Top 10 Most Funded Startups in Africa in 2023

02 July 2024•

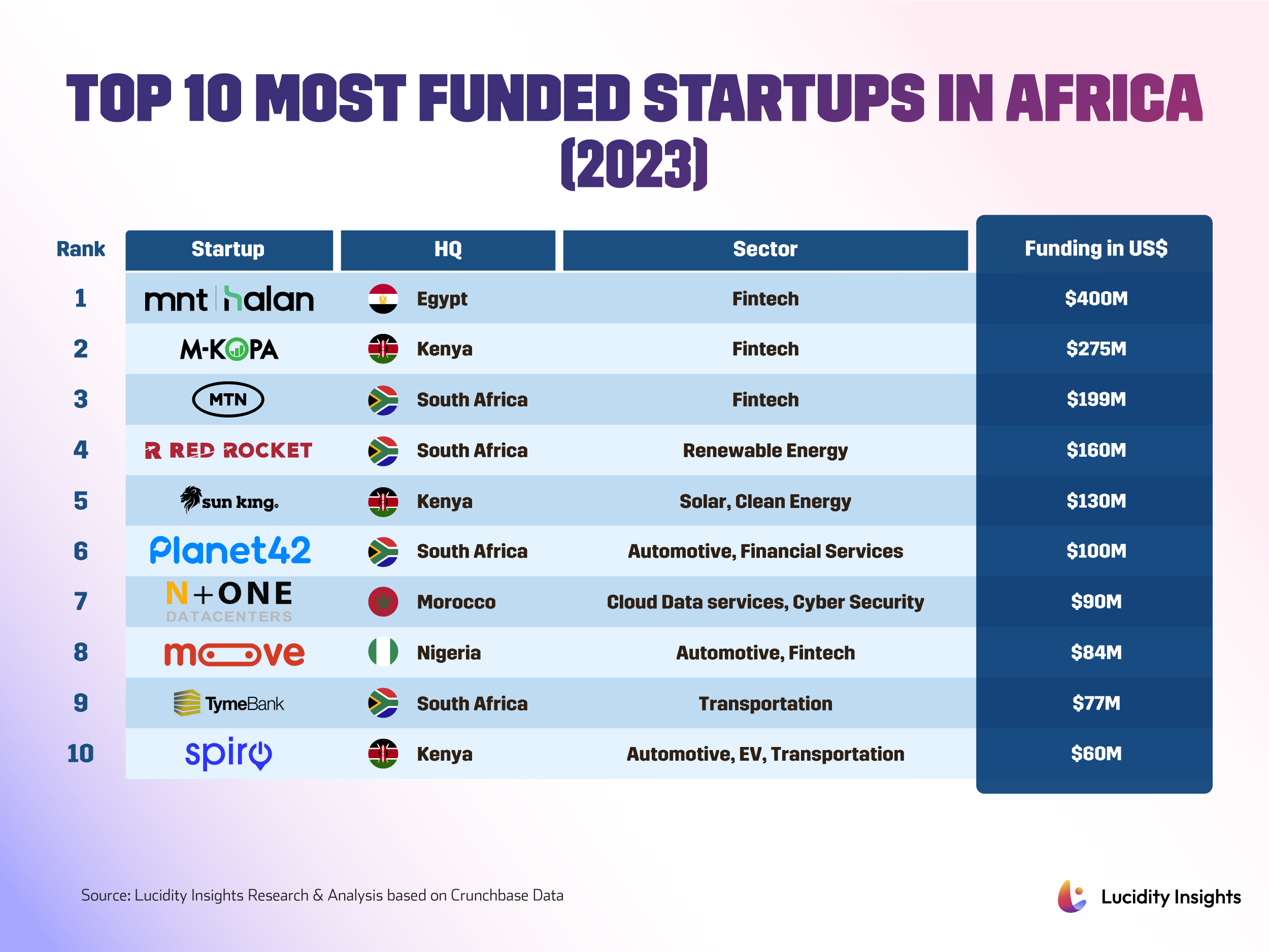

The African startup ecosystem experienced unprecedented growth in 2023, attracting significant attention and investment from around the globe. Fintech attracted the most attention by far, taking all 3 podium positions for the most funded startups in 2023 followed by renewable and clean energy. As for geographical dominance, South Africa took 4 of the top 10 places, followed closely by Kenya. Debt financing also seemed to dominate over equity in several top-funded startups, reflecting a matured approach to capital acquisition that allows businesses to leverage debt without diluting ownership across the continent.

Below is a table showcasing funding amounts of the top 10 most funded startups in Africa for 2023 showcasing their funding amounts:

#1 - MNT-Halan

Established: 2018 in Cairo, Egypt

Sector: FinTech

Funding: 400 US $ million

HQ: Giza, Egypt

Founded by Mounir Nakhla and Ahmed Mohsen as a ride-sharing and delivery app originally called Halan, MNT-Halan transitioned into a digital banking platform that has made significant strides in serving underbanked and unbanked customers in the Egyptian fintech and e-commerce landscape. MNT-Halan offers a diversified portfolio of services including business & consumer lending, loans, and transfers via Halan cash wallet as well as Buy Now Pay Later options where consumers can shop from +4,000 vendors and pay in installments over 36 months. MNT-Halan also doubles as a home appliances and electronics platform with wholesale prices for fast-moving consumer goods for both B2B and B2C markets. In 2023, MNT-Halan raised US $400 million in a mix of debt financing and equity funds led by Chimera Investment to fuel its growth strategy, bringing the company to unicorn status with funds raised totaling up to $470 million.

#2 - M-KOPA

Established: 2011 in Nairobi, Kenya

Sector: FinTech

Funding: 275 US $ million

HQ: Nairobi, Kenya

Founded by Nick Hughes, Chad Larson, and Jesse Moore, M-KOPA is an African connected asset financing platform that empowers underbanked customers by combining digital micropayments with GSM connectivity to make life-enhancing assets accessible. M-KOPA provides a connected financing platform that enables access to solar lighting systems, televisions, fridges, smartphones, and financial services. In 2023, M-KOPA raised US $200 million in Debt Financing from Standard Bank Group, as well as a $55 million venture round led by Sumitomo and a $20 million convertible note from FinDev Canada, bringing its total funds raised to $590.2 million. The new financing is dedicated to delivering sustainable energy solutions and accelerate M-KOPA's expansion plans in the South African market.

#3 - MTN Group Fintech

Established: 1994 in Johannesburg, South Africa

Sector: FinTech

Funding: 199 US $ million

HQ: Johannesburg, South Africa

MTN Group Fintech is a South African multinational corporation subsidiary of MTN Group Limited and a major mobile telecommunications provider. MTN Group focuses on providing innovative digital financial services, and its flagship product, MTN Mobile Money (MoMo), is a fintech platform that enables consumers and businesses to access payments, e-commerce, insurance, lending, and remittance services. MTN Group operates in over 20 countries, with Nigeria being a significant market where it holds about 35% market share. In 2023, the group closed a deal with Mastercard in the form of a ZAR 3.8 billion or US $199 million corporate round, bringing its valuation to US $5.2 billion. In Q1 2024, MTN MoMo achieved 4.8 billion transactions with a transaction value of US $72.3 billion and 2.2 million active merchants.

#4 - Red Rocket South Africa

Established: 2020 in Cape Town, South Africa

Sector: Renewable Energy

Funding: 160 US $ million

HQ: Cape Town, South Africa

Established as the Africa and Middle East business unit of Building Energy, Red Rocket South Africa has evolved into an integrated renewable energy Independent Power Producer (IPP) that focuses on clean energy solutions across Africa. Red Rocket develops, designs, constructs, operates, and owns utility-scale grid-connected renewable energy projects in wind, solar, hydro, and biomass. It currently has 377 MW of projects in operation, under construction, and awarded through public and private bids, and is developing a pipeline of over 2 GW of wind, hydro, and solar projects for future rounds of South Africa's renewable energy procurement program. Red Rocket currently stands with a total funding of US $191.4 million after receiving $160 million in 2023 from an unknown series venture round led by Inspired Evolution Investment Management and Kilgore Investments to build more solar and wind farms in a bid to address the South African energy crisis.

#5 - Sun King

Established: 2007 in Nairobi, Kenya

Sector: Solar, Clean Energy

Funding: 130 US $ million

HQ: Nairobi, Kenya

Founded by University of Illinois graduates Patrick Walsh, Anish Thakkar, and Sam Goldman as Greenlight Planet, Sun King is a provider of solar energy solutions in Africa and Asia on a mission to create affordable, reliable, and clean energy solutions for off-grid communities. Sun King designs, distributes, installs, and finances solar energy solutions such as lighting, home appliance power, and solar inverters for the 1.8 billion global consumers who lack reliable access to traditional electrical grids. It has eliminated 22 million tons of carbon dioxide emissions and saved 82 million people across 40 countries $4.4 billion in energy costs, accounting for 38% of industry-wide PAYG solar revenue globally. In 2023, Sun King partnered with Citi Bank on a securitization deal for US $130 million in debt financing to improve solar panel access for those living off the Kenyan power grid, and its total funding amounts to $714 million today.

#6 - Planet42

Established: 2017 in Johannesburg, South Africa

Sector: Automotive, Financial Services

Funding: 100 US $ million

HQ: Johannesburg, South Africa

Founded by Eerik Oja and Marten Orgna, Planet42 is a car subscription service that democratizes mobility by buying used cars from dealerships and renting them to customers via a subscription model. Its mission is to address transport inequality globally by providing access to personal cars for people typically excluded from traditional car financing, and so far, it has distributed over 12,000 cars in South Africa and Mexico. In 2023, Planet42 collected ZAR273.8 million in a venture round led by ARS Holdings and Naspers Foundry as well as ZAR1.6 billion in debt financing from Rivonia Road Capital, roughly US $100 million, to scale business and provide a million cars globally. It’s also secured another injection of capital for the repayment of higher-cost euro-denominated loans in 2024, bringing its total funds to US $166.8 million.

#7 - N+ONE Datacenters

Established: 2008 in Casablanca, Morocco

Sector: Cloud Data Services, Cyber Security

Funding: 90 US $ million

HQ: Casablanca, Morocco

Founded by Amine Kandil, N+ONE Datacenters is a carrier-neutral data center company and recognized leader in the colocation and online services industry for more than 10 years in Casablanca. With a mission to empower businesses with state-of-the-art cloud and data center solutions, N+ONE primarily allows customers to focus on their core business and increase efficiency. Its venture round in 2023 led by African Infrastructure Investment Managers raised US $90 million to support the roll-out of a new Pan-African data center and cloud services platform with a short-term target capacity of 40 MW.

#8 - Moove

Established: 2020 in Lagos, Nigeria

Sector: Automotive, Fintech

Funding: 84 US $ million

HQ: Lagos, Nigeria

Founded by Ladi Delano and Jide Odunsi, Moove is a global mobility fintech company that aims to democratize mobility and financial inclusion across the continent by providing revenue-based vehicle financing to mobility entrepreneurs. It democratizes vehicle ownership across Africa by embedding alternative credit-scoring technology onto ride-hailing, logistics, mass transit, and last-mile/instant delivery platforms. Moove’s core offering is revenue-based vehicle financing, providing loans to drivers of ride-hailing platforms, making it easier for them to access and use vehicles. In 2023, Moove raised US $8 million and $10 million in Debt Financing from Absa CIB and BlackRock respectively, as well as a $66 million Private Equity round from Mubadala to double down on already profitable markets like the UAE, India, the U.K., and South Africa. Its funding now totals up to $444 million after two additional rounds targeting expansion into new markets in 2024.

#9 - TymeBank

Established: 2012 in Johannesburg, South Africa

Sector: Banking, Financial Services

Funding: 77 US $ million

HQ: Johannesburg, South Africa

Originally developed as part of a Deloitte Consulting project funded by MTN Group, TymeBank became a stand-alone business in June 2012. TymeBank offers basic transactional banking services through its Android banking app, internet banking site, and a national network of self-service kiosks hosted in partnership with retail chains Pick n Pay and Boxer. Customers can open accounts without physical branches. TymeBank has acquired over 7 million new customers since 2019 when it raised US $77.8 million in a pre-Series C round led by Norrsken22 and Blue Earth Capital. Having dedicated the new capital to furthering operations in South Africa and the Philippines and for future expansion in Southeast Asia, TymeBank’s total fund raising currently stands at US $316.8 million.

#10 - Spiro

Established: 2019 in Littoral, Benin

Sector: Automotive, EV, Transportation

Funding: 60 US $ million

HQ: Nairobi, Kenya

Spiro is a leading electric two-wheeler manufacturing company with a mission to revolutionize electric mobility by accelerating access to affordable, renewable energy technology in the sustainable mobility sector. Spiro offers cost-effective and eco-friendly electric bikes and scooters, including models like “COMMANDO” and “CHAP-CHAP”, as well as a unique battery swapping service called “Spiro Swap n’ Go” which allows riders to exchange depleted batteries for fully charged ones at their electric bike battery swapping centers. Recognized by TIME as one of the 100 Most Influential Companies of 2024, Spiro has deployed more than 15,000 innovative electric bikes across Africa to date. In 2023, Spiro collected US $60 million in debt financing from Societe Generale to expand its range of electric motorcycles through leasing, and has already collected another $50 from African Export-Import Bank bringing its total fund raising to $130 million.

%2Fuploads%2Fegypt-2024%2Fcover20.jpg&w=3840&q=75)