The Drivers to Egypt Becoming the Next Big Tech Hub

12 April 2024•

Increasing Investments

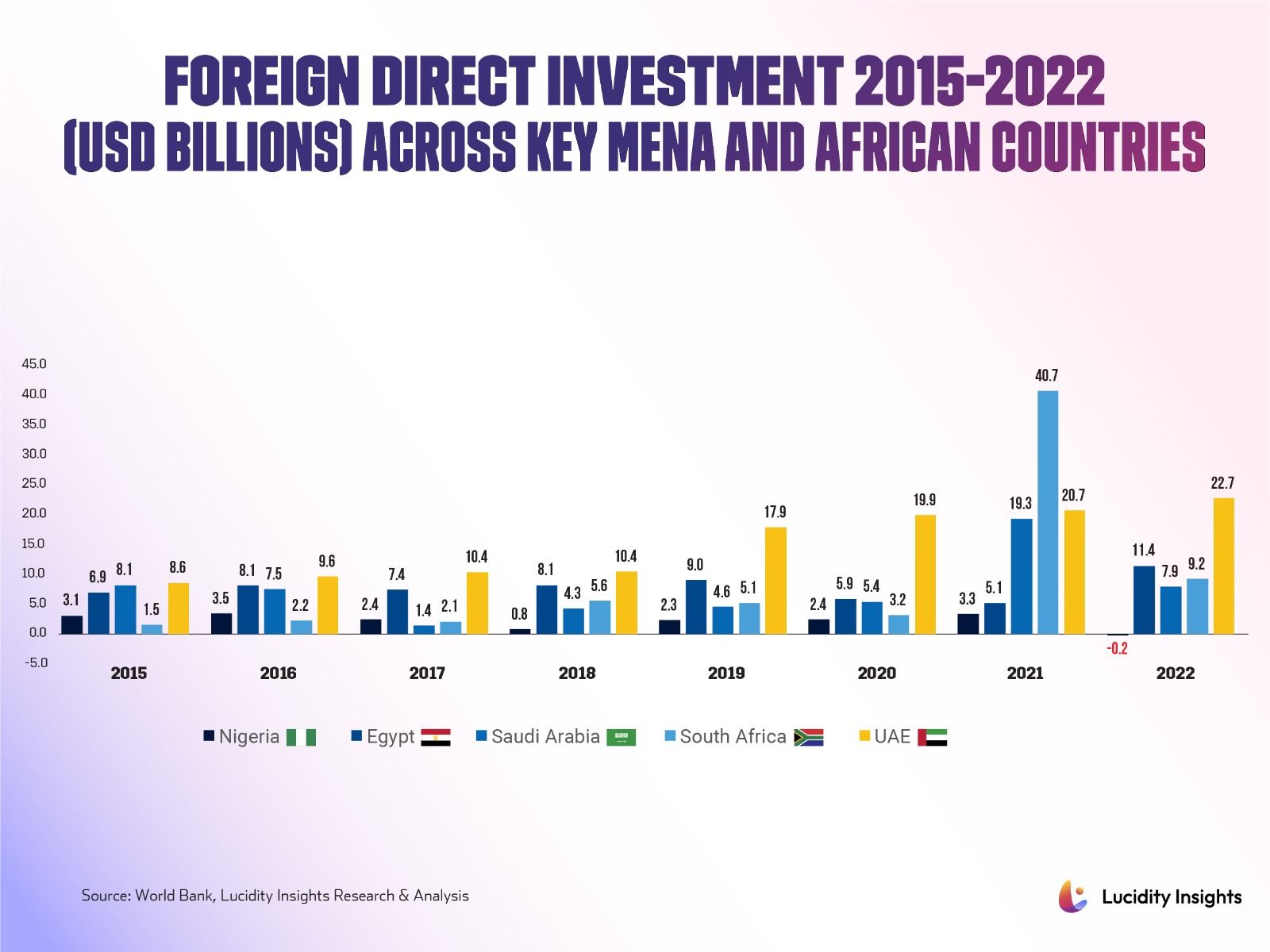

Egypt has seen increasing foreign direct investments (FDI) peaking at US$ 11.4 billion, in 2022, which was the highest volume of FDI into the continent, followed by South Africa. Among the MENA countries, Egypt’s US$ 11.4 billion stood second behind that of the United Arab Emirates (US $22.7 billion), and ahead of other leading tech markets, South Africa, Saudi Arabia and Nigeria.

One of the major contributors for the development in Egypt is the energy sector. It generates more than 13% of the total GDP, clearly indicating the economic growth linked to energy security and stability. Startups received over US$ 500 million in funding from FDI during 2022, representing ~4% of FDIs.

Infobyte: Foreign Direct Investment 2015-2022 (USD Billions) Across Key Mena and African Countries

An Attractive, Youthful & Techsavvy, Consumer Base

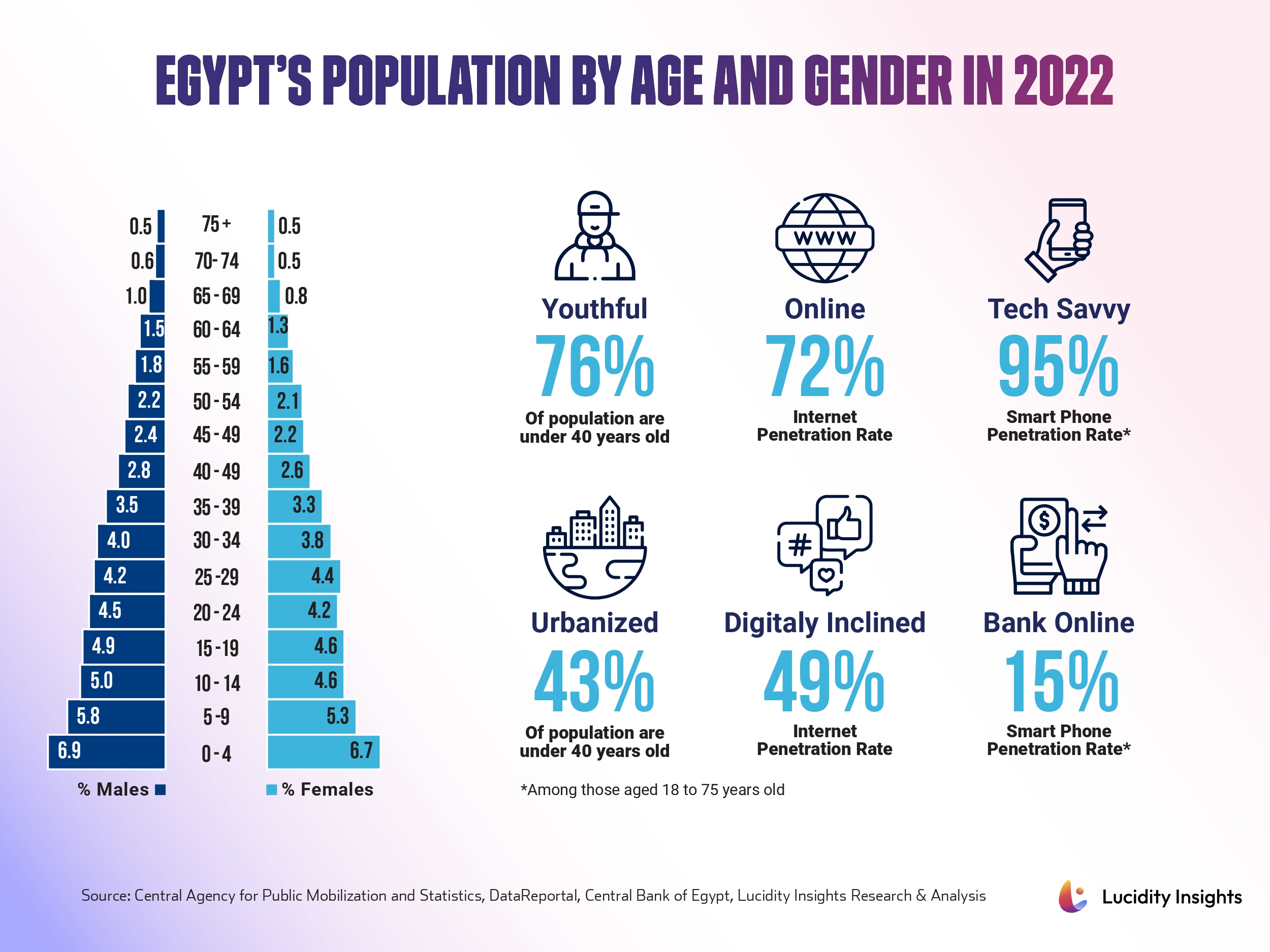

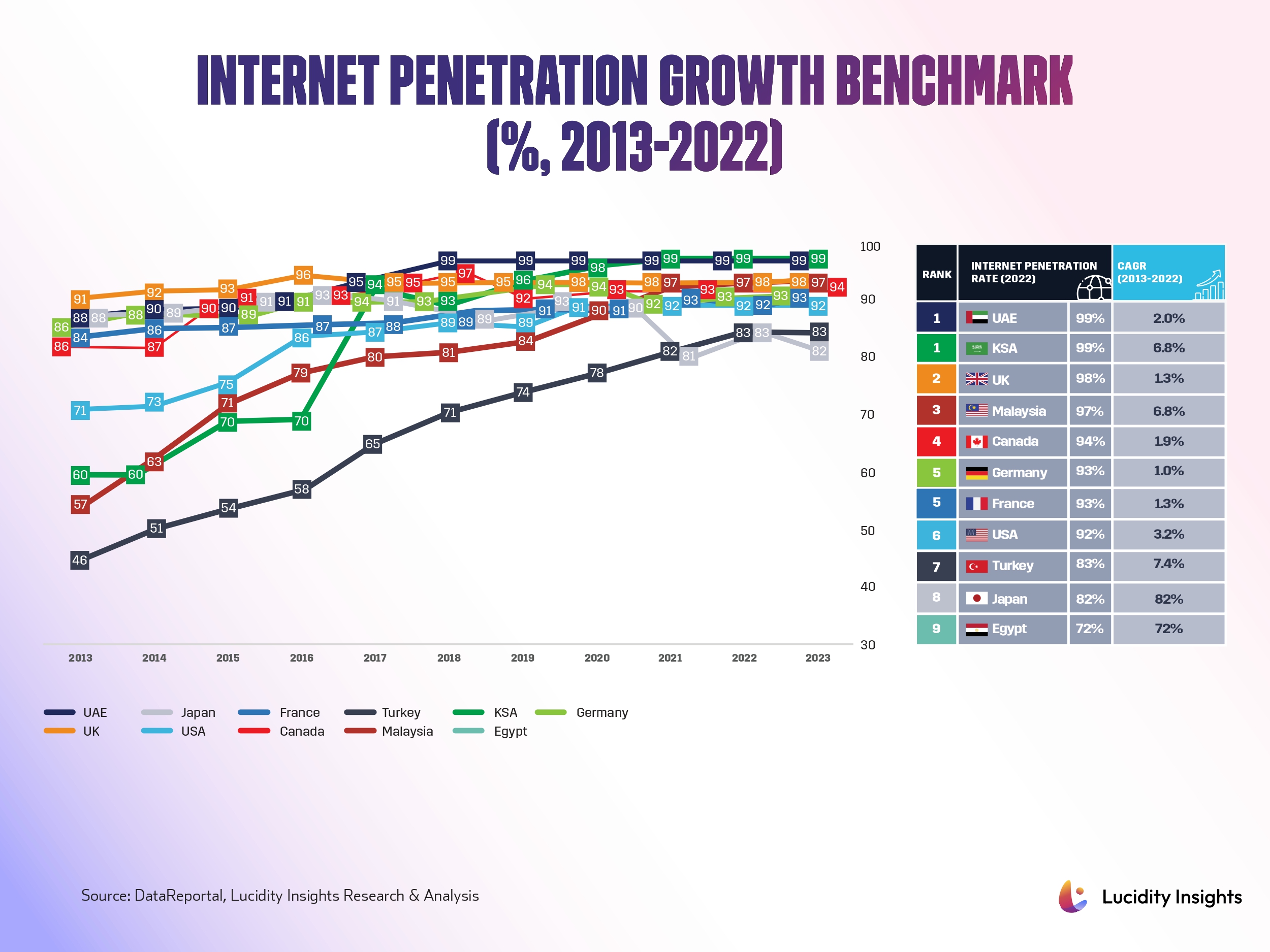

Egypt is a large emerging market consisting of a young consumer base. In the past 10 years Egypt has dramatically improved its internet penetration rates, growing from 29% in 2013 to reach over 70% today. Although it is not as high as the penetration rates found in Gulf Nations, which are close to 100%, it is higher than internet penetration rates in Sub-Saharan Africa, which stands at only 36%. Although Egypt is ranked 86th globally for internet speeds, it has ranked on top among all African countries.

Smartphone penetration is at 95%, but it should be noted that only 50% of Egyptians use social media and only 15% conduct any form of banking activities electronically. In fact, 35% of Egypt’s population is unbanked – providing a great opportunity for Fintech Startups in the country.

Access to a Large, Educated and Cost-Effective Talent Pool

Talent is a major booster for an economy, and Egypt’s workforce provides a great opportunity for businesses, both locally and internationally. Annually, Egypt sees yearly graduates of over 500,000 students, with more than 3.5 million students currently enrolled in universities. There are over 200,000 graduates each year that have STEM qualifications and IT degrees.

Egypt’s literacy rate is 75%, and 80% of the population speaks English as well as other European languages - making them an asset to international businesses. The talent pool is the largest amongst Arabic-speaking countries, and second largest amongst offshoring destinations in the EMEA region, right behind Turkey.

On top of that, the current currency devaluation is making Egyptian talent more cost-effective than ever. Though the economic situation is troubling for local Egyptian companies, international companies are able to get top Egyptian talent at a lower cost than ever before. In short, Egypt is strategically positioned to act as a low-cost service provider with the added benefit of having a talent pool that speaks multiple languages.

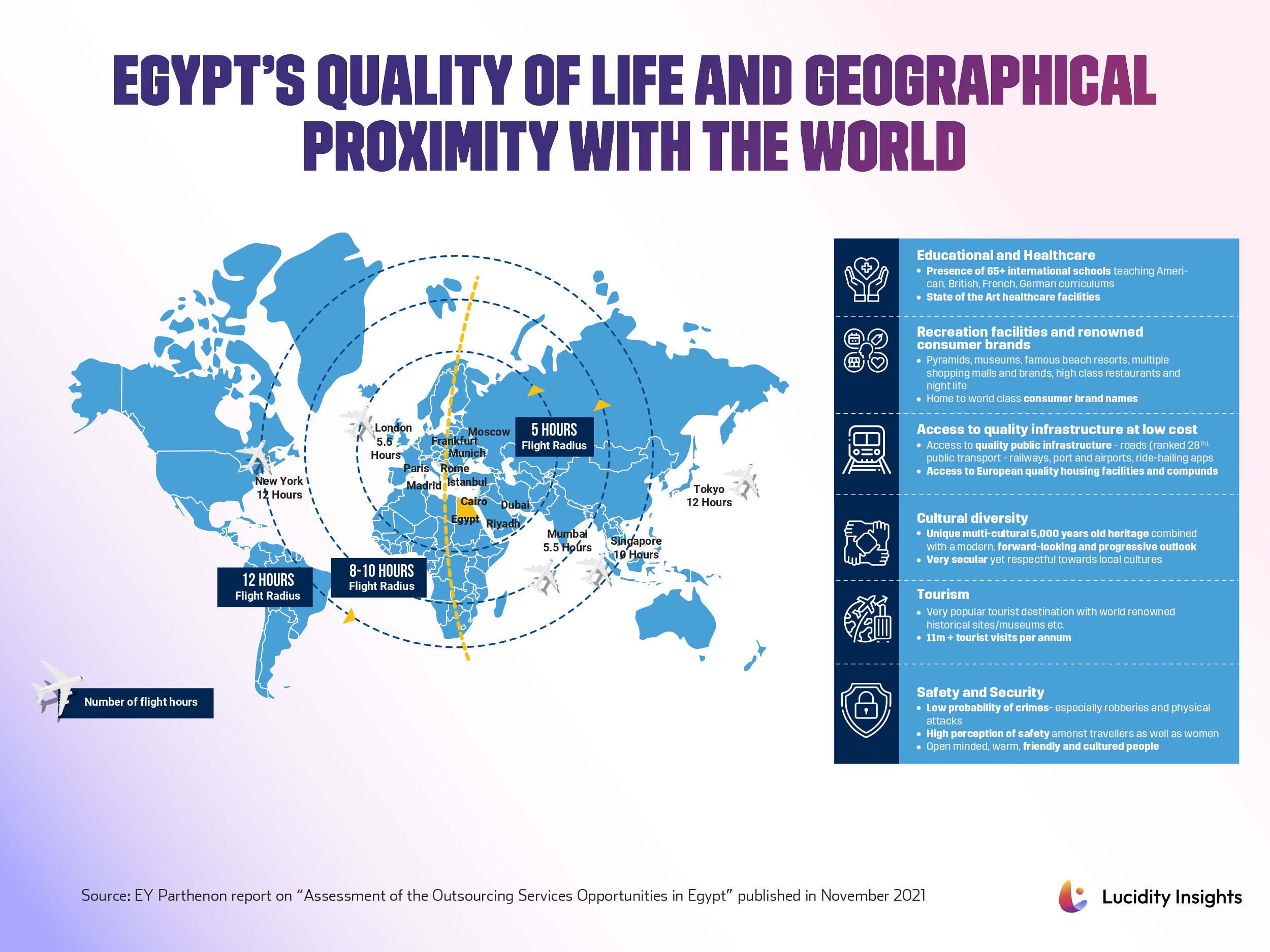

This enables it to act as a gateway to the EMEA region for global startups and companies alike full stop at the end.

Infobyte: Egypt’s Quality of Life and Geographical Proximity with the World

Next Read: Egypt’s Resilient Tech Ecosystem: 10 Graphs You need to see to understand Egypt’s Startup Ecosystem

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)