Top 5 SSA Funding Rounds of October 2025: Can Q4 Momentum Push SSA VC Funding Past 2023 Totals by Year’s End?

27 November 2025•

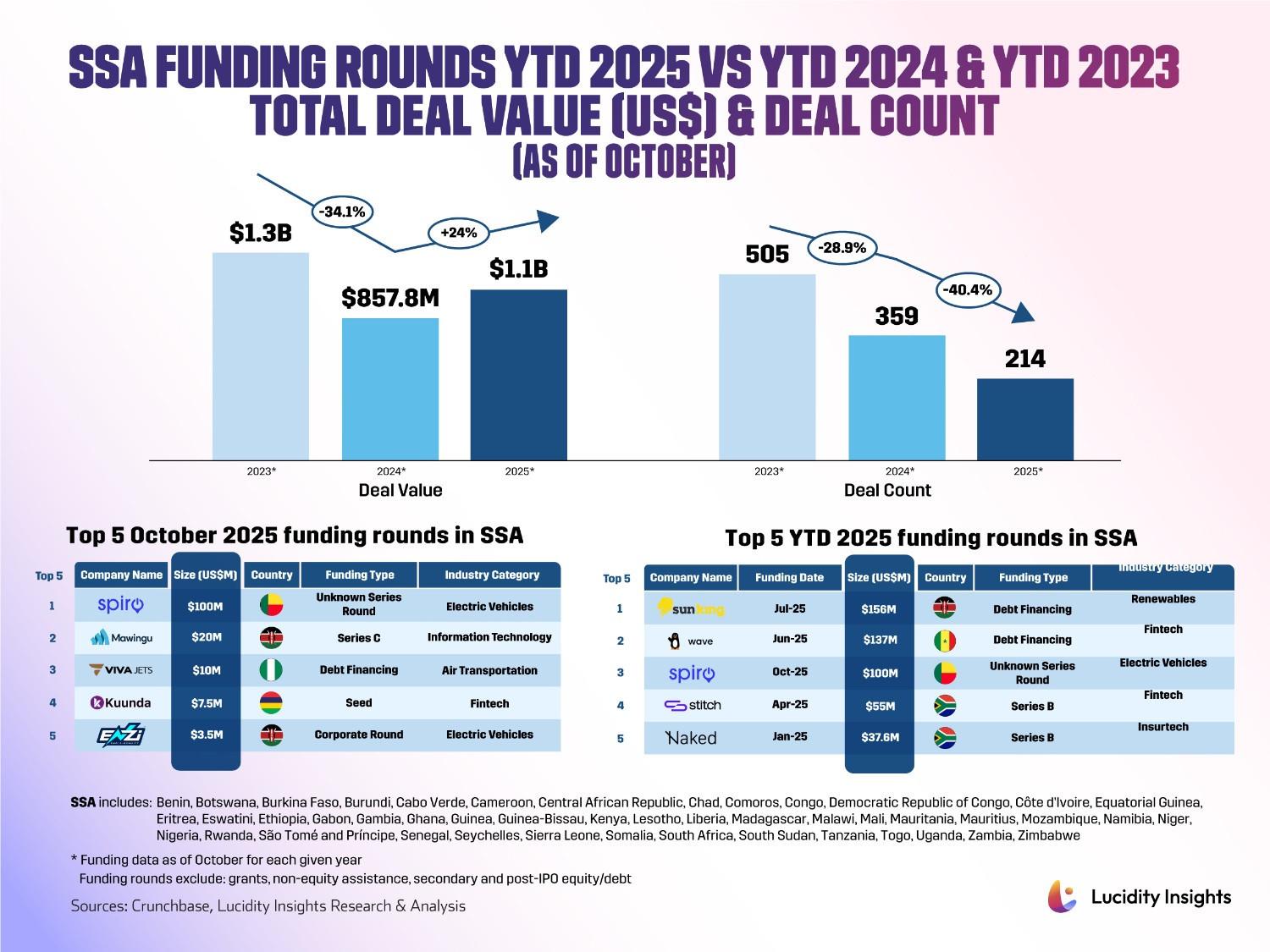

As Q4 2025 begins, venture capital activity in Sub-Saharan Africa (SSA) is showing tentative signs of recovery. Year-to-date (YTD) funding reached USD 1.06 billion by the end of October 2025, up 24% from the USD 857.8 million recorded over the same time in 2024. However, this figure remains below the USD 1.3 billion raised by October 2023, signaling that the region has yet to regain momentum. The decline in deal activity is even more pronounced as a continuous downward slope over the past 2 years: only 214 transactions were closed through October 2025 compared to the 359 deals through October 2024 and 505 deals through October 2023.

The average ticket size in 2025 has surged to approximately USD 5 million, nearly double 2023 levels. October delivered a single mega-round (deals ≥ USD 100 million) - Spiro's USD 100 million funding round as one of Africa’s largest publicly announced investment ever in electric mobility two‑wheelers and the third-largest YTD across SSA. In fact, this deal alone accounts for 9.4% of all SSA capital deployed in 2025 so far.

Sectorally, the emergence of capital-intensive verticals like electric mobility and renewables mark a shift toward infrastructure-heavy bets in industries that align with regional efforts to electrify transport and transition to clean energy. Capital for electricity access remains constrained. The International Energy Agency (‘IEA’) tracks less than USD 2.5 billion committed to new electricity-access connections in sub-Saharan Africa in 2023, even after a modest post-pandemic rebound, and estimates the continent needs around USD 15 billion per year to reach universal access within the next decade. In 2025, African governments collectively allocated about USD 1.9 billion to electricity-access programmes—roughly one-third of their energy budgets—underscoring that public funding alone won’t close the gap. For venture markets, this helps explain why 2025 deal value is being propped up by a few infra-adjacent, larger-ticket rounds (e-mobility, mini-grids) even as overall volumes remain below 2023.

Looking ahead to the final months of 2025, SSA’s VC landscape is entering a pivotal stretch. According to the IMF, the region is expected to maintain 4.1% GDP growth this year with a slight acceleration in 2026 supported by macroeconomic reforms and stabilization across key markets (IMF Regional Economic Outlook for Sub-Saharan Africa, October 2025). However, commodity price fluctuations, tight external financing conditions, and a weakening global trade and aid environment continue to weigh heavily on capital flows into emerging markets. For SSA startups, this means that end-of-year deal-making may remain selective and unevenly concentrated in later-stage or more strategically aligned sectors. As Q4 unfolds, the question is whether the rebound in funding value can hold through year's end to lay the groundwork for renewed momentum heading into 2026.

Let’s take a look at the top 5 funding rounds of October 2025 in SSA.

#1 - Spiro (Benin), E-Mobility, USD 100 Million Unknown Series Round

Founded in 2019 by the Dubai-based Equitane, Spiro is Africa’s largest and fastest‑growing electric‑mobility player on a mission to introduce electric alternatives to auto-rickshaw vehicles in Africa with a focus on the rapidly growing electric two-wheeler market. Spiro is committed to sustainable socio-economic development in Africa by creating jobs, reducing trade deficits and lowering carbon emissions across the continent. Spiro has completed more than 15 million battery swaps and logged over 340 million kilometers driven on its electric two‑wheelers. The company is now building its own manufacturing and assembly facilities, which will make Spiro the first company to produce e‑bikes and batteries in Africa.

In October 2025, Spiro announced a landmark USD 100 million funding round led by Fund for Export Development in Africa (FEDA). As Africa’s largest investment ever in electric mobility two‑wheelers, this deal brough Spiro's total cumulative fundraising to over USD 230 million. Spiro will use the new capital to scale its market‑leading battery‑swapping network across both current and upcoming markets, while also enhancing its core technology platform. The company aims to exceed 100,000 deployed electric vehicles by the end of 2025, solidifying its dominance in Africa and placing it among the top battery‑swapping operators globally.

#2 - Mawingu Networks (Kenya) | Information Technology | USD 20 Million Series C

Founded in 2012, Mawingu Networks is a connectivity‑focused ISP that deploys a hybrid model of wireless, fibre and renewable energy‑powered infrastructure under a “buy‑and‑build” strategy. As Kenya’s largest internet service provider (ISP) dedicated exclusively to the rural and peri urban markets in the country, Mawingu now serves over 20,000 active customers across 30 + Kenyan counties. The company also entered Tanzanian markets recently with the acquisition of ISP Habari in 2024, having raised KSh 1.9 Billion (USD 15 million) of debt and equity financing to enable its expansion into East Africa.

In October 2025, Mawingu closed a USD 20 million Series C funding round led by Pembani Remgro Infrastructure Managers, bringing its total cumulative fundraising to USD 49 million. The new capital will be used to scale Mawingu’s Kenyan network and advance toward its target of serving one million Africans by 2028. Mawingu has plans for a combination of disciplined acquisitions of local ISPs and the development of digital infrastructure in areas historically left behind due to high capital costs and geographic barriers.

#3 - VivaJets (Nigeria) | Air Transportation | USD 10 Million Debt Financing

Launched in 2023 by parent company Falcon Aerospace Limited, VivaJets is a business‑aviation charter specialist operating across Nigeria and into neighboring markets with its Air Operator’s Certificate (AOC) secured from the Nigerian Civil Aviation Authority in January 2025. VivaJets offers luxury private‑jet charter services, including a recently expanded fleet that now features aircraft such as the Hawker 900XP and the Challenger 604, which signal a push into the premium segment of African aviation.

In October 2025, VivaJets announced a USD 10 million debt‑financing facility from TLG Capital and Wema Bank. The new funds will support VivaJets’ plan to induct additional Challenger 604 jets and scale operations across the region, positioning the startup to meet rising demand for intra‑African private aviation in its next phase of fleet rollout and route expansion.

#4 - Kuunda (Mauritius) | FinTech | USD 7.5 Million Seed Round

Founded in 2018 by Andy Milne, Sam Brawerman and Morne van der Westhuizen, Kuunda builds embedded lending infrastructure that enables mobile money operators, banks, and digital platforms in emerging markets to offer real‑time liquidity solutions to agents, merchants, and consumers. Its flagship products - Hapa Cash for instant liquidity and Kazi Cash for working‑capital loans - have supported over USD 1 billion in disbursements across Africa, reaching more than 90,000 active agents and over 1 million consumers as of 2023.

In October 2025, Kuunda announced a USD 7.5 million seed round led by investors including Portugal Gateway Fund, Seedstars Africa Ventures, 4Di Capital, Accion Ventures, Nedbank and E4E Africa, bringing Kuunda’s total cumulative funding to approximately USD 9.8 million. The new capital will be used to deepen Kuunda's lending‑as‑a‑service stack, expand into new MEAPT markets including Egypt and Kenya, and scale partnerships with mobile money operators and banks to embed credit at the point of transaction.

#5 - Enzi Mobility (Kenya) | Electric Vehicles | USD 3.5 Million Corporate Round

Founded in 2021 by Bill Schafer, Enzi Mobility targets Kenya’s large motorcycle taxi (“boda‑boda”) and delivery‑vehicle market to improve the quality of life for both the Kenyan individual and their community through sustainable e-mobility technologies. Enzi's signature product, the Enzi G5 electric motorcycle, is supported by a growing network of battery‑swap and solar charging stations and is promoted as costing roughly 50 % less to run than a petrol bike, boosting drivers’ earnings by about USD 1,000 annually.

In October 2025, Enzi Mobility raised USD 3.5 million in a corporate financing round led by blockchain‑enabled impact‑investor Kula PCC, divided between USD 2 million in equity and USD 1.5 million in blockchain‑technology support tied to ESG‑tracking and token‑based governance. The capital infusion will allow Enzi to scale its fleet and swapping‑station infrastructure across East Africa. Specifically, Enzi is launching two digital tokens - $ENZI for riders and team governance, $BODA for customer rewards - with plans to accelerate deployment of its next‑generation electric motorcycles, battery systems, and rider onboarding program.

%2Fuploads%2Ffintech-africa%2Fcover13.jpg&w=3840&q=75)