The Top 10 Most Funded Startups in MENA in 2023

19 June 2024•

In 2023, the Middle East and North Africa (MENA) region has experienced a remarkable influx of investments into startups, highlighting its burgeoning entrepreneurial landscape. Among the sectors reaping significant financial backing, fintech stands out, having attracted over US $2.3 billion in funding, followed by cleantech, which, like fintech, also saw a doubling of investment since 2021. This investment enthusiasm is mirrored across other vital areas such as healthtech, logistics, e-commerce, and transportation, underscoring a dynamic and rapidly evolving venture capital landscape within the region.

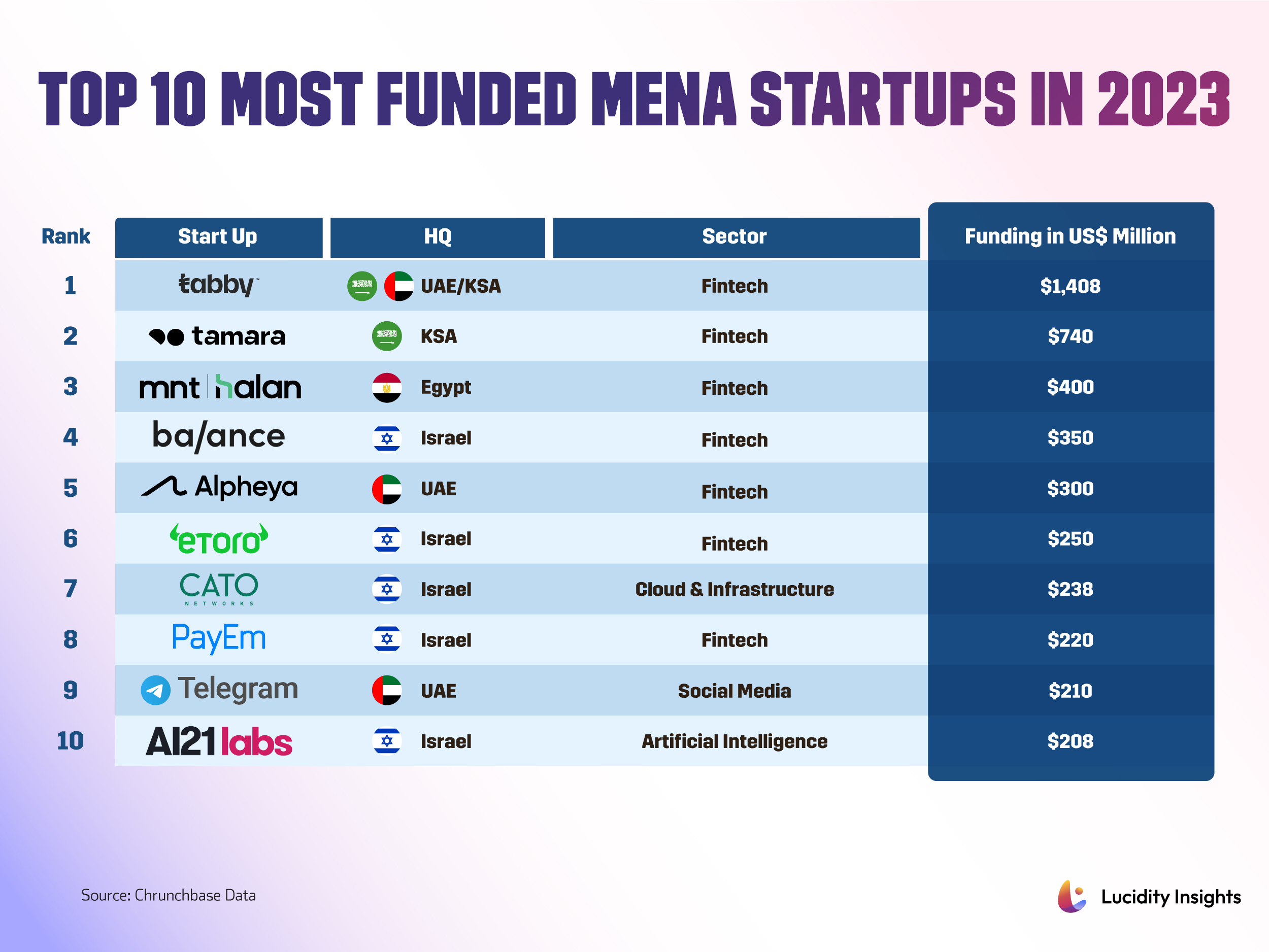

Below is a table of the top 10 most funded startups in MENA for 2023, showcasing their funding amounts:

1. Tabby

Established: 2019 in Dubai, UAE

Sector: FinTech

Tabby operates a financial platform that offers consumers a "buy now, pay later" option. Their platform allows customers to pay for online and offline purchases either in a deferred single payment or in multiple installments. Essentially, the platform provides flexible credit options for safe payments. Tabby witnessed five times year-on-year revenue growth in 2022. It currently caters to four million active shoppers across the UAE, KSA, Kuwait, and Bahrain, selling 10,000+ global brands like H&M, Adidas, IKEA, SHEIN, and Bloomingdale’s.

2. Tamara

Established: 2020 in Riyadh, KSA

Sector: FinTech

Tamara operates a BNPL platform for both merchants and customers, aiming to empower people in their daily lives by revolutionizing how they shop, pay, and bank. The BNPL options are available during online checkout (for e-commerce) and via in-store QR codes (for brick-and-mortar stores), allowing shoppers to divide the cost of online purchases into interest-free installments or pay the entire amount after a specified period. The company reported six times annual run rate revenue growth in less than two years and became Saudi Arabia's first fintech unicorn last year after its US $340 million Series C round in December. Today, they serve over 10 million users and have partnered with 30,000+ merchants across the KSA, UAE, and Kuwait.

3. MNT-Halan

Established: 2018 in Cairo, Egypt

Sector: FinTech

What sets MNT-Halan apart from other FinTechs today is its aims to digitally bank the unbanked and underbanked population by providing innovative financial solutions and substituting cash with electronic alternatives. They provide microfinancing loans, instant digital lending, and finance service for light vehicles with convenient programs, allow companies to offer salary advances to employees, and serve both merchants and consumers with delivery services of fast-moving consumer goods at wholesale prices. Today, MNT-Halan has over 5 million customers in Egypt, including 3.5 million financial clients and 2 million borrowers, and serves 1.3 million active users per month.

4. Balance

Established: 2020 in Tel Aviv, Israel

Sector: FinTech

Balance specializes in B2B payment solutions, providing an online checkout platform designed specifically for businesses. The platform facilitates various payment methods, flexible payment terms, and instant payouts, all consolidated in one location, offering comprehensive infrastructure support tailored for marketplaces, focusing on B2B needs such as effortless vendor onboarding, complete control over payouts, escrow services, and a customizable quote process that allows vendor autonomy. Balance has been recognized as #1 payment and commerce provider according to Visa and Citi, and has been featured in CB Insights' list of 250 Promising FinTechs for 2021 and 2022, as well as Business Insider’s 57 Most Exciting FinTechs.

5. Alpheya

Established: 2023 in Abu Dhabi, UAE

Sector: FinTech

Alpheya offers a complete line of cloud-native, AI-powered wealthtech solutions with a platform that provides client relationship management, financial planning, portfolio construction, trading, and digital portals. Alpheya boasts a unique data model that offers comprehensive, real-time business insights as well as a collection of financial products, models, and research accessible through its platform. Alpheya had garnered 1 million users within the first five days of its release, and is expected to see an annual growth rate of 37.3% by 2030.

6. eToro

Established: 2007 in Tel Aviv, Israel

Sector: FinTech

Founded as RetailFX, eToro is a social trading and multi-asset investment company for both manual and social investing through its platform that allows users to invest in a wide range of financial instruments, including stocks, cryptocurrencies, commodities, and more. In 2021, eToro reported revenues of US $1.23 billion, more than double the previous year's figure, and it now has 20 million users across 140 countries.

7. Cato Networks

Established: 2015 in Tel Aviv, Israel

Sector: Cloud & Infrastructure, Information Technology

Cato Networks Ltd. provides a comprehensive and integrated solution for enterprise communication and security through the world's first Secure Access Service Edge (SASE) platform. Their platform, known as Cato SASE Cloud, combines SD-WAN (Software-Defined Wide Area Network) and network security into a global, cloud-native architecture, leveraging a converged software stack, global cloud distribution, and common policy and data management to reduce complexity, risks, and costs. Cato Networks has been recognized as a Challenger by Gartner in the Magic Quadrant for Single-vendor SASE and a Leader by GigaOm Radar as well as Forrester in the Forrester WAVE™: Zero Trust Edge Solutions, Q3 2023.

8. Telegram Messenger

Established: 2013 in Dubai, UAE

Sector: Messaging, Social Media

Telegram Messenger is a cloud-based, cross-platform, encrypted instant messaging (IM) service. Available on Android, iOS, Windows, macOS, Linux, and web browsers through registration on a smart phone, Telegram allows users to exchange messages, share media and files, and hold private and group voice or video calls, as well as public livestreams. In January 2021, Telegram was the most downloaded app in the world, and as of March 2024, Telegram has more than 900 million monthly active users worldwide, making it the most popular instant messaging application in parts of Europe, Asia, and Africa with India leading in the number of users.

9. PayEm

Established: 2019 in Tel Aviv, Israel

Sector: FinTech, Payments

PayEm provides a comprehensive spend management and procurement platform that streamlines financial processes and empowers organizations to make informed decisions for optimal efficiency and success. PayEm's platform combines plastic (corporate cards) and software to help company leaders approve, track, and manage vendors, automate request and reconciliation processes for finance and procurement teams, and of course offer solutions for reimbursement, procure-to-pay, ERP integration, fund requests, and accounts payable (AP) automation.

10. AI21 Labs

Established: 2017 in Tel Aviv, Israel

Sector: Artificial Intelligence

Founded by Yoav Shoham, Ori Goshen, and Amnon Shashua, AI21 Labs specializes in Natural Language Processing (NLP) and generative AI, offering powerful language models and tools for businesses and consumers. Its products include Wordtune, an AI-based writing assistant, AI21 Studio, a developer platform for building custom text-based business apps, and Jamba, an open weights large language model. The company’s valuation stands at US $1.4 billion currently, and it raised US $208 million in 2023 to accelerate its R&D efforts and reach its goal of developing the next level of AI with the capabilities of reasoning across many domains.

%2Fuploads%2Fdubai-vc-ecosystem%2Fcover-ent.jpg&w=3840&q=75)