How the Saudi Government Has Streamlined the Kingdom for Fintech

02 March 2023•

The Launch of Vision 2030 and Its Impact to Digitization in Saudi

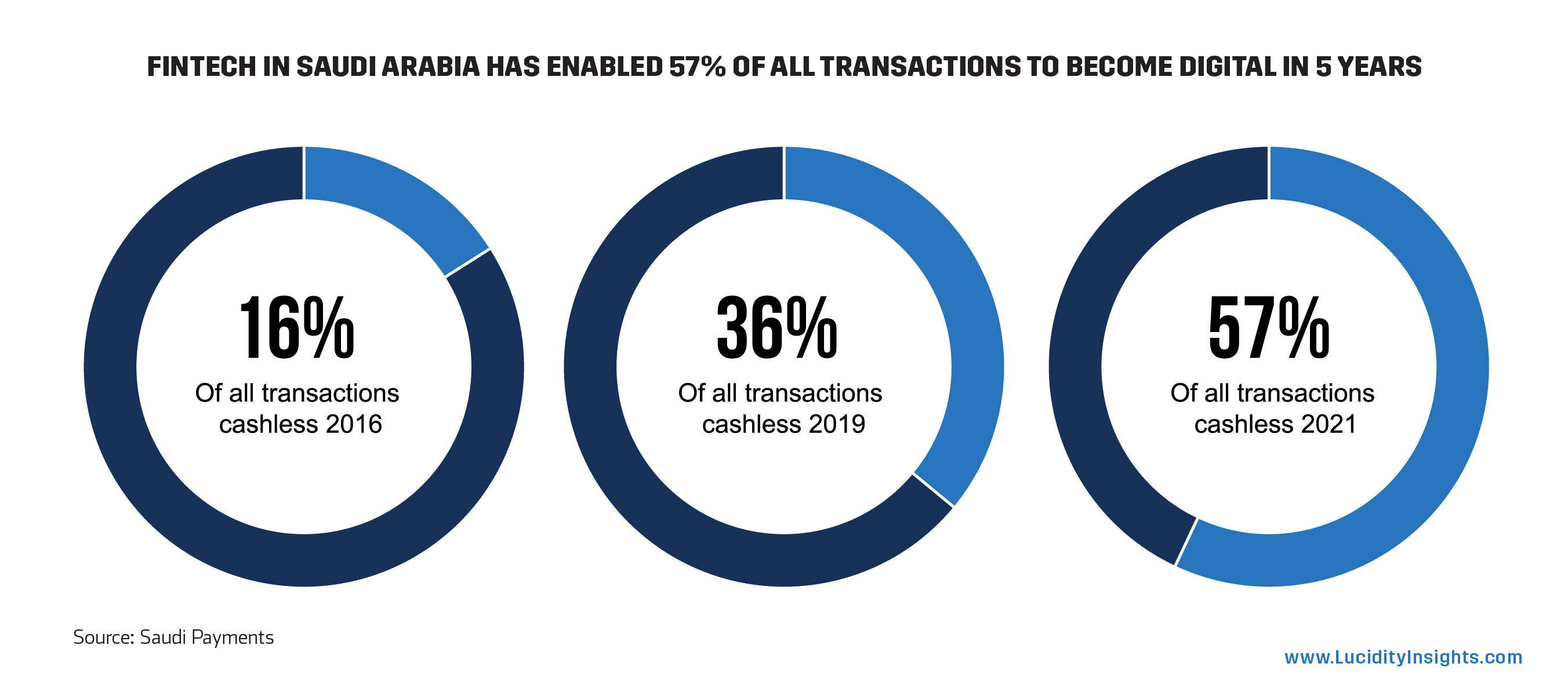

In 2016, Vision 2030 was launched, followed by several comprehensive programs developed to reach specific goals and targets that were set out in the wider strategy. The Financial Sector Development Program (FSDP) is one such program. The FSDP has undertaken several commitments to be reached by 2025 which include supporting financial institutions, promoting emerging fintech companies, financing SMEs, and increasing cashless operations. It aims to digitize the economy and convert 70% of all transactions in the Kingdom to become cashless payments by 2025. The program’s efforts have had a major impact on Saudi citizens, especially supporting Saudis through the trying times the world has endured during the pandemic, which has accelerated the adoption of digital solutions, many of which require e-payments gateways.

Prior to 2016, there had been a very few number of fintech players in the Saudi market; one reason for this inactivity identified by the Saudi government was the lack of clarity on policies and the unregulated nature of the fintech market up until that point. The key stakeholders that have really paved the way for the development of the fintech ecosystem since then are the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). The two institutions have different responsibilities but share a common goal: to regulate and develop the financial sector.

The Birth of Saudi Payments

The Saudi Central Bank (SAMA) was established in 1952 and was previously known as the Saudi Arabian Monetary Authority prior to changing its name in 2020. Its mission is to maintain monetary and financial stability in the Kingdom as well as to support balanced economic growth. In 2019 the Central Bank officially established its digital payments’ arm, Saudi Payments, which operates the technological infrastructure of various payment systems for the government and Saudi institutions, such as Mada, SADAD, SARIE, and Esal.

What is Mada?

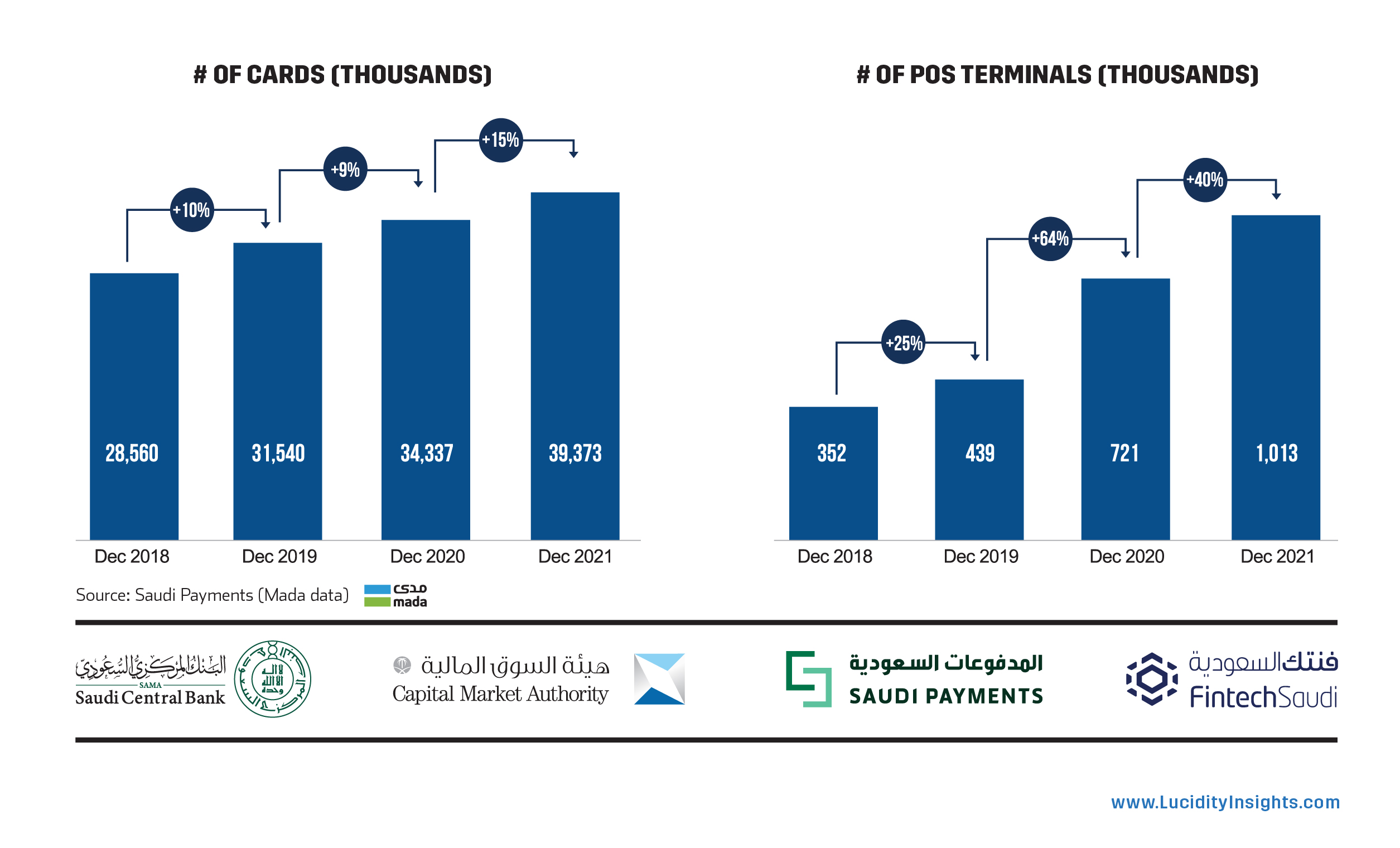

Mada was established in 1990 as Saudi Payments Network (SPAN). It connects ATMs and POS terminals to a central payments switch and has succeeded in boosting their growth as the number of cards has increased by 11% on average between 2018 to 2021 and the number of POS terminals during the same time has increased by 42% CAGR.

What is Esal?

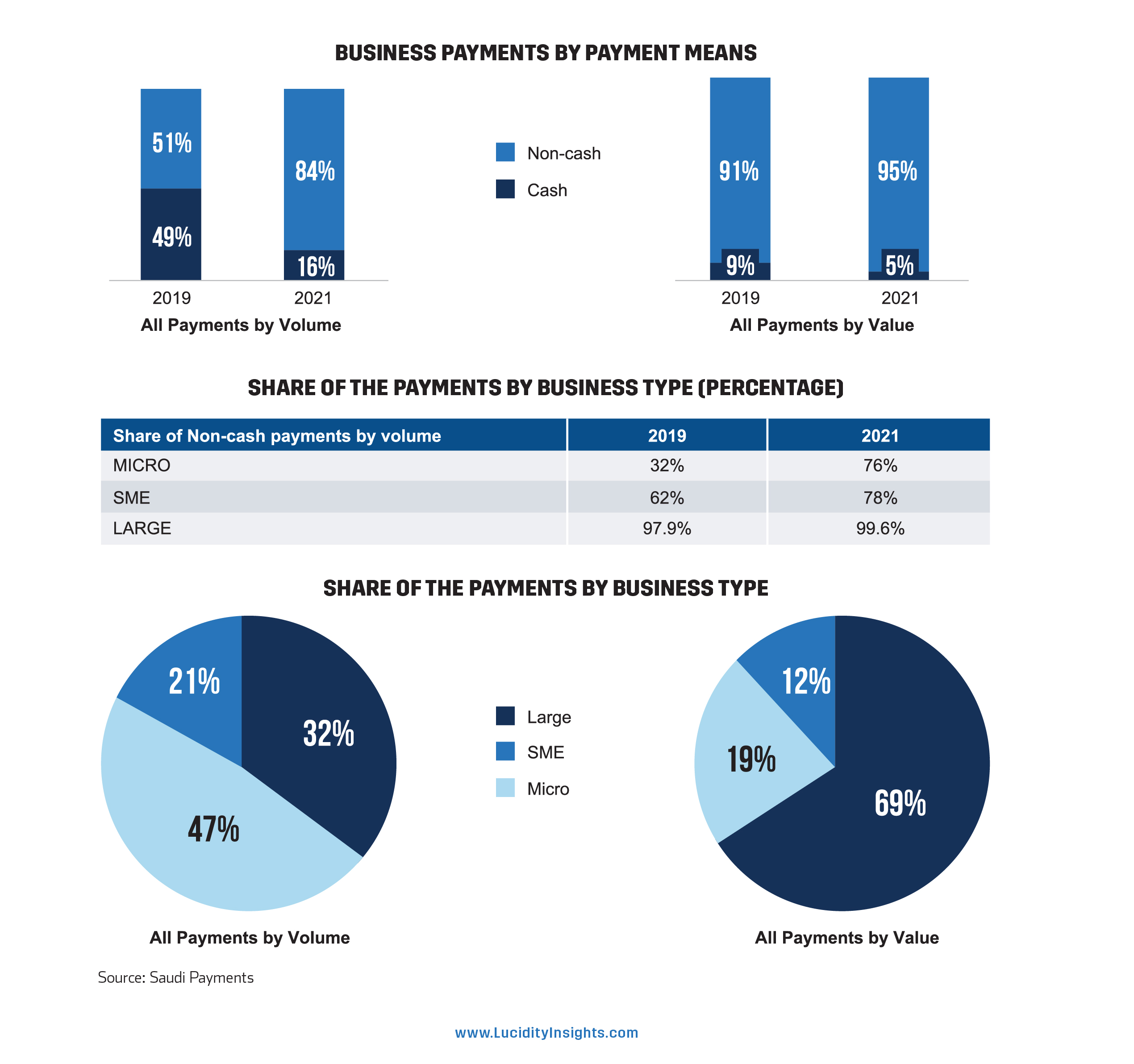

Esal is a national electronic platform for business payments (e-invoicing) providing services to government entities and businesses. In 2019, 99.9% of government payment activities were cashless.

What is SADAD?

SADAD is a national Electronic Bill Presentment and Payment (EBPP) service provider and facilitates payment transactions such as utility, telecommunications, and other government bills.

What is SARIE?

SARIE is an Instant Payments system to facilitate cash transactions across local banks and is accessible 24/7.

As a result of these four platforms, the Kingdom is geared to reach its goal of 70% cashless transactions before 2025. In 2021, the Kingdom hit a milestone when cash was no longer the most common means of payment as 57% of transactions had become cashless. In 2018, SAMA also launched a regulatory sandbox to attract local and international fintech companies to infuse new fintech technologies into the Saudi market. Today, 42 firms have been permitted to operate under the sandbox of which 15 have obtained fintech licenses from SAMA to operate in the wider Kingdom.

The Capital Market Authority regulates the Kingdom’s capital markets by developing an appropriate and transparent investment environment, protecting investors and dealers from illegal acts. One of the key initiatives that it has launched is the Fintech Lab, which is a legislative experimental environment that attracts local and international firms and allows fintech products and services related to securities activity to test innovative business models.

The Birth of Fintech Saudi

SAMA and CMA gave birth to Fintech Saudi in 2018, which is tasked with supporting the development of the Kingdom’s fintech ecosystem and position the Kingdom as an innovative fintech hub. Its Fintech Accelerator Program provides support, coaching and mentorship to fintech companies. 12 fintech start-ups participated in the program this year and the 3 winners were awarded a financial grant of SAR50,000 each by Wa’ed’s incubation program.

Venture Capital firms such as Wa’ed Ventures have shown confidence in the Fintech sector even before it gained momentum. Ali Abussaud, Chairman of Hala Ventures, echoed the sentiments of many Saudi VCs we spoke to, stating that he believes that the fintech sector will continue to grow. “Payments and SMB will continue to lead, and Crowd Funding will be the next area of development for Saudi’s fintech sector.”

See Graphs: Fintech in Saudi Arabia Has Enabled 57% Of All Transactions to Become Digital in 5 Years

Learn more about some of the most prominent VCs and players in Saudi’s startup ecosystem, in the most comprehensive report on the topic to date, The Evolution of Saudi Arabia's Start-Up Ecosystem 2010-2022.

%2Fuploads%2Fsaudi-venture%2Fcover11.jpg&w=3840&q=75)