China’s EV Dominance

10 October 2023•

Previously: Silicon Anode Technology to Supercharge EV Battery Range by 20%

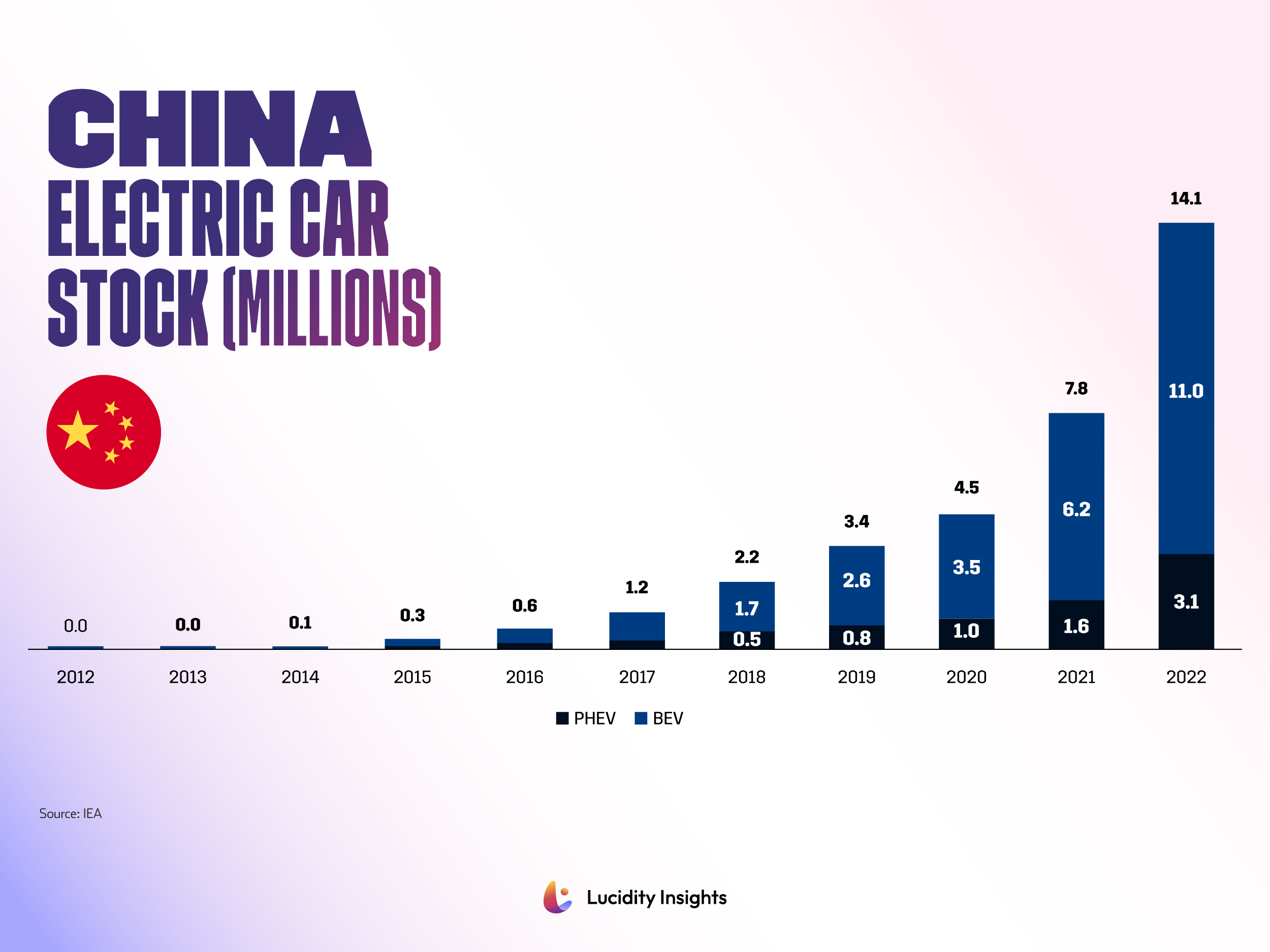

China has the largest EV network in the world with over 7 million electric cars on the road in 2021.

This means that China alone is home to 44% of the world’s total EV stock. Its EV dominance is credited to the government’s “Made in China” strategy which has an entire pilar focused on EV manufacturing and sales, including government-backed subsidies which have set the scene for over 300 manufacturing companies in the country.

Infobyte: China Electric Car Sales

Infobyte: China Electric Car Sales

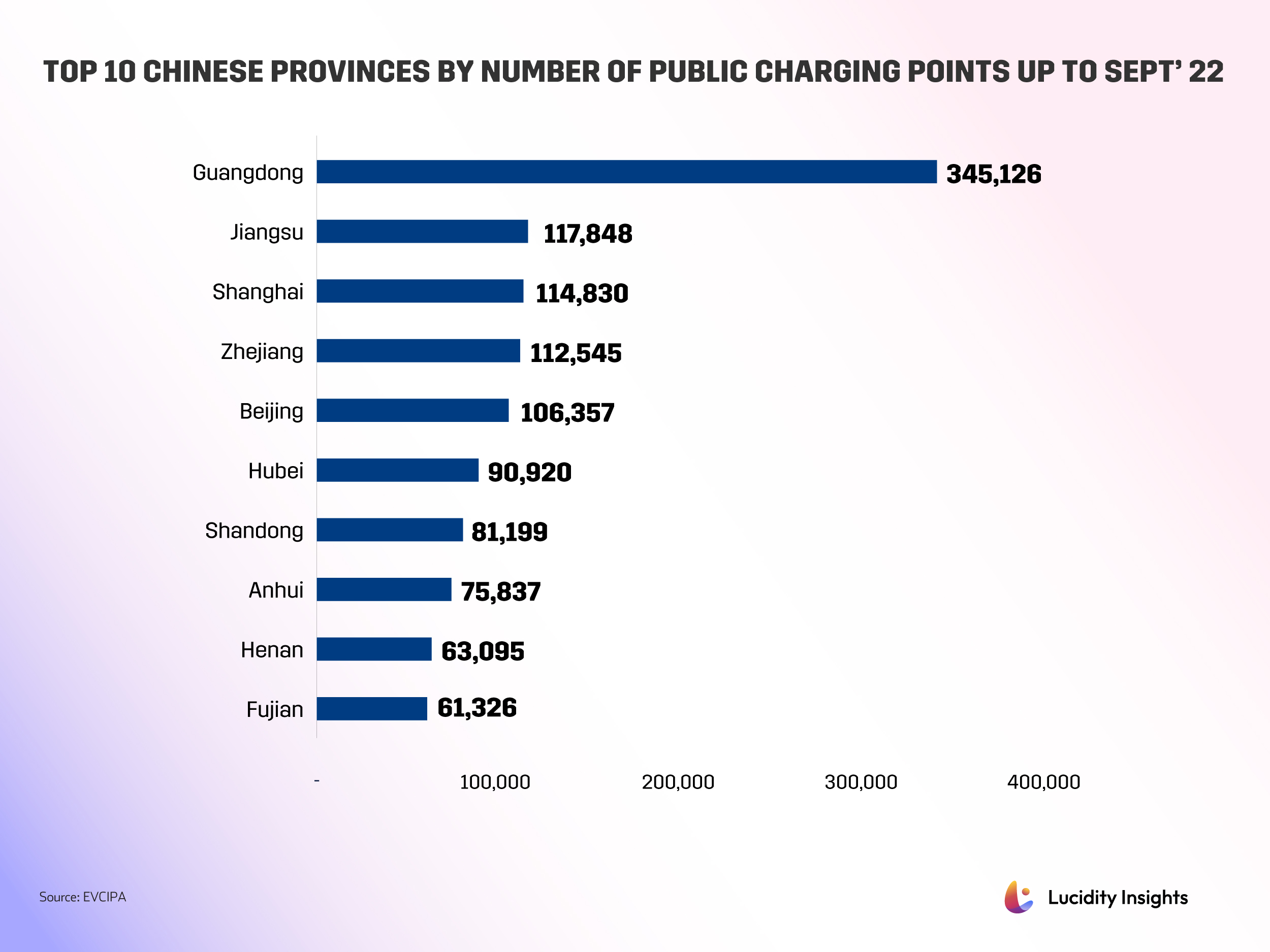

EV sales continue to soar in China. At the end of 2022, China nearly doubled its entire EV stock in a single year, reaching 14.1 million EVs on its road. In the same year, the country sold nearly 6 million EVs, of which 75% are fully battery operated EVs. China also increased its public EV charging infrastructure by 626,000 charging units, or a 55% growth year-over-year.

Infobyte: China Electric Car Stock

Infobyte: China Electric Car Stock

Infobyte: China Number of Public Charge Points 2015-2022

Infobyte: China Number of Public Charge Points 2015-2022

Infobyte: Top 10 Chinese Provinces by Number of Public Charging Points up to Sept’ 22

Infobyte: Top 10 Chinese Provinces by Number of Public Charging Points up to Sept’ 22

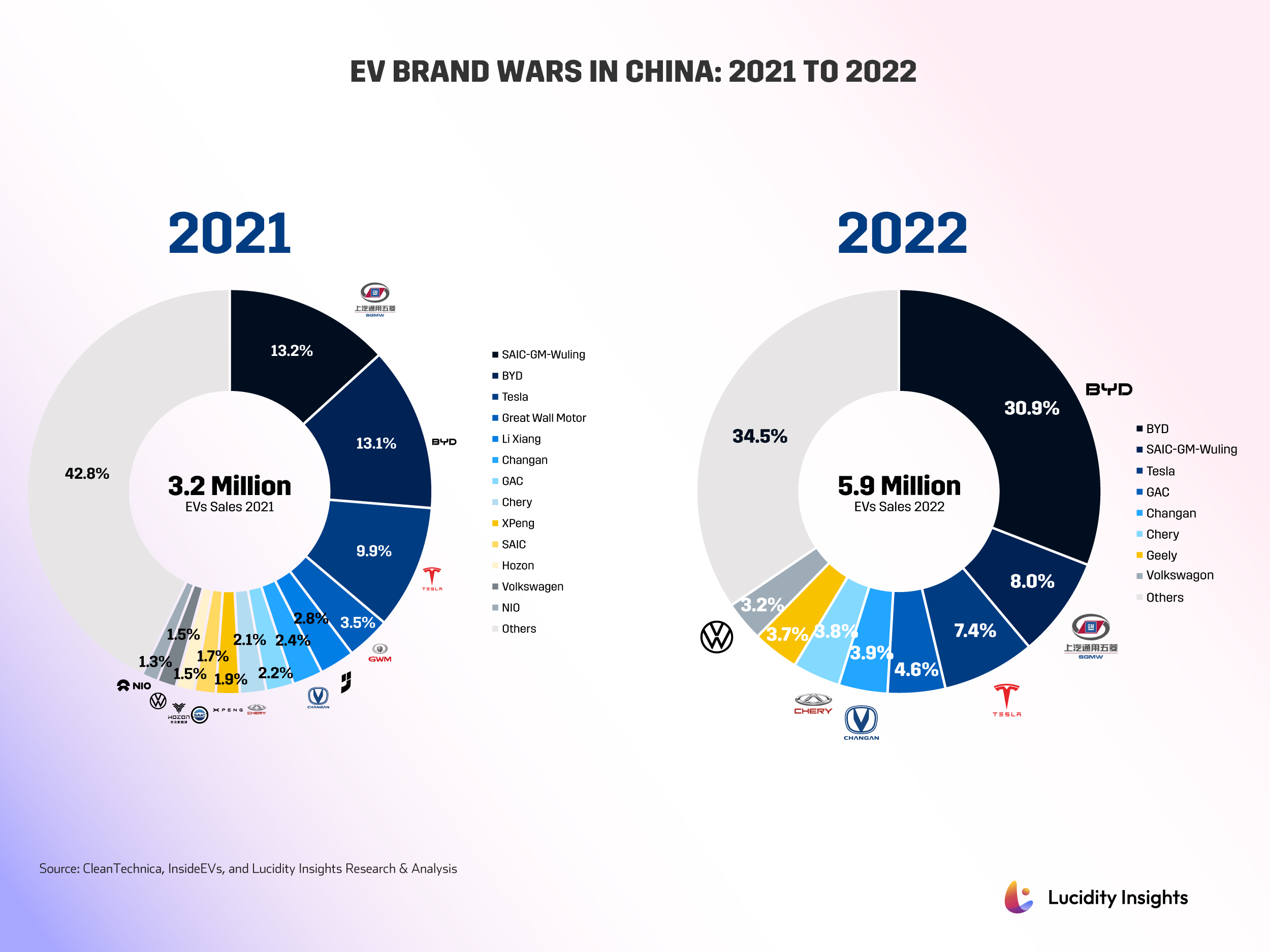

EV Brand Wars in China

In 2021, top EVs sold in China were all Chinese manufacturers except for Tesla and Volkswagen; the same held true in 2022, except there was quite a dramatic shake-up. China’s BYD skyrocketed from 2nd place in 2021 with 13% market share to #1 with an astounding 31% market share. BYD’s dominance has largely shrunk competitors' market shares, sending SAIC-GM-Wuling into 2nd place with 8% market share, nearly flush with Tesla’s 7.4%. Volkswagen, on the other hand, is one of a handful of EV players that increased market share last year from 1.5% to 3.2%. Tesla has a giga factory in Shanghai which started production in 2019, and Volkswagen Group has 33 plants in China.

Related: BYD Speeds Ahead in the EV Race, Surpassing Tesla and Into the Metaverse

Infobyte: EV Brand Wars in China: 2021 to 2022

Infobyte: EV Brand Wars in China: 2021 to 2022

Spoiled for Choice

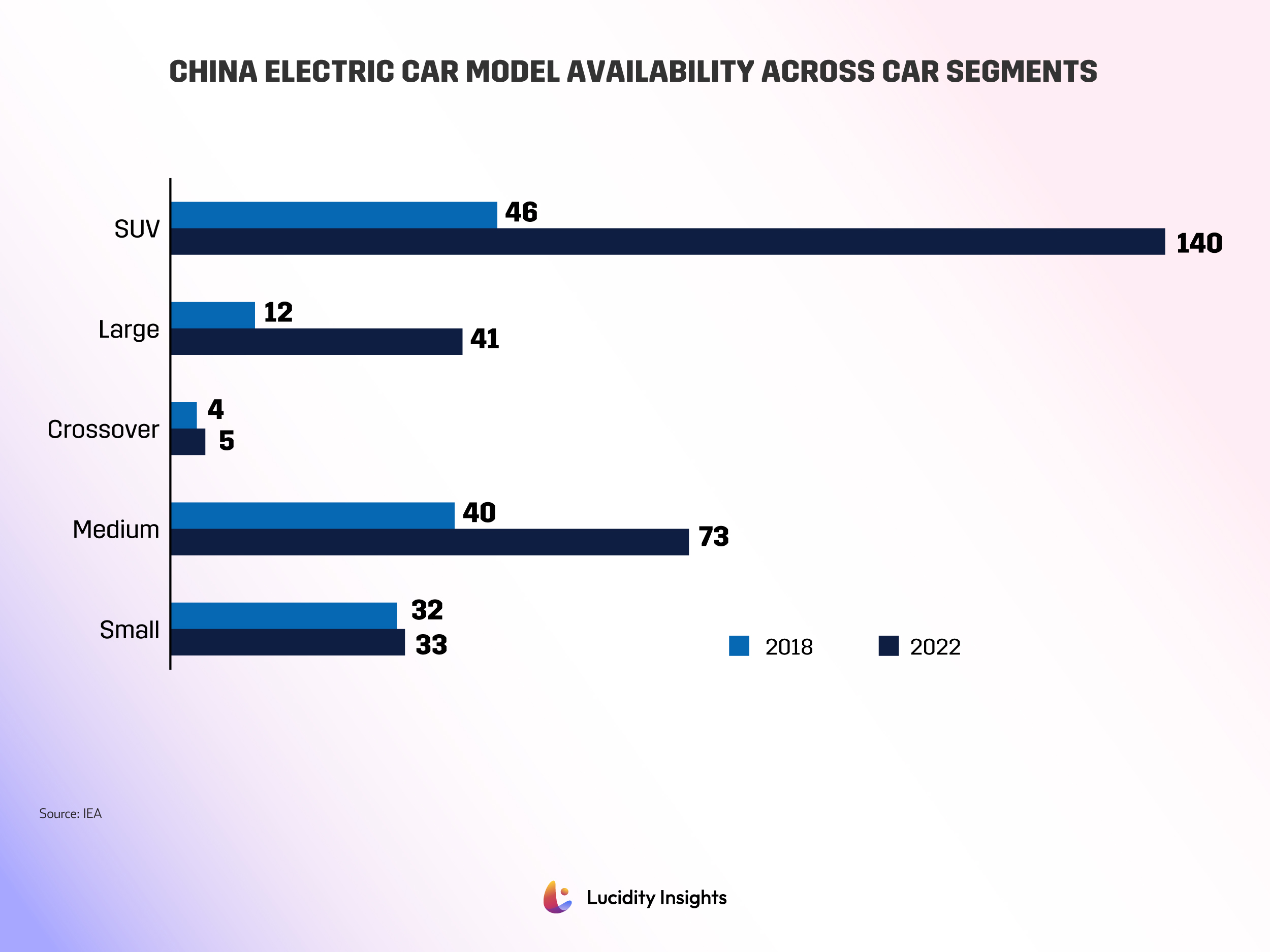

Not only are Chinese consumers spoiled for choice across various Chinese and international EV brands, they are also spoiled for choice across car segments – whether you want a small, medium or large EV, an SUV or a cross-over – there are several models to choose from in each segment.

Infobyte: China Electric Car Model Availability across Car Segments

Infobyte: China Electric Car Model Availability across Car Segments

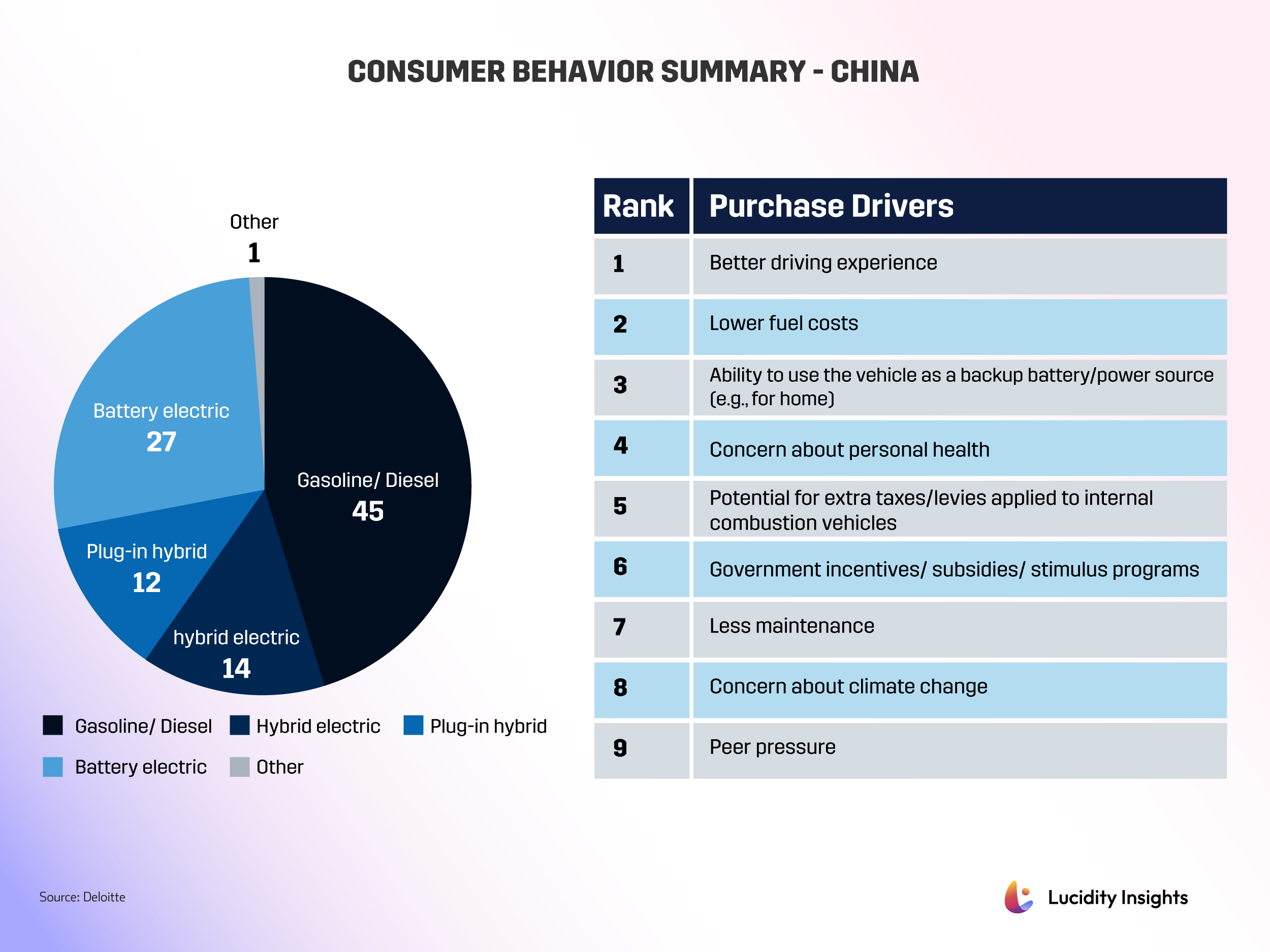

Infobyte: Consumer Behavior Summary - China

Infobyte: Consumer Behavior Summary - China

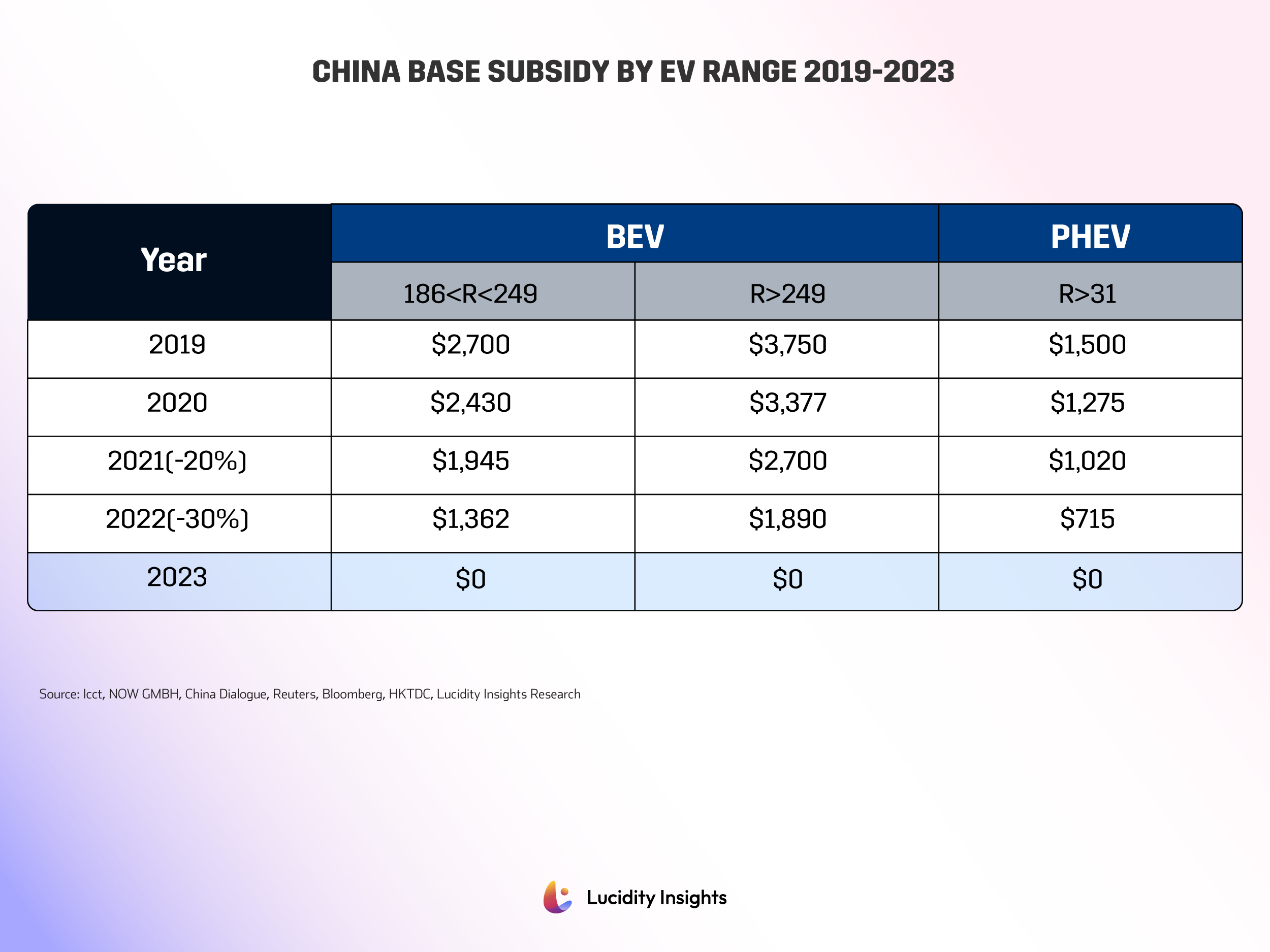

Unwinding Subsidies

China’s implementation of EV subsidies in 2009 has been central to the rapid and widespread adoption of electric vehicles in the country. Between 2009 and 2021, China spent US$14.8 billion on EV subsidies. Up to US$9,000 were granted to those who bought fully electric cars. China planned to gradually eliminate subsidies by 2020 but extended for 2 years due to an increase in demand during the pandemic. The Finance Ministry announced that it would decrease subsidies by 10% in 2020, 20% in 2021 and 30% in 2022. 2023 is the first year where the majority of federal subsidies in China have been removed.

Some short-term benefits still remain though. All electric vehicles, including plug-in hybrid electric vehicles, are exempt from 10% acquisition or purchase tax in China; this subsidy commenced from January 2021 and is applicable until the end of 2023.

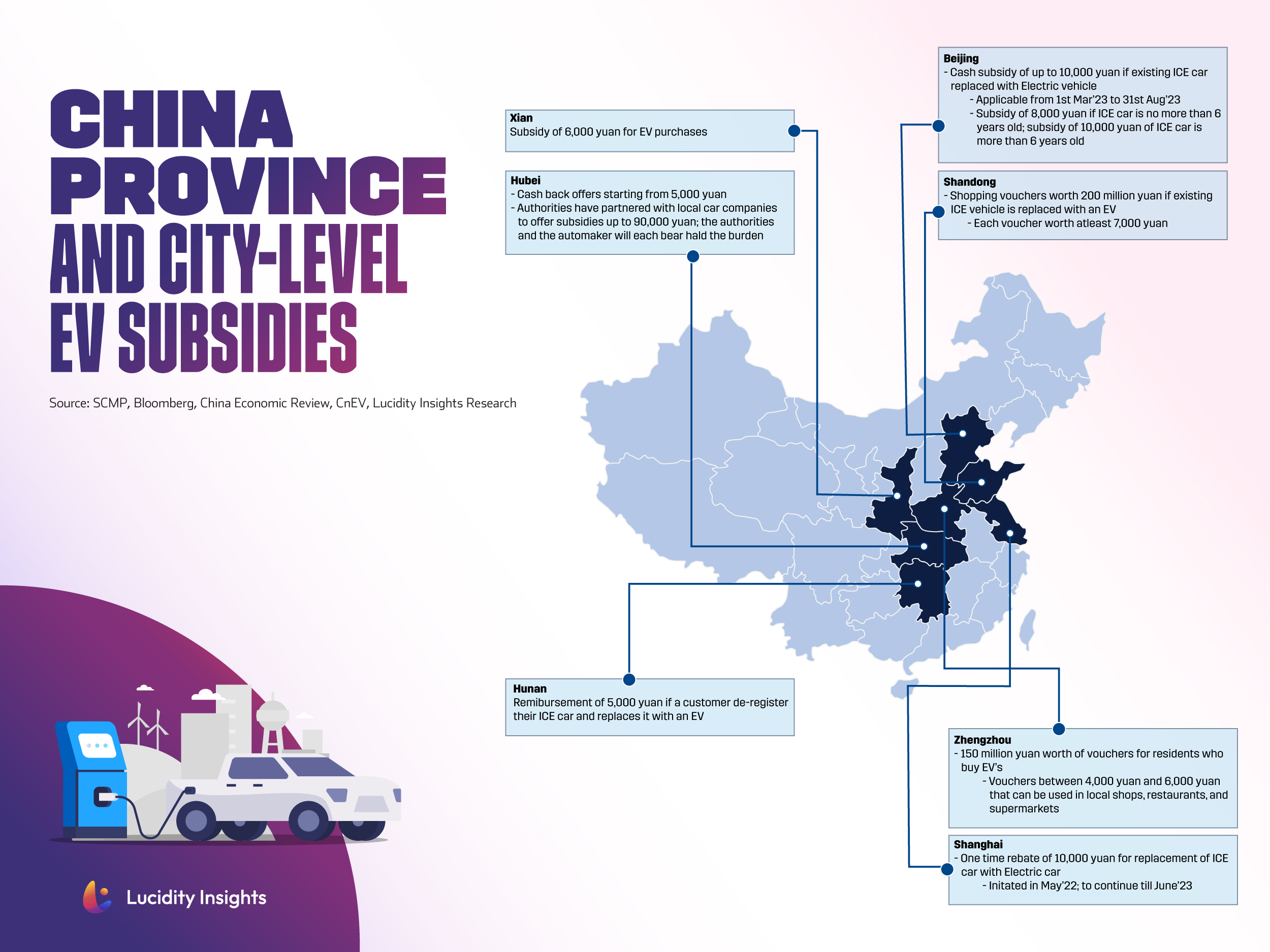

With federal subsidies being removed in 2023, some provincial governments are offering their own subsidies. By March 2023, the number of provincial governments offering subsidies had gone up to 14. Many of these subsidies have been implemented, upon price cuts failing to boost sales.

Infobyte: China Base Subsidy by EV Range 2019-2023

Infobyte: China Base Subsidy by EV Range 2019-2023

Infobyte: China Province and City-Level EV Subsidies

Infobyte: China Province and City-Level EV Subsidies

Read Next: America’s Slow Uptake of EVs

%2Fuploads%2Fev-2023%2Fcover16.jpg&w=3840&q=75)