America’s Slow Uptake of EVs

09 October 2023•

The US EV market has been growing at a slow rate, and the once EV dominating country has slid down the global rankings.

Though EV adoption is still growing in the US it is far slower than its counterparts; America’s 18% global market share in 2020 has slid down to 11% in 2022. With California leading much of the charge, the rest of the USA has been slow to get EV fever.

Infobyte: USA Total Electric Car Sales

Infobyte: USA Total Electric Car Sales

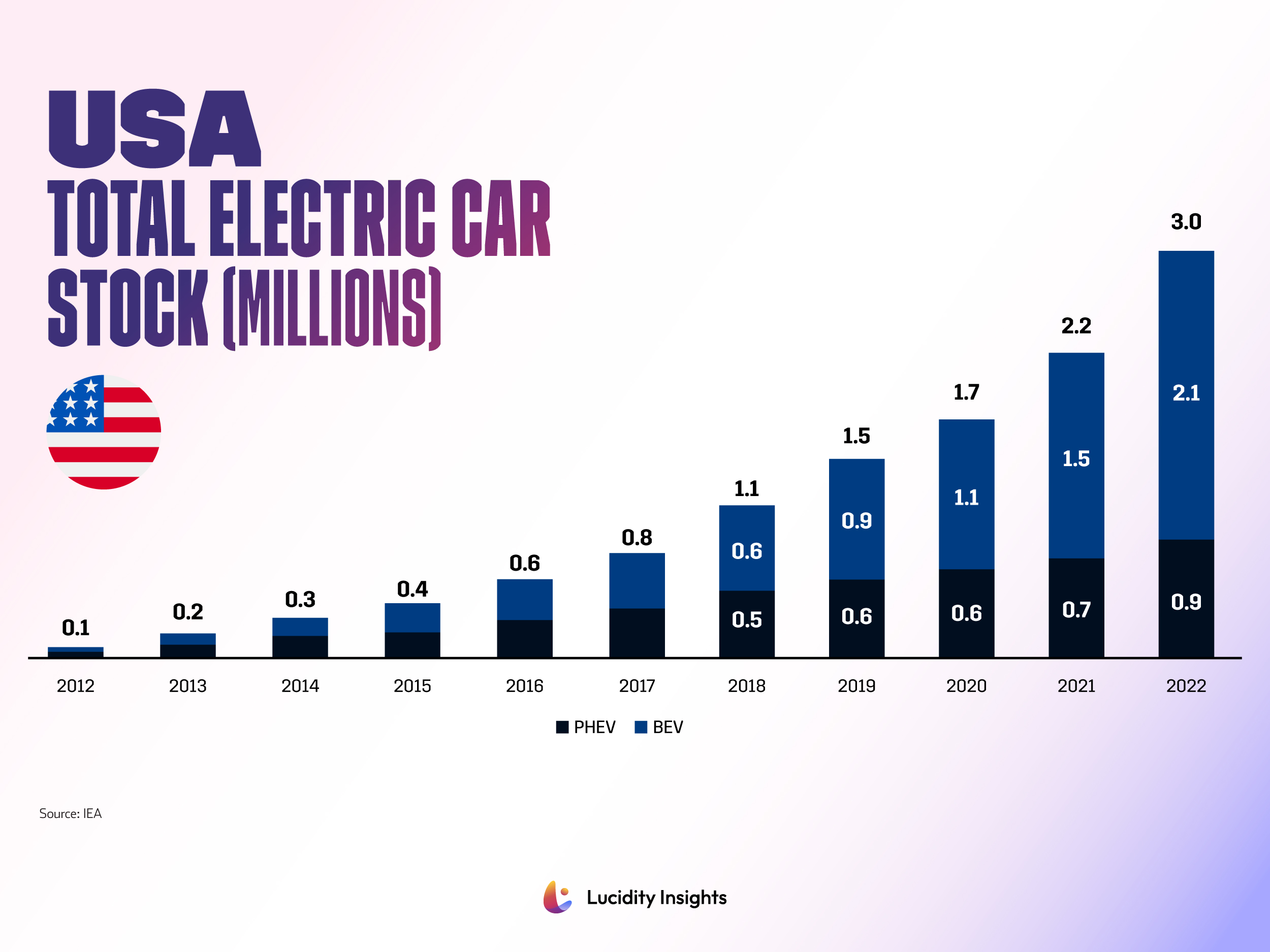

In contrast to China, the US is still largely home to a gas and diesel consuming combustion engine car-loving demographic. California is home to nearly all of the EVs that roam US roads. In 2022, the US sold 990,000 EVs and saw their EV stock rise to 3 million, nation-wide. Normalizing rates by population by looking at the rate of EV adoption across the country’s entire car population puts the US at the back of the pack at 2.1% electrification rate. Europe as a whole sits at 2.7%, while it’s leading nations like Norway take the #1 spot globally with a 27% electrification rate. China’s electrification rate is more than double that of America’s at 4.9%.

Infobyte: USA Total Electric Car Stock

Infobyte: USA Total Electric Car Stock

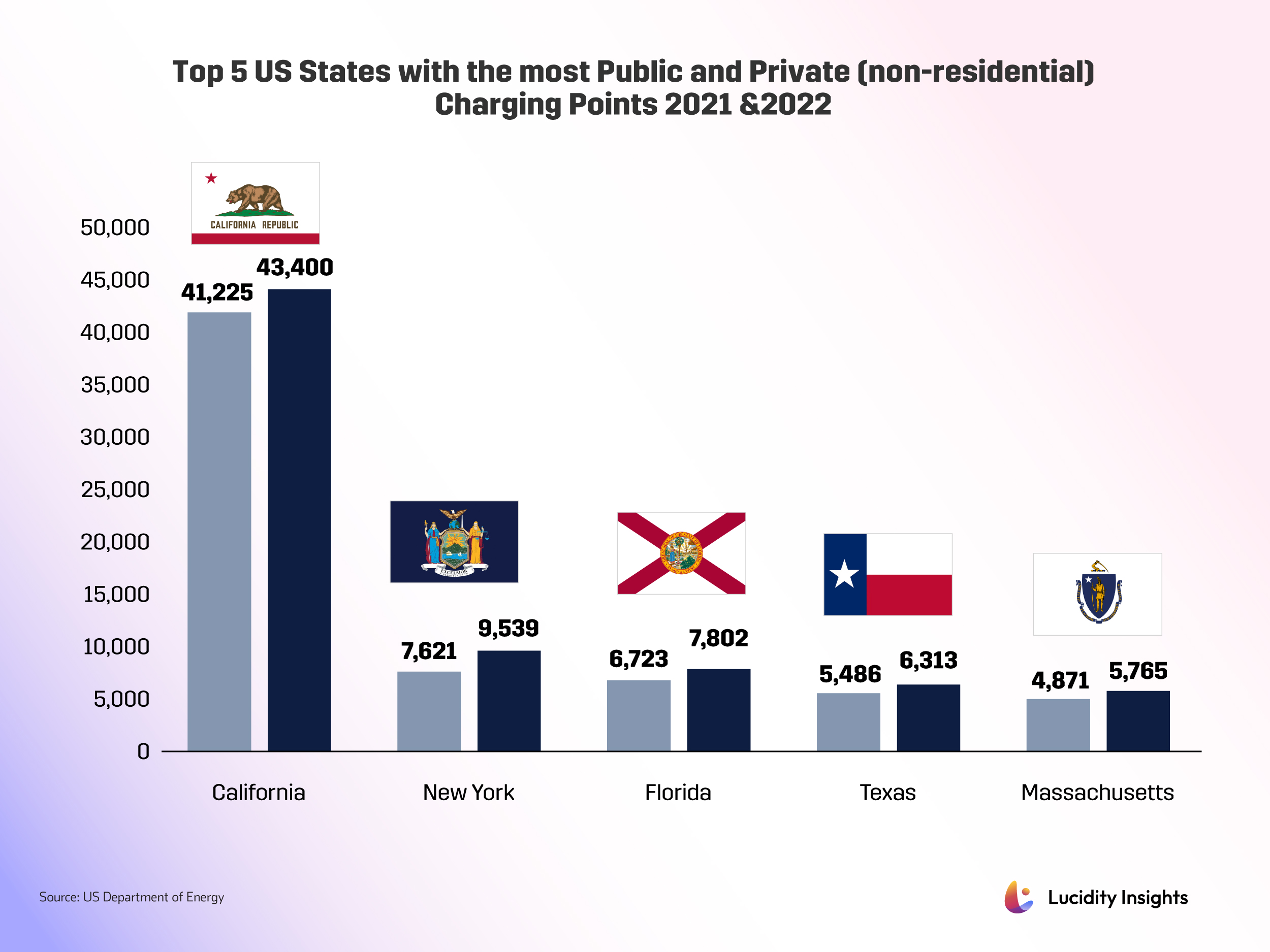

Infobyte: Top 5 Us States with the Most Public and Private (Non-residential) Charging Points 2021 & 2022

Infobyte: Top 5 Us States with the Most Public and Private (Non-residential) Charging Points 2021 & 2022

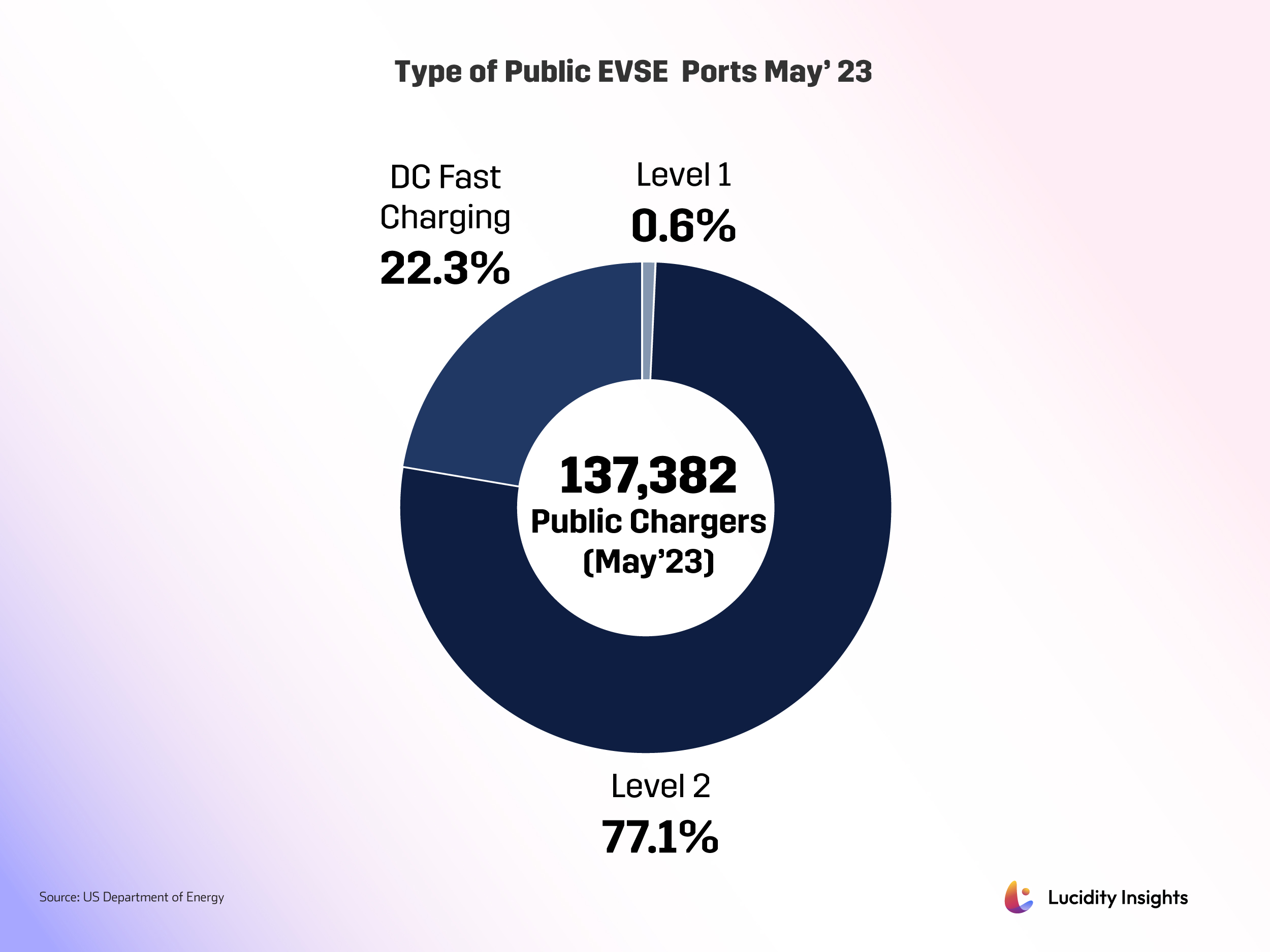

Infobyte: Type of Public EVSE (Electric Vehicle Supply Equipment) Ports, May 2023

Infobyte: Type of Public EVSE (Electric Vehicle Supply Equipment) Ports, May 2023

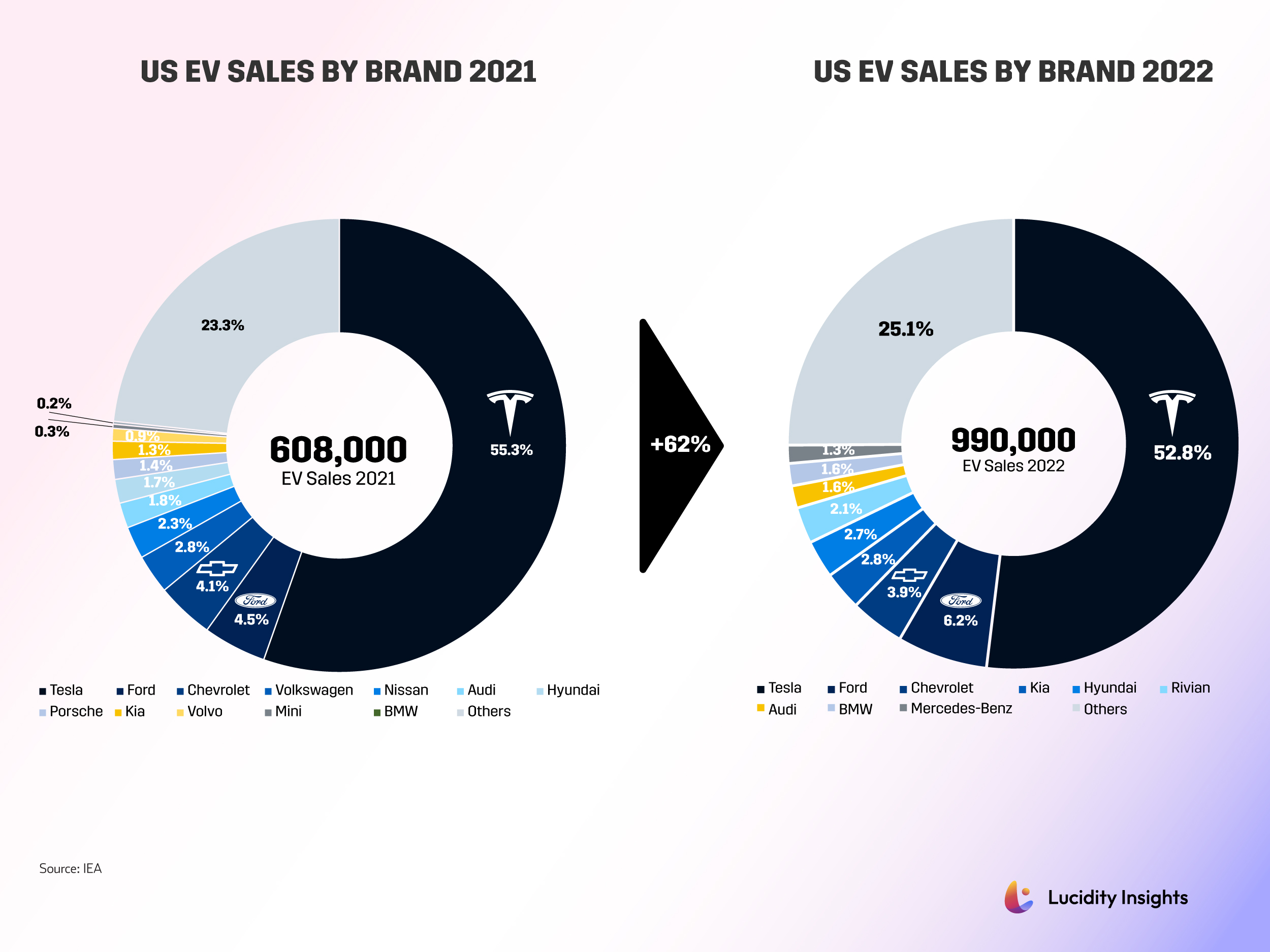

Brand Wars Limited to a Few

Tesla has dominated US EV sales for the better part of the last five years, but as more and more American and European brands electrify their fleets, Tesla’s market share is slowly being chipped away. The top 3 players in 2022, are the same top 3 players as in 2021: namely Tesla (522,388 units sold), Ford (61,575 units sold), and Chevrolet (38,120 units sold). Ford in particular nearly tripled its annual sales, and increased its market share from 4.5% to 6.2%, while the entire EV pie grew by 62% year on year.

Infobyte: US EV Sales by Brand 2021 vs 2022

Infobyte: US EV Sales by Brand 2021 vs 2022

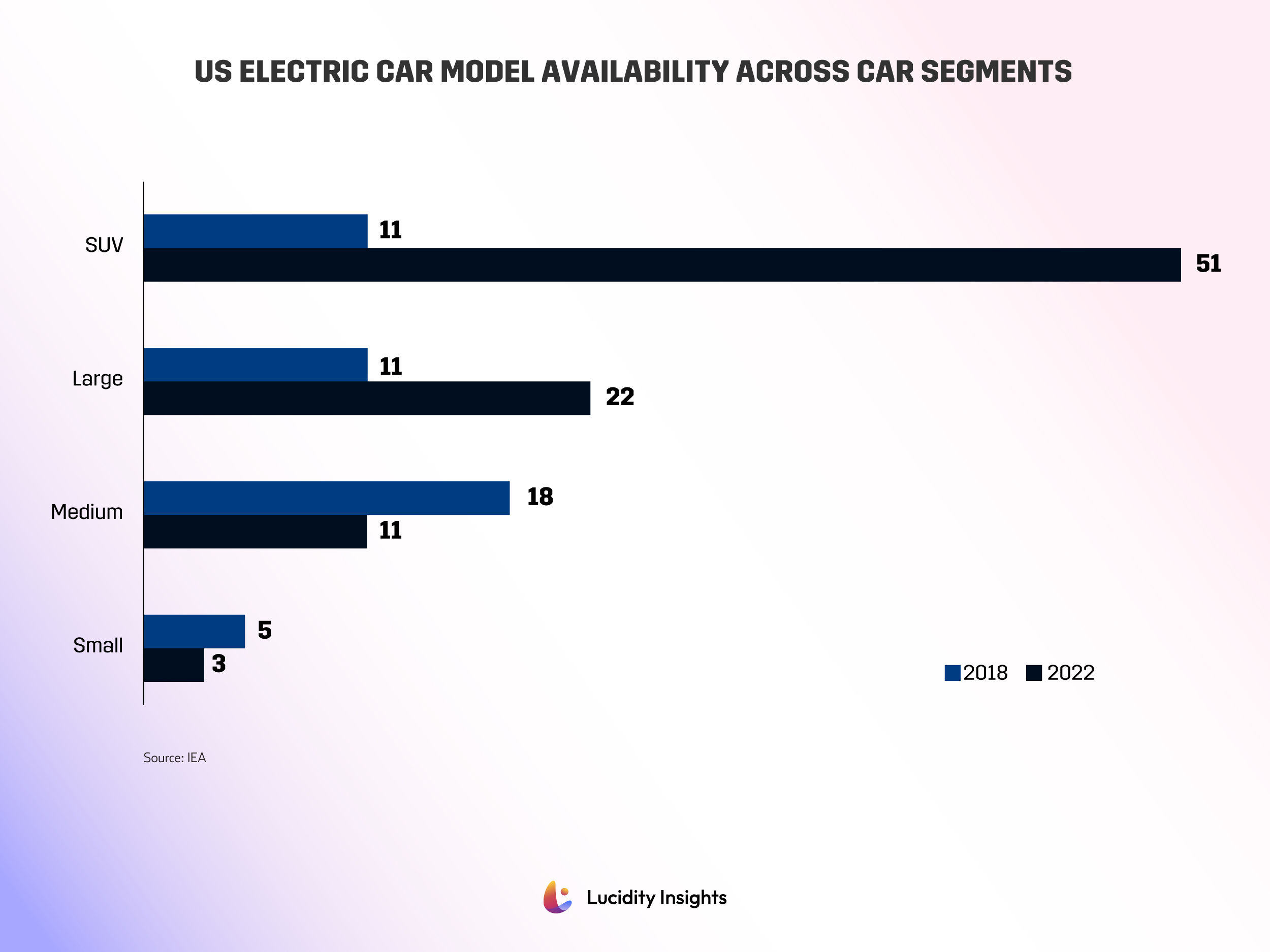

One of the challenges the US faces compared to its European and Chinese counterparts is the number of EV models made available in the USA. In the past, some analysts would have said that this was largely a lack of demand problem: because there is not enough demand for EVs, international players were not bringing their EV models to the US. Today, we can see that though demand is still a relatively small fraction of the population, it is growing rapidly. This points to US policies being the challenge; if a certain percentage of each vehicle is not built or assembled in the United States, vehicles cannot be sold to the US market. In the past, this has stimulated and protected the US automotive sector; but until recently, it has kept global EV manufacturers from building EVs state-side. It is likely that this may change in the future, as more interest in EVs accumulates, but US and Canadian consumers will largely have to put up with smaller pool of EV car models to choose from, compared to its European counterparts.

Infobyte: US Electric Car Model Availability across Car Segments

Infobyte: US Electric Car Model Availability across Car Segments

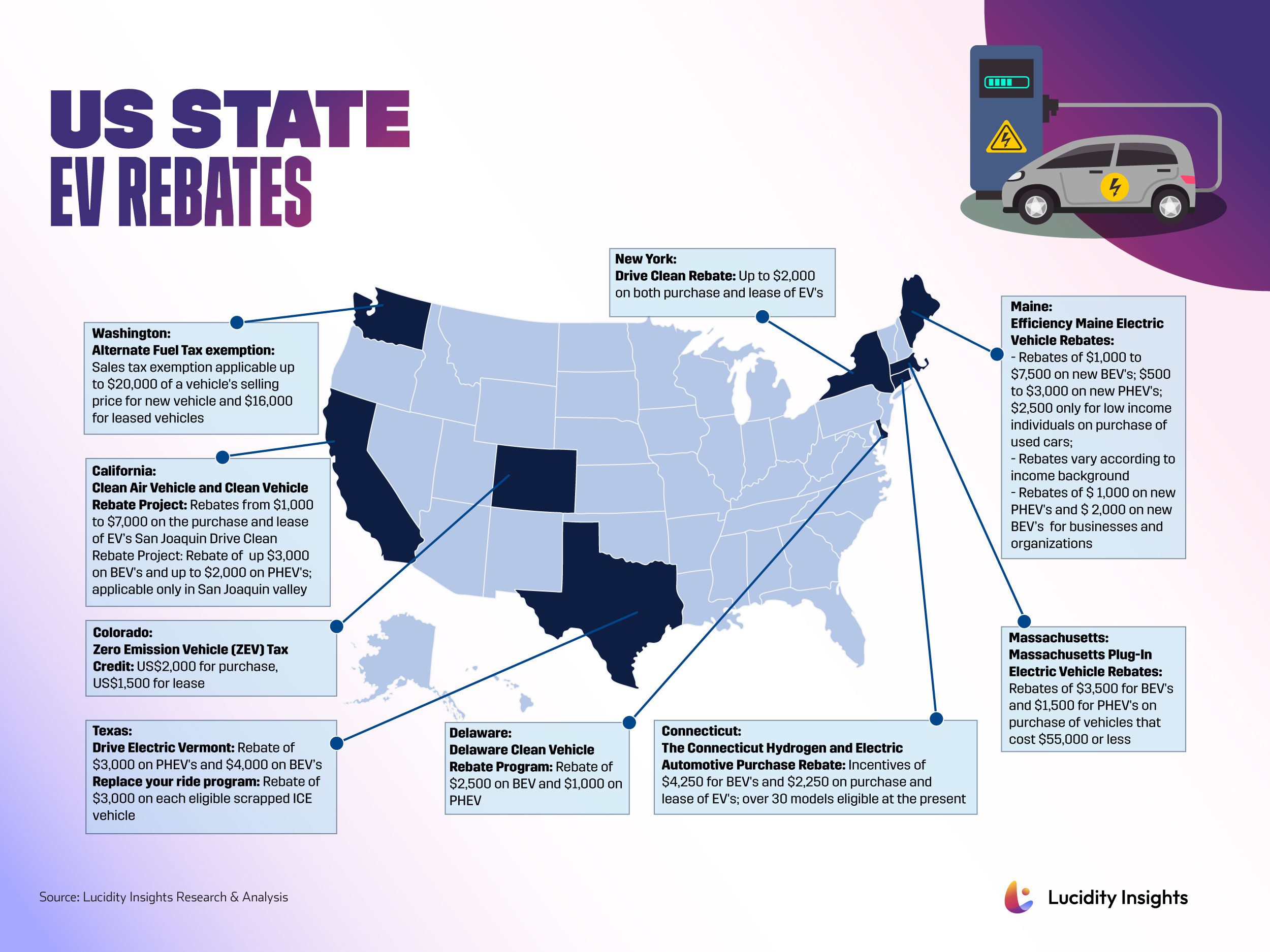

State-Driven EV Rebates

To drive further EV adoption, there is a federal tax credit on offer in the US, but most subsidies are coming from specific states which are offering different rebates for EV consumers. These rebates vary from sales tax exemptions, “replace your ride” programs which provide up to $3000 in rebates for each scrapable ICE vehicle, and “clean vehicle” rebates anywhere from $1000 to up to $7500 depending on which state you live in.

Infobyte: US States EV Rebates

Infobyte: US States EV Rebates

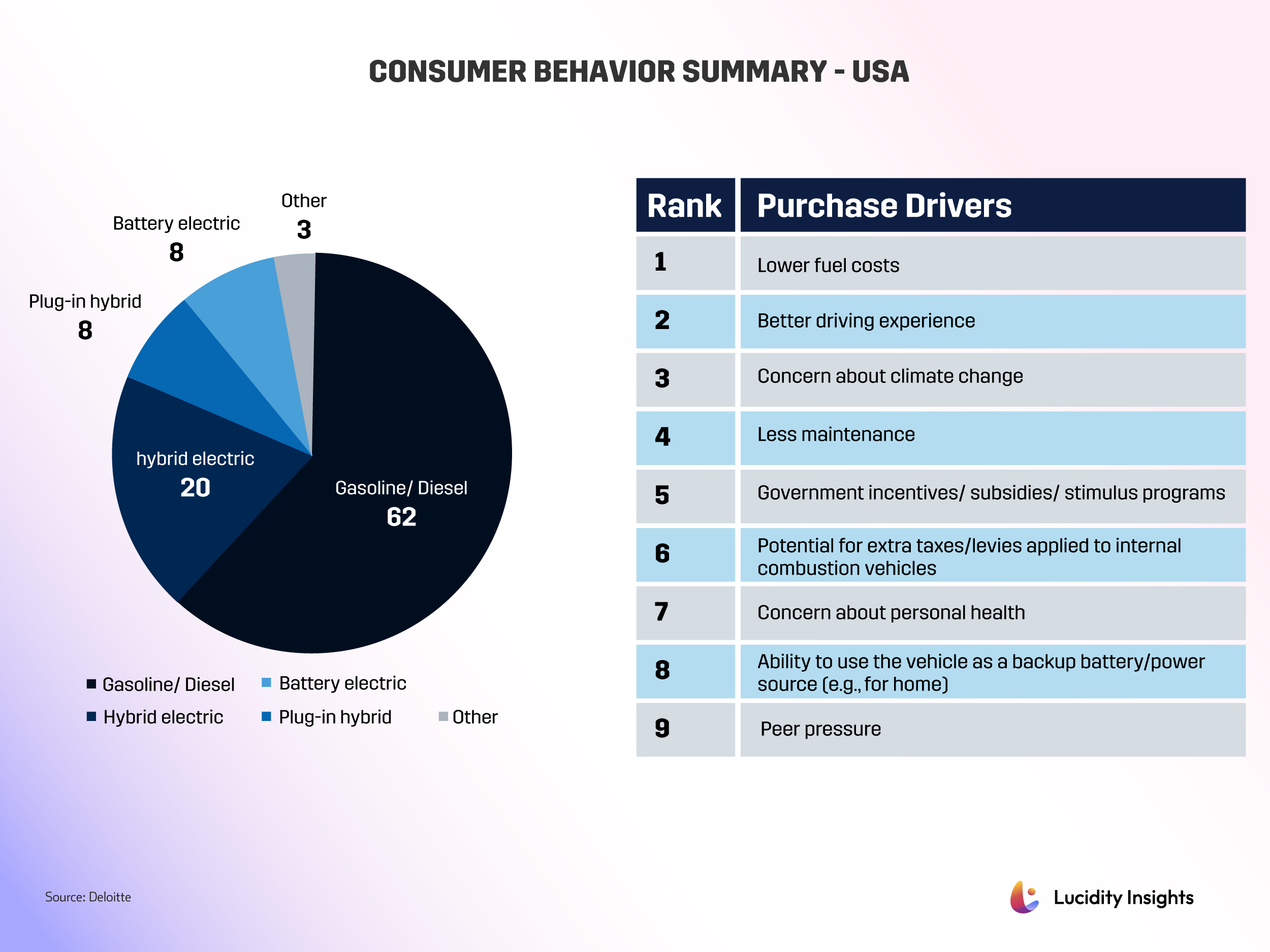

Consumer Behavior in the USA's EV Market

62% of Americans surveyed still preferred an internal combustion engine (ICE) vehicle for their next car purchase. Despite soaring gas prices and Americans saying the number one driver to switch to EVs one day might be the price of fuel, Americans still seem to love and prefer their gas and diesel powered cars and trucks. 20% are looking at hybrids, while only 8% are looking at plug-in hybrids, equal to the 8% looking at 100% battery powered EVs.

Infobyte: Consumer Behavior Summary - USA

Infobyte: Consumer Behavior Summary - USA

EV Charging Conundrums in the USA

The US currently has 136,513 charge points. It is targeting 500,000 public charging stations by 2030 nationwide; but even with ambitions to nearly quadruple its public charging infrastructure stock, it will still not be enough to meet the charging needs of the federal government’s aim for electric vehicles to constitute 50% of vehicle sales in 2030. The US$7.5 billion Bipartisan Infrastructure Law, which will be used to develop public charging infrastructure, includes the National Electric Vehicle Infrastructure (NEVI) Formula Program that will provide funding to states. Besides the federal law to develop charging infrastructure, several states have been investing in public charging. California’s governor and state legislators approved a US$3.5 billion budget for zero emission vehicles and infrastructure, which includes US$500 million to the Clean Transportation Program administered by the California Energy Commission to develop public chargers. California also provides funding for private charging and has installed 79,023 public and private chargers as of June 2022. Other states have a long road ahead to satisfy public charging needs.

It is precisely this lack of charging infrastructure that is driving some major developments and partnerships in the US EV scene. For one, General Motors Co. announced plans to adapt its EVs to use Tesla’s Supercharger network in the summer of 2023. This means that GM EV drivers will have greater access to chargers, and will be able to use Tesla’s 12,000 Tesla Superchargers located throughout North America beginning in early 2024. GM will also begin to incorporate the NACS connector design into its electric vehicles starting in 2025.

The shifts in the EV charging landscape, specifically OEMs aligning with established networks like Tesla's Supercharger, are causing a significant hit to the stocks of other EV charging players, too, of course. This has led to what some industry insiders have termed “an EV Glut” as an oversupply of less desirable EV models flood the US market, causing an inventory build up. This shift introduces a new dynamic to the EV market, prompting a reconsideration of EV charging strategies and questioning the future of standalone charging companies.

Meanwhile, even Tesla, America’s EV giant with the largest EV charging network to its name, is starting to place bets on different methods of wireless charging technologies.

Next Read: Tesla betting $76M on Wiferion: the Future of Wireless Charging

%2Fuploads%2Fev-2023%2Fcover16.jpg&w=3840&q=75)