February 2025: Spotlight on MENAPT's Leading Funded Startups

06 March 2025•

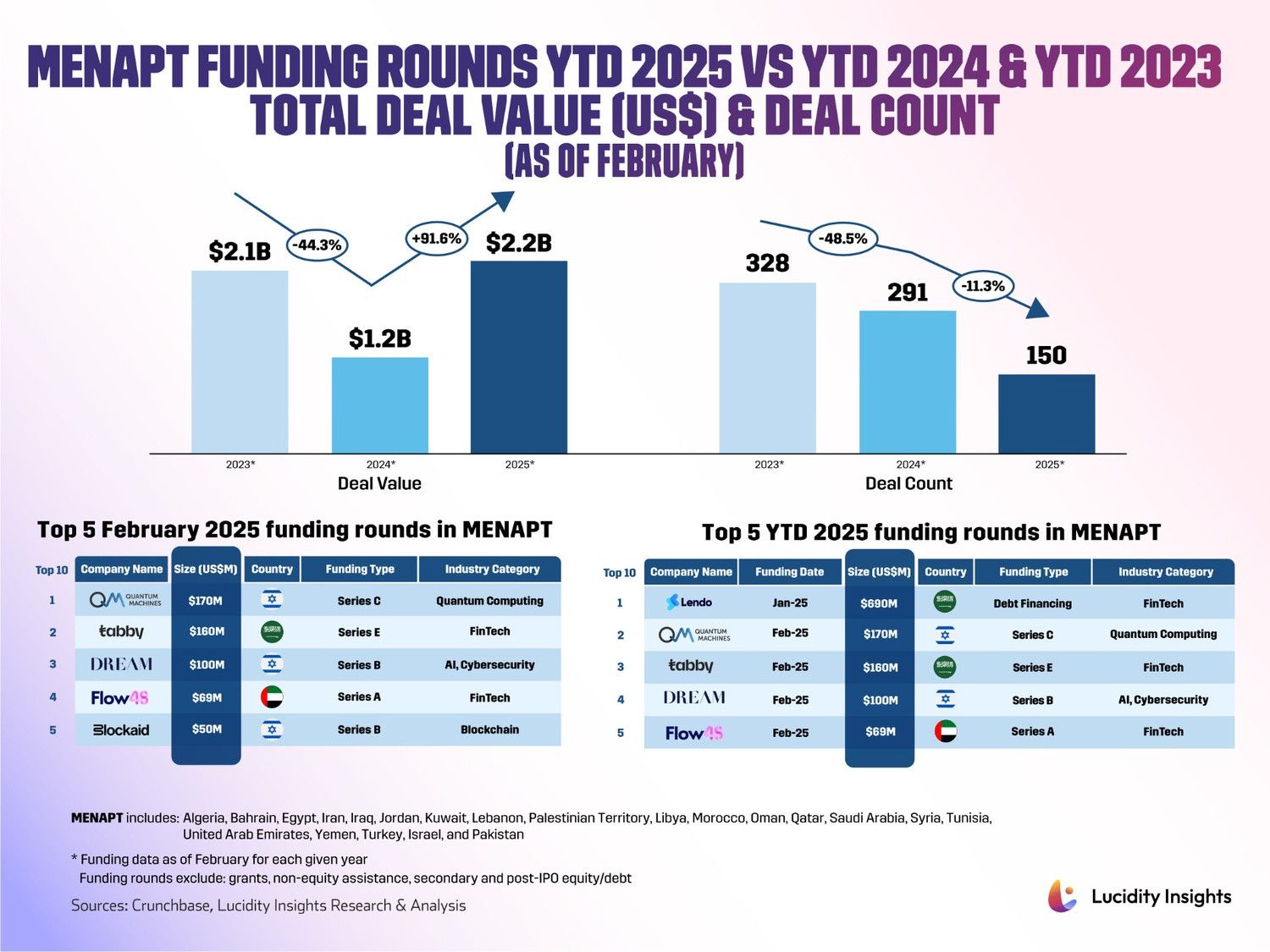

After experiencing a downturn in 2024, venture capital activity in the MENAPT region has shown signs of recovery in early 2025. Year-to-date, total deal value saw a decline of 44.3% from US $2.07 billion in February 2023 to US $1.15 billion by February 2024, highlighting ongoing challenges faced since that period. However, 2025 has started on a positive note with a staggering 91.6% increase, bringing the total deal value up to US $2.21 billion by February.

In contrast to total deal value, the number of deals has consistently decreased over the last three years. There were 328 deals recorded by February 2023, which dropped by 11.3% to 291 deals by February 2024, and further declined to 150 deals by February 2025. These trends indicate a significant shift toward fewer but larger and more strategic funding rounds, marking a departure from the smaller, more frequent investment rounds that previously characterized the region’s VC landscape.

With increased funding in the region for the second month in a row, investor confidence might be gradually returning despite previous setbacks, supported by stabilizing global interest rates and a strategic shift toward high-impact investments. The World Bank projects that economic growth in MENAPT will rise to 3.8% in 2025, a significant increase from 2.2% in 2024. Government efforts such as Saudi Arabia’s Vision 2030, the UAE’s National Innovation Strategy, and Egypt’s tech-focused incubation programs keep playing a key role in shaping the MENAPT startup ecosystem, boosting investor confidence, and attracting more venture capital to the region. These figures hint at an exciting period of consolidation and innovation-driven growth to come, and we’ll continue to monitor developments throughout the year to assess whether these positive trends can be sustained for long-term impact in the MENAPT VC landscape.

Let’s take a look at the top 5 funding rounds of February 2025 in MENAPT.

#1 - Quantum Machines (Israel) | Quantum Computing | US $170 Million Series C

Founded by Dr. Itamar Sivan, Dr. Yonatan Cohen, and Dr. Nissim Ofek in 2018, Quantum Machines develops hardware and software solutions for the control and operation of quantum systems used by quantum computing companies and research centers in 15 countries. Their flagship product is the Quantum Orchestration Platform, which enables seamless execution of complex quantum algorithms and real-time quantum control.

In February 2025, Quantum Machines raised US $170 million in a Series C round led by PSG Equity, bringing its total funding to US $363 million. The funds will be used to drive the development of quantum computers with tens of thousands of qubits and to further advance their quantum control technology.

#2 - Tabby (KSA) | FinTech | US $160 Million Series E

Founded by Hosam Arab and Daniil Barkalov in 2019, Tabby operates a financial platform that offers consumers a "buy now, pay later" (BNPL) option to pay for online and offline purchases either in a deferred single payment or in multiple installments. Essentially, the platform provides flexible credit options for safe payments. It currently caters to 15 million active shoppers across the UAE, KSA, Kuwait, and Bahrain, selling 40,000+ global brands and merchants like H&M, Adidas, IKEA, SHEIN, and Bloomingdale’s.

In February 2025, Tabby secured US $160 million in a Series E round led by Blue Pool Capital and Hassana Investment Company (HIC), bringing its total funds to US $1.9 billion. The funds will be used to expand Tabby's financial services, including digital spending accounts, payments, cards, and money management tools to drive the Kingdom's cashless economy forward as it plans for IPO.

#3 - Dream Security (Israel) | Cybersecurity | US $100 Million Series B

Founded by Shalev Hulio, Sebastian Kurz, and Gil Dolev in 2023, Dream is rebuilding cybersecurity with a suite of proprietary AI models designed to think like both a defender and an attacker. By fusing advanced posture management with AI predictive detection, Dream has created a robust data ecosystem that not only anticipates but actively eliminates threats before they materialize.

In February 2025, Dream Security raised US $100 million in its Series B funding round led by Bain Capital Ventures for a total funding of US $153.6 million. The funds will be used to accelerate the development of Dream's Cyber Language Model (CLM), a first-of-its-kind family of Language Models specifically trained for cybersecurity operations, and fuel the company's expansion with a strategic focus on markets where cyber threats continue to pose significant national security challenges.

#4 - Flow48 (UAE) | FinTech | US $69 Million Series A

Founded by Idriss Al Rifai in 2022, Flow48 provides revenue-based financing to small and medium-sized enterprises (SMEs), allowing them to secure upfront capital based on their future revenues as a flexible alternative to traditional debt and equity financing. Flow48 has cemented its position in the UAE and strengthened its market presence in South Africa while introducing new products for SMEs.

In February 2025, Flow48 secured US $69 million in Series A funding led by Breega, bringing its total amount raised to US $94 million. The funds will be used to further expand in its two key markets and replicate its solution in Saudi Arabia as well as add new features to enhance its platform capabilities, leveraging alternative data sources and advanced risk assessment tools to deliver tailored financial solutions to SMEs.

#5 - Blockaid (Israel) | Blockchain | US $50 Million Series B

Founded by Ido Ben-Natan and Raz Niv in 2022, Blockaid has developed a unified platform that monitors, detects, and automatically responds to fraud and attacks on infrastructure, assets, and end users. The platform provides exclusive access to the largest repository of real-time transaction data through integrations with leading Web3 wallets, allowing it to identify and neutralize new threats in advance.

In February 2025, Blockaid raised US $50 million in its Series B funding round led by Ribbit Capital, bringing its total funds to US $83 million. The funds will fuel Blockaid's expansion in operations and R&D, ensuring it stays ahead of the ever-growing demand for ironclad onchain protection.