A Closer Look at the Top 5 Most Funded Crypto Startups for H1 2024

29 July 2024•

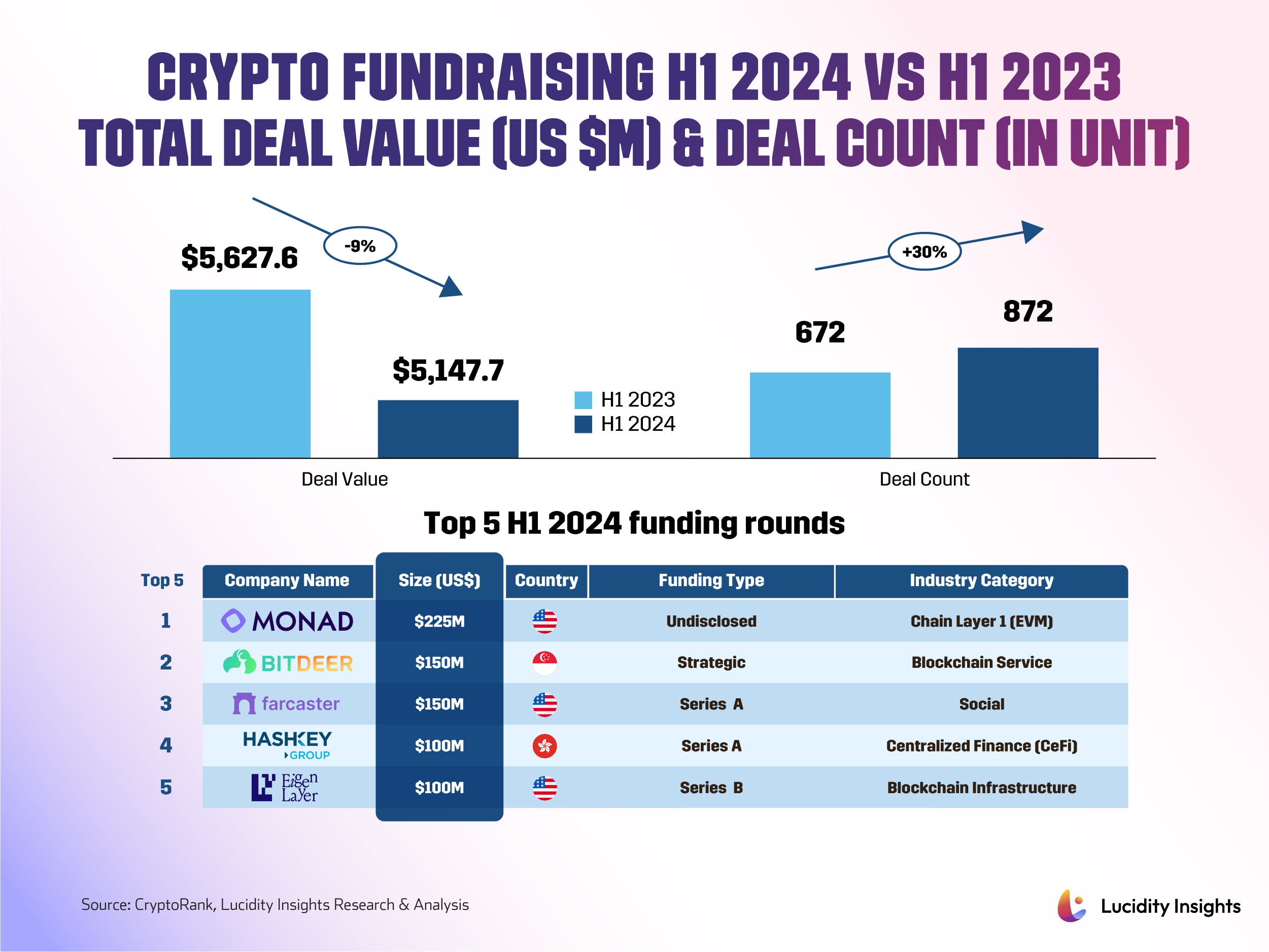

Total deal value in the global cryptocurrency sector was US $5,627.6 million in H1 2023, and has experienced a 9% YOY decline, falling to US $5,147.7 million in H1 2024. Deal count, however, has experienced a significant 30% YOY increase, surging from 627 deals in H1 2023 to 872 deals in H1 2024.

While total deal value may have dipped, possibly continuing a two-year downtrend, the surge in deal count suggests sustained interest and innovation within the industry as more projects and startups are entering the crypto space. Investors are diversifying their portfolios by participating in a larger number of projects, even if individual deal sizes have decreased.

Let's take a look at the top 5 most funded crypto startups across the globe in the first half of 2024.

#1 - Monad | Chain Layer 1 (USA) | US $225 Million Undisclosed Funding

Launched by Monad Labs in 2022, Monad is a high-performance blockchain platform designed as an Ethereum Virtual Machine (EVM)-compatible Layer 1 (L1) scaling solution to address the limited throughput and high cost of existing Layer-1 solutions. Monad’s client is built from scratch in C++ and Rust, resulting in a throughput of 10,000 transactions per second as of March this year, and it maintains full compatibility with the EVM, making it easy for developers to port existing Ethereum applications.

In April 2024, Monad raised US $225 million in a funding round led by Paradigm. The funds are being used to scale the team and bring Monad to production as it is expected to be live by the end of 2024, with mainnet deployment planned for early 2025.

#2 - Bitdeer | Blockchain Service (Singapore) | US $150 Million Strategic Funding

Founded by Jihan Wu in 2022, Bitdeer is a Nasdaq-listed provider of digital asset mining services for blockchain and high-performance computing. Bitdeer operates six mining data centers around the world, with a total hash rate of 22.4 EH/s under management. Total revenue was US $368.6 million in 2023, a 10.6% YOY increase, after successfully testing its first Bitcoin mining chip, the 4nm SEAL01.

In May 2024, Bitdeer announced a subscription agreement with Tether International Limited which generated US $100 million in gross proceeds from the share issuance and as well as an additional $50 million if the warrant is fully exercised. Bitdeer intends to use the proceeds to fund its data center expansion, ASIC based mining rig development, and for working capital and other general corporate purposes.

#3 - Farcaster | Social (USA) | US $150 Million Series A

Founded in 2020 by Dan Romero and Varun Srinivasan, Farcaster is a decentralized social network that operates on the Ethereum blockchain to move identity between applications by creating an open protocol. Farcaster users can claim unique usernames, store social data off-chain, and developers have the freedom to build applications with new features on the network.

Farcaster achieved unicorn status in May 2024 after it raised US a $150 million Series A round led by Paradigm. The funds are being used to grow its user base and add developer tools as Farcaster sees to hire engineers and add new features like channels and direct messaging throughout 2024.

#4 - Hashkey Group | Centralized Finance (Hong Kong) | US $100 Million Series A

Founded in 2018 by Dr. Xiao Feng, HashKey Group is a leading end-to-end digital asset financial services group in Asia. HashKey Group operates several core businesses including a licensed virtual asset exchange regulated by the Hong Kong Securities and Futures Commission, a global asset manager exclusively investing in blockchain technology and digital assets, leading global Web3 infrastructure services, and tokenization services.

In January 2024, Hashkey Grou also achieved unicorn status after raising US $100 million in a Series A funding round led by OKX Ventures. The new funds are being used to strengthen HashKey's Web3 ecosystem, speed up the diversification of its licensed products in Hong Kong, and promote the Group's compliant and innovative development on a global scale.

#5 - EigenLayer | Blockchain Infrastructure (USA) | US $100 Million Undisclosed Funding

Founded by Dr. Sreeram Kannan in 2021, EigenLayer (Eigen Labs) is a blockchain infrastructure startup that focuses on crypto-economic security. EigenLayer’s technology allows clients to validate different types of modules, including consensus protocols, data availability layers, virtual machines, keeper networks, oracle networks, bridges, threshold cryptography schemes, and trusted execution environments. It has developed an Ethereum-related technology known as “re-staking” which supports Ethereum security through re-staking methods and offers a customizable and hyper-scaled data availability service.

In February 2024, EigenLayer raised a US $100 series B round led by a16z crypto. The funds are being used to finalize its platform as EigenLayer aims to facilitate “100x faster innovation” in crypto-based technologies, such as “bridges” enabling users to transfer tokens between blockchains and “oracles” that integrate real-world data into the blockchain.

%2Fuploads%2Finnovations-blockchain%2Fcover22.jpg&w=3840&q=75)