Challenges Affecting the EV Landscape in 2022-2023

05 October 2023•

The electric vehicle (EV) market stood at the crossroads of potential and challenge in 2022-2023.

Despite achieving continued rates of strong EV growth around the world, there also appeared various challenges. From chip shortages and market saturation to the termination of China's and Germany’s EV subsidies, the industry's meteoric rise is countered by an equally powerful array of obstacles. As stakeholders jostle for the upper hand in this dynamic landscape, the rate of EV adoption growth hangs in the balance.

Read on as we delve deeper into the highs and lows of the EV world in the past year.

1. EV Chip Shortages Limit EV Production

Semiconductors control a wide range of EV features from the engine to infotainment systems, but a combination of increased demand for consumer electronics during the pandemic, semiconductor chip manufacturing slowdowns due to US-China trade tensions, and supply chain disruptions have limited supply of these chips recently. China, a key producer of semiconductor chips, was forced to halt production in early 2020 due to the pandemic, intensifying an already tight supply. Additionally, a subsequent surge in demand for digital products, such as gaming systems and smartphones, strained the supply chain even further. This created the perfect storm which not only slowed EV production, but overall car production around the world, leading to extended delivery wait times and rising prices.

Cars account for roughly 15% of global chip consumption, and the average modern car can have anywhere between 1,400 to as high as 3,000 chips embedded into a single vehicle.

Toyota was just one of many car makers that missed its production targets over the past few years, citing chip shortages. In September 2021, Toyota announced that they would slash their annual production target by 40%; in 2022, Toyota continued to miss monthly production targets, averaging 6.7% below target production in the first five calendar months of their fiscal year, which began in April 2022. In January 2023, the world’s largest automaker managed to increase monthly production figures by 8.8% MoM, but still did not achieve production targets the company had set at 800,000 vehicles, citing chip shortage effects were still lingering. Things seem to have finally turned around this summer, as Toyota managed to produce and sell a record number of vehicles, with a monthly output of over 1 million vehicles.

The shortage of semiconductor chips have resulted in the EU’s Chip Act, which is the European Commission’s ambitious US $47.5 billion proposal to help produce 20% of the world’s semiconductors by 2030. Numerous semiconductor companies have already announced new chip production facilities across Europe. Germany has also prepared a US $22 billion fund to support the development of its own local production in the coming years.

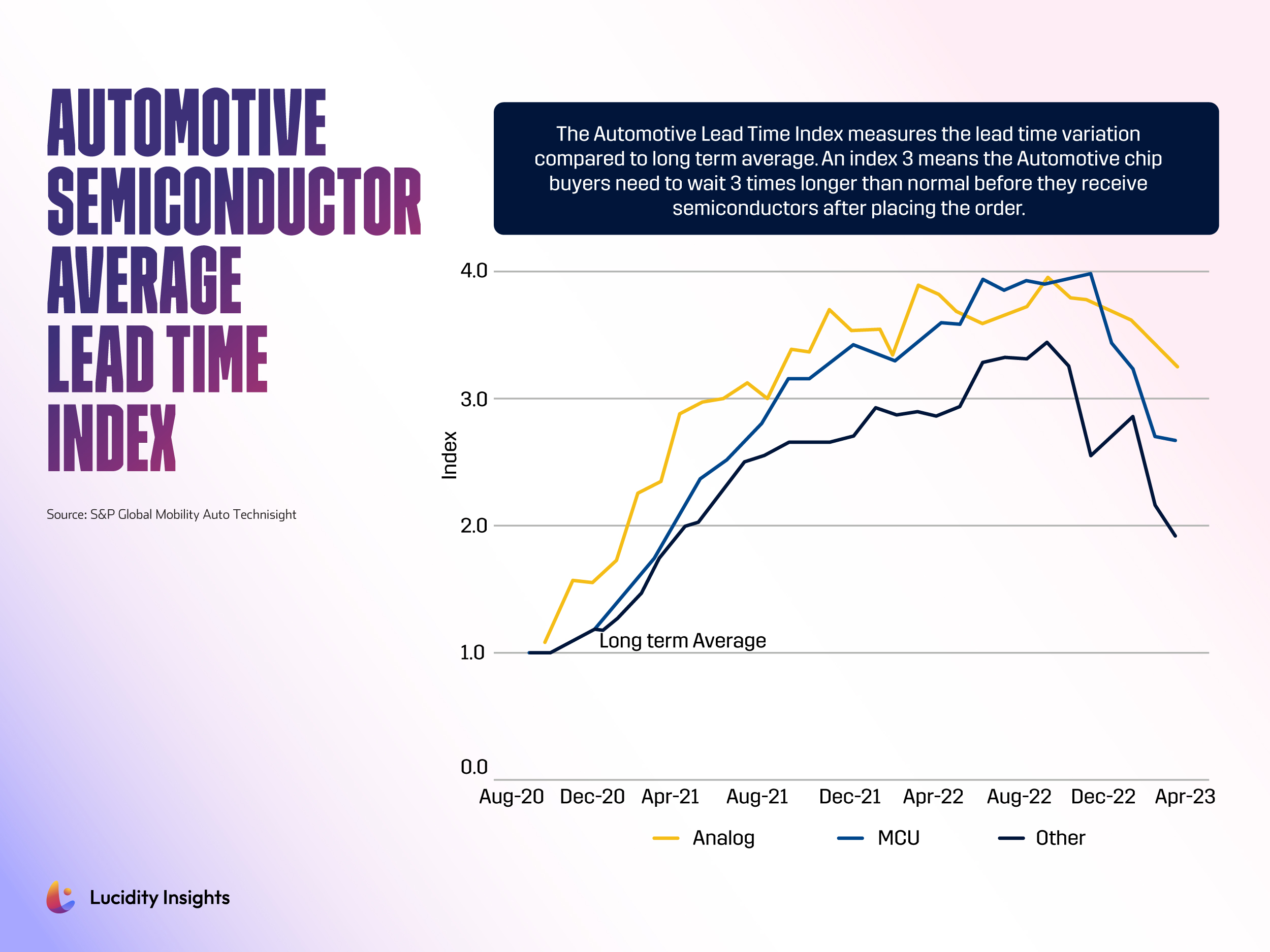

Infobyte: Automotive Semiconductor Average Lead Time Index

Infobyte: Automotive Semiconductor Average Lead Time Index

2. EV Supply Lags Cause Price Increases

New EV models have seen price increases of over 10% in the past two years, largely due to the semiconductor chip shortages; while used electric vehicles now cost buyers 54% more than two years ago due to the shortage. However, other factors, such as inflation and high raw material costs have also contributed to this price surge.

Despite prevailing uncertainties, there are some encouraging signs. In early 2023, Manufacturers, including Tesla and Ford, lowered their vehicle prices to qualify for the EV federal tax credit. Major automotive industry chip suppliers are uncertain about the future of chip shortages. It seems there has been a gradual easing of the shortage, but many caution about potential economic slowdowns and energy shortages slowing down chip production. Others claim that the demand for EVs are growing too fast, and will likely lead to another shortage in the near future.

Switching to alternative semiconductors, using silicon carbide (SiC) or gallium nitride (GaN) instead of Silicon (Si), is an emerging trend being used to combat short supply of silicon. EV manufacturers are also forming partnerships with secondary battery producers to secure supply for their EV growth plans and exploring strategies to minimize future disruptions from pandemics or other unforeseen events.

3. The End of EV Subsidies in China

As the world's largest EV market, China significantly influences global EV trends. In 2022, new energy vehicle (NEV) sales in China surged to 6.7 million units, a leap which meant that 1/3rd of all new vehicle sales in the country were electric. However, much of the growth we’ve witnessed in China over the past few years can be attributed to China's broad subsidy program for EVs, which concluded at the end of 2022. China has been reducing its EV subsidies for the past several years, but 2022’s cessation represented a significant industry turning point, with subsidies falling from Yuan 12,600 per unit (approximately US $1,730) to zero.

Earlier this year experts predicted that the subsidy cut would impact EV demand particularly in the first half of 2023. Evidence of this impending slowdown can be seen in the actions of battery manufacturers, who reportedly curtailed production from December 2022 in anticipation of diminished demand. That said, despite a slow start in Q1 2023, China’s first half year sales are 37% higher than those posted in H1 2022.

In fact, both global EV heavyweights such as Tesla and BYD reported record sales in the second quarter of 2023. Tesla delivered 466,140 vehicles, surpassing Wall Street estimates, while China's leading auto brand, BYD, sold an impressive 700,244 vehicles - half of them all-electric. These results suggest that despite inflationary pressures, and higher borrowing costs, the EV market can still witness impressive sales figures due to strong demand and strategic business operations.

Tesla's robust sales performance has positively impacted its stock price, having grown 78% from the beginning of the year to prices in mid-August. This growth has been spurred by several strategic maneuvers, including price cuts across their range and incentives such as three months of free fast charging in the U.S. However, Tesla continues to face intense competition, particularly in China, where it significantly trails BYD. After Q2 ended, Tesla cut the prices of its premium models in China by more than 4.5%, signaling its strategy to maintain competitiveness in the market, even in the face of subsidy cuts.

Related: BYD Speeds Ahead in the EV Race, Surpassing Tesla and Into the Metaverse

4. Economic Woes & Subsidy Reductions in the West

As the EV market faces the end of China's subsidies, it's also contending with economic difficulties in major Western markets. Driven largely by macroeconomic factors and the economic outlook, these challenges pose a significant risk to EV sales in Europe and the US.

As economic momentum slowed in the US, the Inflation Reduction Act was designed to stimulate EV sales and is expected to yield positive results primarily in 2024 when buyers can use the EV tax credit value to reduce vehicle prices. Ironically, the Act could introduce new challenges associated with sourcing battery metals and components that could negatively affect EV sales. From 2023 onwards, certain percentages of battery components and metals must be sourced within the US or a country with a free-trade agreement with the US to qualify for full tax credits. These progressively increasing thresholds have been identified by numerous US automakers as potential hurdles due to the complexities of modifying the supply chain on short notice.

On the other hand, escalating inflation and surging energy costs - exacerbated by the conflict in Ukraine -have threatened the EV market in Europe. This economic pressure is likely to suppress EV sales due to the relatively high prices of EVs compared to internal combustion engine vehicles. The situation is further complicated by the expiration of state subsidies in Germany for plug-in hybrids at the end of 2022 and reduced subsidies for BEV passenger cars.

5. EV Charging Infrastructure Issues

EV charging infrastructure remains a significant challenge. Investment in charging infrastructure has been robust but unevenly distributed, with over 1.4 million EV charging points in China as of September 2022, compared to fewer than 400,000 in Europe and only 140,000 in the US. This discrepancy underscores the need for a more comprehensive and equitably dispersed charging infrastructure across the globe.

The Society of Motor Manufacturers and Traders (SMMT) in the UK has called for government intervention to facilitate a transition to electric for all drivers and stimulate investment in nationwide charging infrastructure. According to the SMMT, forecasts indicate the UK will need between 300,000 and 720,000 charging points by 2030 – this would necessitate the installation of more than 100 new chargers every day to meet even the lower limit.

Another concern is the lack of a universal standard for DC fast-charging as currently, the multiple charging socket standards frustrate many potential EV consumers. This lack of uniformity exacerbates range anxiety, as users fear they may not find a compatible charging station in an emergency, making EVs appear less attractive compared to ICE vehicles.

Related: Wiferion: the Future of Wireless EV Charging

However, there's a contrasting perspective that views this "delay" in establishing a universal standard differently. Some suggest that EV technology, in its current developmental stage, still requires substantial research and innovation to fully actualize its potential. By not hastening to set a standard too early, manufacturers are granted the liberty to experiment and innovate, which could ultimately enhance the evolution and improvement of the EV market.

Going forward, automakers, policymakers, and infrastructure developers must continue to collaborate, strategize, and innovate to overcome these hurdles. Though the road ahead for EVs for the rest of 2023 is undeniably bumpy, the destination is clear: a greener, cleaner, and more sustainable transportation future. Navigating these market challenges requires concerted effort, innovative thinking, and strategic foresight. And, in overcoming these obstacles, the EV industry has the opportunity to evolve, mature, and ultimately solidify its critical role in the transition towards net zero mobility solutions.

Related: Ubitricity helps Charge your EV by Connecting to Street Side Lamp Posts

%2Fuploads%2Fev-2023%2Fcover16.jpg&w=3840&q=75)