Boomtown on the Blockchain: Where Old-School Finances Meet the Wild West of Web3

10 July 2023•

Picture this: a world where traditional real-world assets - think property, art, precious metals, and even bonds - are diced up, digitized, and unleashed into the freewheeling universe of decentralized finance (DeFi). In this not-so-distant world, everyday folks could invest in high-end art or real estate, all with a few taps on their phone. Welcome to the exciting frontier of real-world asset (RWA) tokenization!

The recent crypto bear market hasn’t dampened this spirit; it’s actually fueled the push to bring RWAs onto the blockchain. Big names like Goldman Sachs have joined in on the fun, launching their own digital asset platform (GS DAP) to give old-school assets a blockchain facelift. MakerDAO and Aave, among other DeFi protocols, are also adapting their platforms to accommodate RWAs. This convergence of traditional finance and blockchain technology marks a transformative moment for DeFi.

What on Earth are Real-World Assets?

Before we dive in, let's clear up some jargon. RWAs are everyday assets, ones you could touch and feel if you wanted, that have been tokenized and integrated into DeFi. Tokenization is like creating a digital twin for your asset on the blockchain, and this digital twin, represented as a token, can participate in DeFi in ways that the original asset never could.

What's cool about RWAs is that they can be just about anything with tangible value. Art, property, carbon credits even those fusty old bonds can be minted into digital tokens and put to work in DeFi. It's like having a universal passport for your assets, granting them access to all sorts of opportunities they couldn't touch before.

Why should I care about RWA?

RWAs could be the catalyst that takes Web3 into the mainstream. Boston Consulting Group's research is betting big, predicting a whopping $16 trillion industry around tokenizing illiquid assets by 2030. That's trillion, with a T! The marriage between DeFi and RWA tokenization makes traditional assets more liquid and easier to trade. It's like an open house invitation to anyone with an internet connection, opening up many opportunities from new yields in DeFi and exciting credit offerings.

|

Tangible Assets |

Intangible Assets |

|

Real Estate |

Equities |

|

Gold / Silver / Metals |

Government / Corporate Bonds |

|

Collectibles |

Carbon Credits |

Show Me the Money: RWA in action

While the world of RWAs is expanding, a few key areas are already making waves.

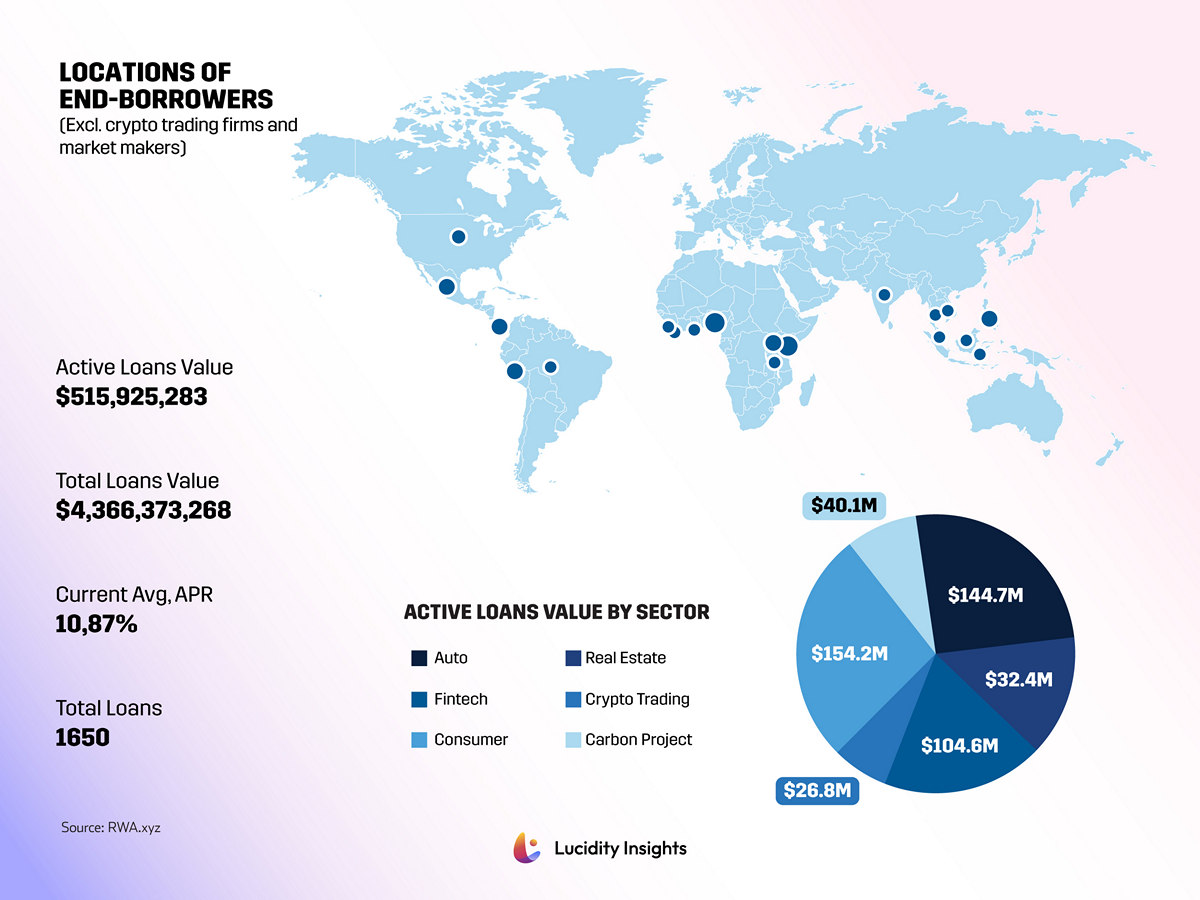

Take the private credit market, for example. We're seeing tons of new, diverse RWAs in private credit, with over $4.3 billion across 1650 loans spread across sectors like carbon projects and real estate. Protocols like Centrifuge, Goldfinch, and Credix are breaking down barriers, enabling borrowers without traditional financial access to use real-world assets as collateral for a loan in stablecoins. The mission-driven company Cauris is a shining example here, already loaning out nearly $30 million to help supercharge Fintechs in Africa.

Infographics: Private Credit on DeFi Rails: Active and Total Loans Value, Current Average APR, Total Loans, Locations of End-Borrowers, Active Loans Value by Sector

Infographics: Private Credit on DeFi Rails: Active and Total Loans Value, Current Average APR, Total Loans, Locations of End-Borrowers, Active Loans Value by Sector

In the public credit market, the regulatory hoops make things a bit slower, but we've got a rising star in Ondo Finance. After a successful $20 million Series A funding round in 2022, co-led by Founders Fund and Pantera Capital, they've launched three RWA funds tracking US treasuries, corporate bonds, and more. Their US treasuries-backed fund (OUSG) has already locked in $104.3 million14. OUSG invests entirely in Blackrock's iShares Short Treasury Bond ETF (SHV). Ondo, through its Flux Protocol, also allows OUSG holders to lend and borrow stablecoins against it.

In the world of DeFi, MakerDAO is leading the RWA charge. It runs on Ethereum, acting like a high-tech, sci-fi vault. You put assets into this vault, and in return, you borrow DAI, MakerDAO's own stablecoin. These vaults, run by smart contracts, are like automated bankers keeping a watchful eye on your Ethereum-based collateral until your borrowed DAI is repaid. If the collateral value takes a hit, they've got your back, auctioning your assets to square off your loan, zero trust issues involved. In 2020, MakerDAO threw a curveball by accepting RWA as collateral. Today, these RWA vaults hold a whopping $680 million, bolstering the issuance of DAI and helping with maintaining the peg value to $115. Despite a market downturn, MakerDAO's RWA vaults have been a revenue powerhouse, pulling in a yearly $23 million. (1)

They're doing the heavy lifting, making up 56.7% of MakerDAO's total income, while shouldering only around 13% of the platform's debt. Not just small players, but heavyweights like Monetalis, Huntingdon Valley Bank, and Société Générale are in on the action, with most RWA collateral being US treasury bonds managed by Monetalis. MakerDAO's focus on RWA is successfully merging the physical and digital finance worlds, offering borrowers diverse collateral options while enhancing the platform's stability and profitability.

Real estate is also getting in on the RWA action, with RealT already tokenizing over $52 million16 in real estate since its launch. This tokenization is like creating bite-sized shares of property that anyone can buy, sell, or trade. RealT token holders are also able to use their tokens to borrow stablecoins such as DAI via a 3rd party partner.

And let’s not forget about our green buddies, carbon credits. Toucan, a trailblazer in this space, has tokenized over 20 million carbon credits from more than 50 climate projects. This means they've retired more than 50,000 tons of carbon credits, accounting for an impressive $4 billion in carbon trading volume. Their efforts are making the global carbon market more efficient, transparent, and scalable, opening up new possibilities for environmental sustainability.

Related: AirCarbon Exchange: Simply and Effectively Streamlines Carbon Trading

The renewable energy market isn't missing out either. Powerledger, an Australian company, is leveraging blockchain for energy tracking, trading, and making energy markets more efficient. Powerledger has experienced significant growth in the past few years, attracting more utilities, renewable energy generators, energy retailers, and large corporate organizations with renewable energy targets into its marketplace. They've set some lofty goals: 100 million smart meters on their platform in five years and hope to reach 1 billion users down the line, creating markets that remove any obstacles in achieving 24/7 carbon-free energy.

Finally, major financial institutions are also getting in on the RWA action, looking to boost their efficiency and reach a wider market. JPMorgan, for instance, executed the first live trade using tokenized yen and Singapore dollars on the Polygon blockchain.

WisdomTree launched nine digital funds on Stellar or Ethereum blockchains. Hong Kong's central bank offered a $100 million tokenized green bond while, Credit Agricole CIB and SEB are jointly launching so|bond, a platform for digital bonds built on blockchain technology

|

Vault |

Capital Allocation |

|

6s Capital |

Secured loans for commercial real estate development |

|

New Silver |

Financing purchase or construction of residential assets |

|

ConsolFreight |

Collateralized freight shipment invoices |

|

Harbor Trade Credit |

Tokenizing and securing short term global trade receivables |

|

Fortunafi |

Yield and lending for tokenized cash flowing assets |

|

Blocktower |

Whole loans, asset backed facilities, and structured credit products |

|

HV Bank |

Commercial loans for domestic businesses |

|

OFH - SocGen |

On-chain bond tokens issued by Societe Generate Bank |

|

MIP65 |

High quality liquid bond strategies maintained by Monetalis |

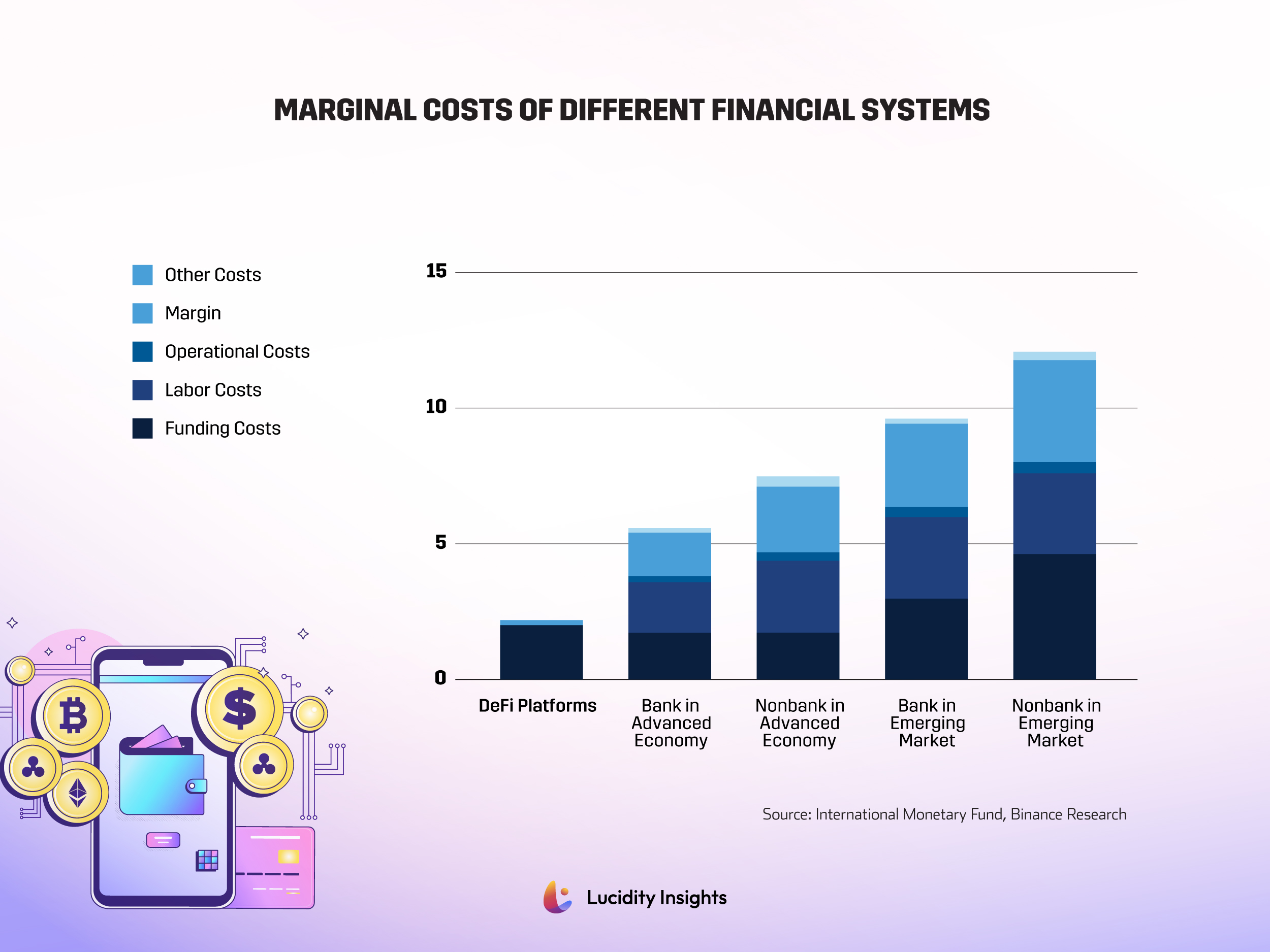

Infographic: Marginal Costs of Different Financial Systems

The Challenges: Regulatory and Governance Hurdles for RWAs in DeFi

Of course, no pioneering journey is without its obstacles. As with all new projects and technologies, especially as disruptive as blockchain, it is worth mentioning several challenges that are hindering the adoption of RWA by both DeFi and TradeFi such as the current regulatory framework designed for systems with financial intermediaries, making it difficult to apply to DeFi's or the decentralization nature of DeFi, which presents numerous challenges around governance, with implications for consumer protection, oversight, and enforcement.

Yet, these challenges don't eclipse the promise of RWAs on chains. They're proving to be a pivotal bridge between traditional finance and DeFi. They're driving the expansion of DeFi, bringing bonds, real estate, carbon credits, and more onto the blockchain for the first time. Projects like MakerDAO, Centrifuge, and Ondo Finance are leading this charge, showing us how RWAs can shape a more interconnected financial world. DeFi is not in its own little corner anymore; it's shaking hands with the real world, signaling the enormous influence and potential of blockchain in our dynamic financial landscape. Exciting times ahead, folks.

To read more about the future of web3, the decentralized web – read the full report here.

Next Read: The Dawn of Web3: Joseph Lubin’s Visionary Journey

%2Fuploads%2Fopportunities-web3%2Fcover14.jpg&w=3840&q=75)