January 2025 VC Snapshot: Top 5 Funded Startups in GCC Region

19 March 2025•

Venture capital funding in the GCC region experienced opposing swings in total deal value and deal count in January 2025, marking a stark contrast to the comparably stable figures observed between January 2023 and January 2024. This recent shift in funding dynamics is in response to both global economic conditions and regional initiatives such as Saudi Vision 2030, particularly evident as the majority of the biggest deals this month occurred in the KSA.

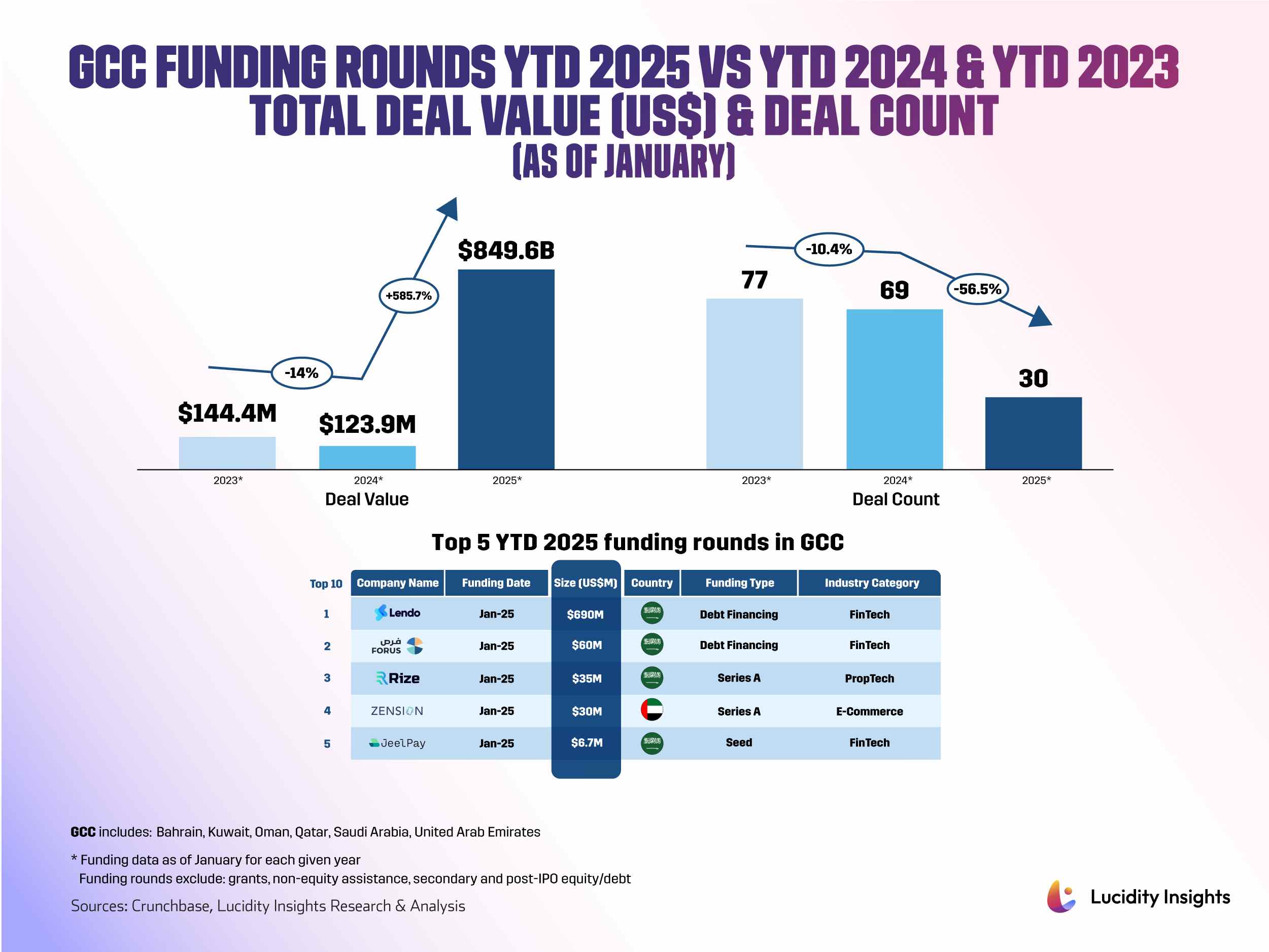

Looking back, there was a decrease of 13.96% in deal value from January 2023 to January 2024, with figures dropping from US $143.8 million to US $123.9 million. This decrease reversed dramatically in January 2025, with total deal value skyrocketing by 585.7% to reach US $849.6 million. This surge can largely be attributed to a single mega-round of US $690 million by Saudi Arabian fintech Lendo, which alone represented over three-fourths of the total funding for January 2025 and exceeded the total deal values of both January 2023 and January 2024 combined.

Deal count, on the other hand, continued its downtrend, falling by a mere 10.39% from January 2023 to January 2024 before plummeting more than 56% to only 30 deals in January 2025. Notably, the average deal size in January 2023 was around US $1.87 million, which increased to approximately US $1.79 million by January 2024 and a staggering US $28.32 million in January 2025, heavily influenced by the Lendo mega-round reflecting a trend towards larger deals despite the overall decrease in funding.

Despite dramatic headline numbers, the rest of the deals in January 2023 and 2024 were similar to those in January 2025 (excluding the Lendo mega-round) both in terms of deal sizes and industry sectors. This shows that while the potential for large-scale funding in the region is definitely there, it also tends to skew the data. The consistency in the nature of the deals outside of this single outlier, however, suggests that the underlying venture capital landscape in the GCC might not have shifted as drastically as the occasional large-scale funding event might imply.

Nonetheless, it’s too early to say for sure if VC dynamics in the GCC have really shifted as of late, and watching how the rest of the year plays out will provide a clearer picture of whether the changes observed this January reflect a lasting transformation or merely a one-off occurrence in the GCC VC landscape.

Let’s take a look at the top 5 funding rounds of January 2025 in the GCC.

#1 - Lendo (KSA) | FinTech

US $690 Million Debt Financing

Founded by Osama Alraee and Mohamed Jawabri in 2019, Lendo operates as a Shariah-compliant, peer-to-peer digital lending marketplace to help pre-finance outstanding invoices for small and medium-sized enterprises (SMEs) across Saudi Arabia. Lendo has facilitated over US $667 million in financing through more than 5,000 transactions, generating US $33.3 million in returns for investors.

In January 2025, Lendo raised US $690 million led by J.P. Morgan, bringing its total funding to US $725.2 million. The funds will be used to increase Lendo's lending capacity, introduce more innovative products, and expand its SME coverage in the Kingdom, which aligns with Saudi Vision 2030's goal of increasing SME lending from 4% in 2018 to 20% by 2030.

#2 - Forus Financial (KSA) | FinTech

US $60 Million Debt Financing

Founded by Nosaibah Alrajhi and Abdulwahab Majeed in 2018, Forus Financial operates as a debt crowdlending platform, providing innovative working capital solutions for SMEs in Saudi Arabia. Forus offers a debt marketplace that bridges the funding gap for SMEs by providing businesses with funds to support their operational needs, offering up to SAR 5 million with terms from 1 to 36 months. It also offers short-term financing against POS receipts and cash financing against company invoices, covering up to 80% of the invoice value with terms from 1 to 12 months.

In January 2025, Forus Financial secured US $60 million in debt financing from Fasanara Capital. The funds will be used to scale Forus' lending operations, provide more than US $150 million in working capital loans to hundreds of Saudi SME borrowers, and support the company's growth towards becoming one of the largest non-bank providers of debt financing to SMEs in Saudi Arabia.

#3 - Rize (KSA) | PropTech

US $35 Million Series A

Founded by Ibrahim Balilah and Mohammed AlFraihi in 2021, Rize is the first Saudi real estate technology company to offer a "Rent Now, Pay Later" (RNPL) service, allowing tenants to pay annual rents in flexible monthly installments instead of a one sum payment. Since its founding, the company has achieved significant milestones, including reaching a total rental value of over half a billion SAR through its platform.

In January 2025, Rize raised US $35 million in its Series A funding round led by Raed Ventures, bringing its total funds raised to US $37.9 million. The funds will support Rize's growth plans and expand its services in line with the Kingdom’s vision for digital transformation and enhancing the real estate sector.

#4 - Zension (UAE) | E-commerce

US $30 Million Series A

Founded by Khalid Saiduddin in 2016, Zension focuses on promoting a circular economy that minimizes electronic waste and support sustainable practices in the mobile device industry across the GCC. Zension offers flexible device access that covers upgrade options, unlimited repairs, and replacements, as well as buyback and trade-in programs.

In January 2025, Grand Games secured US $30 million in Series A funding. The funds will allow Zension to launch its subscription service for personal tech devices, Zaam, in Saudi Arabia and the UAE throughout the first quarter of 2025.

#5 - Jeel Pay (KSA) | FinTech

US $6.657 Million Seed

Founded in 2022, Jeel Pay develops payment and collection solutions for educational institutions, offering a "Study Now, Pay Later" (SNPL) service that allows students and their families to pay tuition fees in installments over 12 months without interest. Jeel Pay pays the full tuition fees upfront to the educational institution, simplifying the payment process for both students and schools through its digital platform that integrates with school management systems.

In January 2025, Jeel Pay secured US $6.657 million in Seed funding led by Joa Capital. The funds will allow Jeel to enhance its digital services and hire expert personnel, aiming to offer solutions that increase educational accessibility and fulfill market needs.

%2Fuploads%2Ffintech-sap-2025%2Fcover24.jpg&w=3840&q=75)