region. Overall, current investment strategies involve spurring innovation in priority sectors (energy, fintech, AI, etc.) to achieve financial returns. Moreover, a close linkage between government intervention and VC in the region means that even as global investors pulled back in 2022-2023, local “smart money” continued deploying capital.

Investors seem to be focusing their resources on opportunities that promise substantial returns and have critical mass, particularly in strategic sectors and key geographic locales like Israel. This could lead to a more polarized ecosystem where established, scalable ventures thrive while smaller, emerging startups or those not operating within the high-priority sectors may struggle to find funding. However, it is too early to say if these trends will persist throughout 2025, and investors are keeping a close watch on how these trends develop in the coming months to better understand the evolving investment climate in the MENAPT region.

Let’s take a look at the top 5 funding rounds of January 2025 in MENAPT.

#1 - Lendo (KSA) | FinTech | US $690 Million Debt Financing

Founded by Osama Alraee and Mohamed Jawabri in 2019, Lendo operates as a Shariah-compliant, peer-to-peer digital lending marketplace to help pre-finance outstanding invoices for small and medium-sized enterprises (SMEs) across Saudi Arabia. Lendo has facilitated over US $667 million in financing through more than 5,000 transactions, generating US $33.3 million in returns for investors.

In January 2025, Lendo raised US $690 million led by J.P. Morgan, bringing its total funding to US $725.2 million. The funds will be used to increase Lendo's lending capacity, introduce more innovative products, and expand its SME coverage in the Kingdom, which aligns with Saudi Vision 2030's goal of increasing SME lending from 4% in 2018 to 20% by 2030.

#2 - Forus Financial (KSA) | FinTech | US $60 Million Debt Financing

Founded by Nosaibah Alrajhi and Abdulwahab Majeed in 2018, Forus Financial operates as a debt crowdlending platform, providing innovative working capital solutions for SMEs in Saudi Arabia. Forus offers a debt marketplace that bridges the funding gap for SMEs by providing businesses with funds to support their operational needs, offering up to SAR 5 million with terms from 1 to 36 months. It also offers short-term financing against POS receipts and cash financing against company invoices, covering up to 80% of the invoice value with terms from 1 to 12 months.

In January 2025, Forus Financial secured US $60 million in debt financing from Fasanara Capital. The funds will be used to scale Forus' lending operations, provide more than US $150 million in working capital loans to hundreds of Saudi SME borrowers, and support the company's growth towards becoming one of the largest non-bank providers of debt financing to SMEs in Saudi Arabia.

#3 - Oligo Security (Israel) | Cybersecurity | US $50 Million Series B

Founded by Nadav Czerninski, Gal Elbaz, and Avshalom Hilu in 2022, Oligo Security specializes in Application Detection and Response, focusing on securing applications against vulnerabilities and attacks in real-time. Oligo provides a platform that offers deep, real-time visibility into application behavior to detect vulnerabilities and stop attacks, particularly in cloud-native environments.

In January 2025, Oligo Security raised US $50 million in its Series B funding round led by Greenfield Partners for a total funding of US $78 million. The funds will be used to fuel Oligo's global expansion, enhance its go-to-market strategy, and meet increasing demand by improving the platform's capabilities to detect and neutralize exploitable application vulnerabilities in real-time.

#4 - Finout (Israel) | FinOps | US $40 Million Series C

Founded by Roi Ravhon, Asaf Liveanu, and Yizhar Gilboa in 2021, Finout provides a cloud cost management platform that helps enterprises understand, allocate, and optimize their cloud spending through real-time insights and transparency into cloud costs, enabling smarter financial decisions.

In January 2025, Finout secured US $40 million in Series C funding led by Insight Partners, bringing its total amount raised to US $84.8 million. The funds will be used to double its engineering team in Tel Aviv and expand its go-to-market teams.

#5 - Rize (KSA) | PropTech | US $35 Million Series A

Founded by Ibrahim Balilah and Mohammed AlFraihi in 2021, Rize is the first Saudi real estate technology company to offer a "Rent Now, Pay Later" (RNPL) service, allowing tenants to pay annual rents in flexible monthly installments instead of a one sum payment. Since its founding, the company has achieved significant milestones, including reaching a total rental value of over half a billion SAR through its platform.

In January 2025, Rize raised US $35 million in its Series A funding round led by Raed Ventures, bringing its total funds raised to US $37.9 million. The funds will support Rize's growth plans and expand its services in line with the Kingdom’s vision for digital transformation and enhancing the real estate sector.