Crypto Regulations Around the World

04 June 2022•

The Crypto ecosystem and the underlying blockchain technology offer decentralization, transparency, and flexibility. It is set to revolutionize and redefine the way we operate, but why are opinions so divided on the right path forwards with regards to regulation? How are different governments approaching this emerging asset class?

On one hand, blockchain technology with its decentralized, distributed ledger means that no single entity can control, compromise, or manipulate cryptocurrencies. It proposes an attractive alternative to traditional finance systems by cutting out the middlemen and providing an open, democratic and decentralised monetary exchange and governance system. It provides both time and cost efficiencies in a world that is looking to save on both time and cost.

On the other hand, decentralization also means that without a central governing authority, there is nowhere for crypto users to turn to when things go wrong, such as in the case of cyber-attacks, fraud, or even accidental loss of funds. Exchanges are digital and therefore automatically vulnerable to hackers, ransomware and operational glitches. Essentially crypto currently exists on a non-regulated 24-hour stock market. It is not insured and there isn’t any responsibility for monitoring and identifying suspicious transaction patterns. This has brought up questions around how safe and secure these crypto platforms, applications and stakeholders are.

Crypto has been accused of being an ideal breeding ground for illegal activity, associated with money laundering through crypto exchanges, the finance of terrorism and human trafficking as well as the darknet market. Is the crypto world rampant with illegal activities, more so than the traditional banking system? The traditional banking system seems to be rife with money-laundering and corruption scandals as well – the world’s institutional banks were dealt out US$10.4 billion in Anti-Money Laundering (AML) fines in 202017.

Whilst it is true that the pseudo anonymity of blockchain technology creates somewhat of a data gap, it is a misconception that transactions are untraceable. Compared to traditional banking, blockchain transactions are often more transparent, traceable, and therefore accountable due to the distributed ledger function, making it a poor vehicle for money laundering compared to cash. However, the problem is that although transactions can be traced, specific parties may not be as easy to identify as there are many crypto exchanges that provide their services with no anti-money laundering (AML) or know your customer (KYC) practices in place.

However, data does show that crypto-based crime hit an all-time high in 2021, with illicit addresses receiving US$14 billion over the course of the year, nearly twice the amount of the previous year. This includes terrorism financing, scams, stolen funds, ransomware and the darknet market. Though crypto-crime has increased in value in the past year, it has gone down as a total share of crypto value in the market; we must remember that total crypto transactions grew to US$15.8 trillion in 2020, a 567% increase compared to 2020 levels18. Comparatively, the annual amount of money laundered and connected with illicit activity globally is 2 - 5% of global GDP (USD $1.6 to $4 trillion USD)19.

Crypto Scams: Beware and Protect Yourself

Though the jury is still out on whether or not the crypto-ecosystem is more rife with scams than in traditional financial system, investors must be prudent and do their due diligence, just as in any other market. Financial scams and fraud associated with crypto have also been on the rise for the past 5 years with many coming from ‘rug pulls.’ This is a relatively new concept where crypto projects are launched and then abandoned by developers who take investors’ money, by removing transaction (or trading) ability and draining liquidity from the market by quickly cashing out. Rug pull scams often rely on extensive marketing to attract investors including the heavy use of social media, influencers, and popular culture to promote the project. One recent example was the ‘SQUID’ coin, marketed as a ‘play-to-earn’ cryptocurrency, where users purchased tokens to play in online games. Many users believed that the tokens were associated with the hit Netflix show Squid Games and that they could be used for a new online game inspired by the show. SQUID was traded on a decentralised exchange and increased 83000% in just days fuelled by major news outlets running headlines about it. SQUID peaked at $2681 before crashing to zero and developers are reported to have disappeared with around USD $3.4 million20.

Initial Coin Offerings or ICO scams are happening too. ICOs are the crypto industry equivalent to IPOs and a popular way for companies to raise money to create a new coin or crypto related service. Yet whilst IPOs have strict legal guidelines to follow in most countries, ICOs simply require a whitepaper, website and an interesting feature or story to entice potential investors. Social engineering scams such as blackmailing, romance scams, and phishing that are already prevalent in the traditional finance world, are becoming increasingly used to trick crypto users into compromising their secure information. Moreover, even when crypto investors try and protect themselves by using exchanges to store their cryptocurrency, they are still at risk from being hacked whether on a centralized or decentralized exchange. There is little support or insurance for such losses today.

This points to the need to protect investors and to create an infrastructure for the industry. If the future of money is crypto and the future of finance is blockchain, then building trust in the system is essential. The market is complicated, inundated with mis-selling and scams due to low investor awareness and education. There needs to be a way that the performance, potential and risks of crypto assets are made more transparent, while monitoring and minimizing the manipulation and illegal activity in the crypto ecosystem.

These are just some of the risks and challenges posed by this 13-year-old industry. Many believe that regulation of the industry will start to solve these issues and ensure its global legitimacy as well as pave the way to mainstream adoption. But, what then, does a good regulatory framework look like?

What does Regulation mean for Crypto?

As the crypto world continues to gain unprecedented level of interest, regulation is going to continue being a major theme for the industry in 2022. This includes establishing security, business regulations, taxation rules as well as consumer protection mechanisms.

As with any new technology, the lack of regulation in the early days was beneficial for the industry, allowing for plenty of new ideas, platforms, experimentation, and rapid innovation. But today, there is a strong case for carefully thought-out regulation for the evolution of the crypto industry. The crypto world is made up of crypto-assets, cryptocurrencies, central bank digital currencies and NFT’s each providing a unique set of benefits, challenges, and complexities; thus, this is not, and cannot be a copy-paste exercise of regulation from the traditional financial system – as the same rules and regulations for traditional finance do not directly apply.

There are many important regulatory concerns and considerations that touch every part of the crypto ecosystem. Given it is still a relatively new industry, it is essential that innovation can continue, competition is supported and growth can continue to help it reach its potential. It is critical that regulation minimizes risks, garners trust, and maintains financial stability, without eliminating the benefits of the technology.

When it come to crypto services, it is vital for regulation to consider if they should be allowed to have multiple roles; many of them currently act as a trading platform but also as a broker. How can such conflicts of interest be managed to ensure investor protection? And should the assets be separated with independent governance structures?21.

Crypto-users that are keen for some regulation state that effective regulation of the crypto ecosystem will actually allow for more tangible use cases for the technology to be realised and for the technology to create opportunities in all areas of society. Pro-regulation users say it should encourage mass adoption even to the level that companies will begin to implement virtual assets into their operations without fear. Those against regulation take the position that any government control will take-away from original ethos of why crypto was built in the first place: decentralized finance, away from control of any individual or group.

It’s a fine line between over-regulation and under regulation and one which Governments around the world are trying to tackle, not least as they also want to now reap the economic rewards of this world changing technology. In recent years, the question has gradually begun to shift away from whether or not to regulate, but how best to regulate.

Crypto Regulation around the World

Much of the regulatory framework is still being developed around the world. Whilst some countries are actively cultivating a regulatory environment to enable the crypto industry to grow, others are seen to be taking a reactive approach and some are taking strict restrictive measures. The opinions on the industry have been divided from the outset; most governments, financial institutions and even the media have swayed back and forth between dismissing crypto altogether, fearing its impact, to investigating the potential benefit of crypto. And now the different regulations being put in place reveal this stance. Countries are starting to specify rules and restrictions that will depend on a variety of factors including how crypto is used (ie. payments, investments, derivatives), how it is classed (ie. money, property, commodity) and taxation status. Many nations have started to find ways to tax on crypto gains and income.

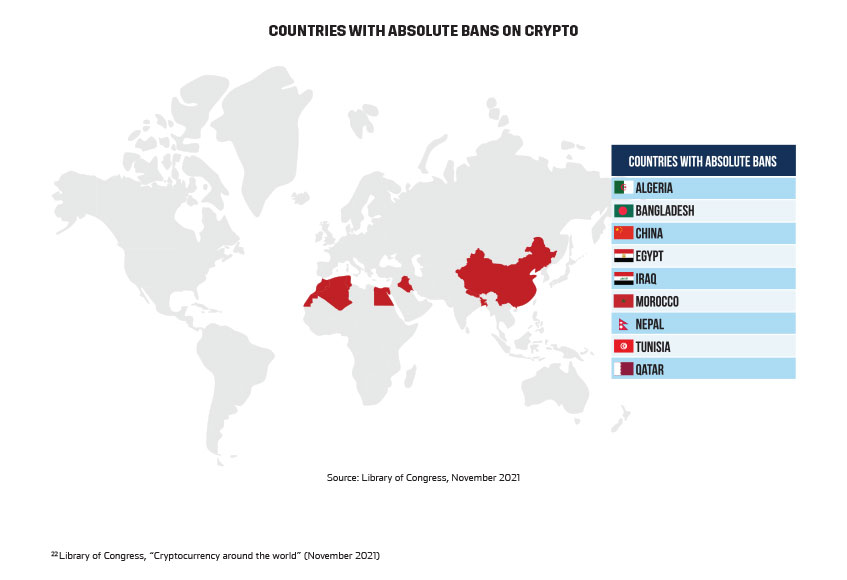

According to the Library of Congress (LOC) November 2021 review, 103 countries are directing their financial regulatory agencies to develop regulations for banks and other financial institutions regarding crypto and their use in anti-money laundering and counter terrorism finance22. This includes the USA, UK, Canada, Australia and El Salvador; El Salvador is the only country in the world that has declared bitcoin to be legal tender.

There are 9 countries shown in red on the map that have absolute bans including China, Egypt, and Qatar. Russia also seems itching to join the list of countries with an absolute ban, but 2022 will see how that story unfolds. Forty-two countries including Bolivia and Turkey have implicit bans meaning that they cut off banking and financial system support for crypto such as the use of exchanges essential for trading.

What is the Regulatory Stance of the Major Economies?

China

China has a complete ban on crypto, which was implemented in different phases. China has been wary from the beginning and initially restricted banks from using Bitcoin as currency in 2013. Restriction became tighter with the banning of crypto exchanges and trading in 2019 although it remained possible for citizens to continue trading through international crypto exchanges. In 2021, China officially announced everything crypto-related was ‘illegal financial activity’. This means citizens are banned from using any exchange services globally, cannot work for any crypto related companies and financial institutions are unable to provide any crypto-related services. It sent a clear message that even cryptocurrency transactions originating outside China will be treated as crimes. China is regulating internet content, access and advertising related to cryptocurrencies.

The 2021 crackdown on crypto-related business also include mining. With low electricity costs and the availability of cheap computer hardware, China had become a hub for Bitcoin mining with 65-75% of the world’s Bitcoin mining happening there. The mass exodus of miners from the country caused the value of Bitcoin to halve. It fell to below USD $30,000 in June 2020 from its record high of USD $64,000. However, Bitcoin had a surprisingly speedy recovery and bounce back, which demonstrated the resilience of the global bitcoin mining industry in particular, which was able to set up again quickly in places like Kazakhstan, Russia, and the USA.

Many factors likely led to China’s final decision, including the volatile fluctuations of crypto being seen as a threat to the country’s economic and financial stability as well as the use of electricity derived from coal for bitcoin mining, which threatened to undermine Beijing’s commitment to reach carbon neutrality by 2060. Is this really the end for crypto in China? It is not clear whether this is a long-term strategy or a way of shifting the industry into a government-favored direction and clearing the path for the Bank of China issuing a digital Yuan.

USA

Much like China, the USA is grappling with its own way of controlling the cryptocurrency sector. Regulation of the crypto ecosystem in the US is complicated as there is no single federal authority that is responsible for it. Bitcoin is considered a commodity regulated by the Commodity Futures Trading Commission (CFTC), it is considered a property for tax-purposes by the IRS and Bitcoin futures exchange-traded funds (ETFs) come under the purview of the Securities and Exchange Commission (SEC).

These authorities have started laying out some regulatory frameworks, but there is a long way to go. Even though the actual buying and selling of cryptocurrency with blockchain technology are considered extremely secure, the SEC and CFTC have issued multiple warnings about cryptocurrency investments scams. They report that US consumers lost more than $80 million dollars in such cryptocurrency-related investment scams in the 6 months between October 2020 and March 2021 which was over 10 times the amount lost during the same period a year previous. In 2018, the SEC launched a fake ICO website as a creative way to warn people of the dangers. The howeycoins.com site was complete with a whitepaper, celebrity endorsements and when users clicked to buy tokens, they were directed to a SEC information page revealing the scam as well as investor education.

In December 2020, the SEC charged Ripple (XRP) for conducting an unregistered securities offering by raising $1.3 billion through the sale of Ripple’s XRP token; news sent the XRP token price down by half its value within a few days, though Ripple has more than recovered since then. Instead of settling the case, Ripple has decided to fight back. Ripple claim’s that it deserves the same treatment that Ethereum received (a pass from the SEC), as Ripple’s set-up is not materially different from Ethereum’s. They also claim that while Ethereum launched based on an ICO, Ripple was actually backed by venture capital. All eyes are on this case as it will set precedence for crypto regulation in the US.

The SEC has also made claims that they are interested in the workings of Coinbase, one of the largest cryptocurrency exchanges, that achieved unicorn status in 2017, and went public in 2021. In June 2021, Coinbase announced plans for a product called Lend, which would allow cryptocurrency owners to loan out their coins and tokens for interest. In September, Coinbase announced that the SEC had threatened to sue the company over Lend, alleging that the offering involved a security. The SEC has not publicly commented on the matter, and Coinbase has suspended its Lend project, for the time being.

United Kingdom

The UK categorises crypto as ‘property’ but not as legal tender. The UK Financial Conduct Authority (FCA), HM Treasury, and the Bank of England make up the Taskforce initiated in 2018 to explore the impact of the crypto-asset market. Currently, crypto exchanges are required to register with the FCA and there is a ban on trading cryptocurrency derivatives to protect consumers from market volatility. The FCA have also created regulations around ‘know your customer’ (KYC), ‘anti-money laundering’ (AML) and ‘counter-finance of terrorism’ (CFT) tailored specifically for crypto-assets. In terms of taxation, investors pay capital gain tax on profits from crypto trading, and generally taxes are based on type of activity and transaction. The UK are in the process of gathering data and evidence from various stakeholders (including the views of industry, consumers, and regulators) on the use of digital assets which will then help make proposals for new laws taking into consideration the views of these stakeholders.

Bahrain

Bahrain is looking to strengthen its crypto industry. The Central Bank of Bahrain (CBB) implemented a robust set of regulatory frameworks and supervisory measures to all crypto related activity in 2019. These cover rules for licensing, governance, minimum capital, control environment, consumer protection, risk management, anti-money laundering and counter-terrorism financing, standards of business conduct, avoidance of conflicts of interest, reporting, and cyber security for crypto-asset services. In January 2021, the sharia compliant CoinMENA exchange acquired the “Crypto Assets Services Company License” from the CBB allowing them to operate fully as a regulated crypto exchange and onshore platform in the country.

Iran

Though there is no formal regulatory framework for trading cryptocurrencies, Iran recognized cryptocurrency mining as a legal industry in 2018, regulating the mining farms in the country; this has led to a surge in crypto-mining farms in the country, and even more so – after China announced it would ban the activity in 2021. Some estimates put it at US$660 million worth of crypto being mined in Iran each year, which is 4-6% of the world total. Despite legalizing crypto-mining, Iranian officials claim that the majority of crypto-miners are still operating illegally without proper licenses. In 2021, Iran was forced to shut-down and place temporary bans on the crypto-mining industry due to the country’s electricity supply gaps causing black-outs across the country during high-surge times. Banks and money-changers in Iran are allowed to use cryptocurrencies minted by licensed miners to pay for imports, and trading or swapping cryptocurrencies is permitted. It has been reported that more than 11 million Iranians own and trade cryptocurrencies. More recently, in January 2022, Iran announced that its Central Bank and Ministry of Trade have agreed to start allowing merchants to use cryptocurrencies to settle international trade deals.

Israel

Israel legalized Bitcoin in 2017, and began building a regulatory framework around digital assets. The Israel Tax Authorities do not classify Bitcoin as a currency, but as a taxable asset. There is a 25% capital gains tax each time Bitcoin is sold, and Miners are treated as corporations and are liable for corporate income tax as well as the 17% VAT charge. In November 2021, there was an update to AML laws, requiring identification, reporting and registration of all cryptocurrency transactions.

Jordan

The Jordanian government took a harsh stance on cryptocurrency, banning them outright initially. Today, the Central Bank of Jordan prohibits all banks, currency exchanges, financial service and payment service providers to facilitate cryptocurrency transactions. However, Jordan does not prohibit citizens from using international exchanges to buy and sell cryptocurrencies on their own.

Kuwait

In Kuwait, financial institutions were banned from trading crypto in late 2017; however individual citizens can legally buy and sell crypto on supported exchanges. The Central Bank of Kuwait makes a point to caution against the use cryptocurrencies. They issued a public warning in May 2021 around the volatility of cryptos as well as to remind citizens that crypto is not considered as ‘real currency’.

Oman

Crypto is legal but unregulated today in Oman. Citizens are warned of the risks involved and the lack of consumer protection. However, the Central Bank of Oman has launched a high-level task force set to study the impact, risks and potential economic advantages and disadvantages of crypto usage in the country. The output of which is likely to shape regulation going forward.

Saudi Arabia

Similar to Kuwait, financial institutions in the Kingdom of Saudi Arabia are not allowed to deal with cryptocurrency unless permitted by the Central Bank of Saudi (SAMA), and there currently is no crypto-related regulatory framework in place. That said, there are Crypto ATM’s and citizens can trade cryptocurrencies legally in the Kingdom. SAMA has begun using blockchain technology in its activities in the banking sector and to keep pace with market trends. Project Aber was launched in collaboration by the Central Bank’s of Saudi and the UAE, which is exploring the viability of a single dual-issued digital currency between the two economies to be used for domestic and cross-border payments between the two countries that operate on different currencies.

United Arab Emirates

In September 2021, the UAE Securities and Commodities Authority signed an agreement with the Dubai World Trade Centre Authority (DWTCA) aimed at supporting the trading of crypto assets. The DWTC will essentially become a dedicated special crypto zone and regulator for cryptocurrencies, virtual assets, products, operators and exchanges. The DWTCA will be responsible for approving and licence financial activities relating to crypto assets; though the development of the associated regulations around investor protection, AML, compliance and cross-border transactions are still being developed. In October 2021, the Dubai Financial Services Authority (DFSA) released the first part of its regulatory framework for investing in digital tokens, as part of its’ wider DFSA Digital Assets regime. In addition, As part of the UAE’s new online security laws – which went into effect on January 2, 2022 – promoters of online cryptocurrency scams could face a possible five-year jail term and fines of over US$270,000. In May 2021, the government released a statement to dissociate themselves from ‘Dubai Coin’ which was in fact an elaborate phishing website which was designed to steal and use personal information. UAE authorities have a growing interest in taking measures to protect the public from similar fake cryptocurrency schemes.

How to make Regulation work at the Global level?

Crypto allows for both cross-border and cross-sector transactions which makes coordination particularly difficult given the various regulatory frameworks being set up in different countries. Many crypto exchanges also operate across borders and operate in offshore financial centres, which means that both supervision and enforcement is not only complicated, but nearly impossible without dedicated international collaboration. This makes regulation an evolving and global challenge that also needs to be addressed by international bodies as well as at a national level.

Some of the work in this area includes that of The Financial Action Task Force (FATF), the inter-governmental body which sets international standards to prevent money laundering, terrorist financing and the financing of the proliferation of weapons of mass destruction. They have published specific guidance for virtual assets and virtual asset service providers (VASPS) as how to licence providers and carry out sufficient monitoring and supervision of activity.

In the EU, the Markets in Crypto-Assets (MiCA) proposal is part of the digital finance strategy which aims to create a single market for capital in Europe called the Capital Markets Union. MiCA will establish uniform rules for crypto assets for the block.

In addition, the International Monetary Fund have also released information on how global crypto regulation can be ‘comprehensive, consistent and co-ordinated’.

%2Fuploads%2Fcrypto-universe%2Fcover1.jpg&w=3840&q=75)