10 Graphs You need to see to understand Egypt’s Startup Ecosystem

Today’s Egypt is illuminated by startups spanning all sectors, from e-commerce and fintech to healthtech.

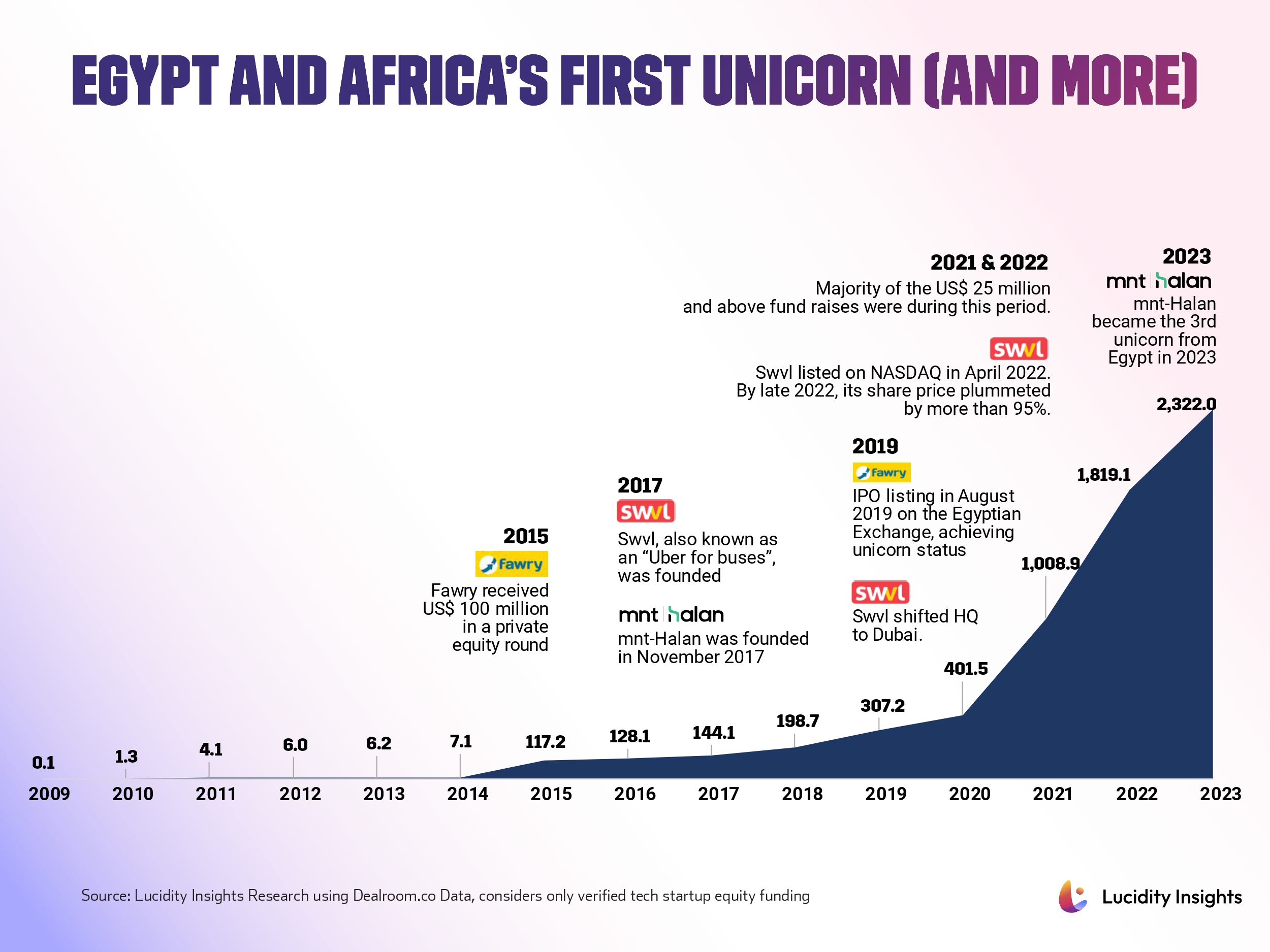

These modern-day dynasties are creating solutions that don’t just serve Egypt but reverberate across continents. The original face of this revolution was Fawry, a fintech player that listed on the Egyptian Stock Exchange in 2019 and subsequently reached a billion dollar valuation one year after listing. The new official face of this unicorn revolution in Egypt might be MNT-Halan, though, Egypt’s latest unicorn, birthed in early 2023.

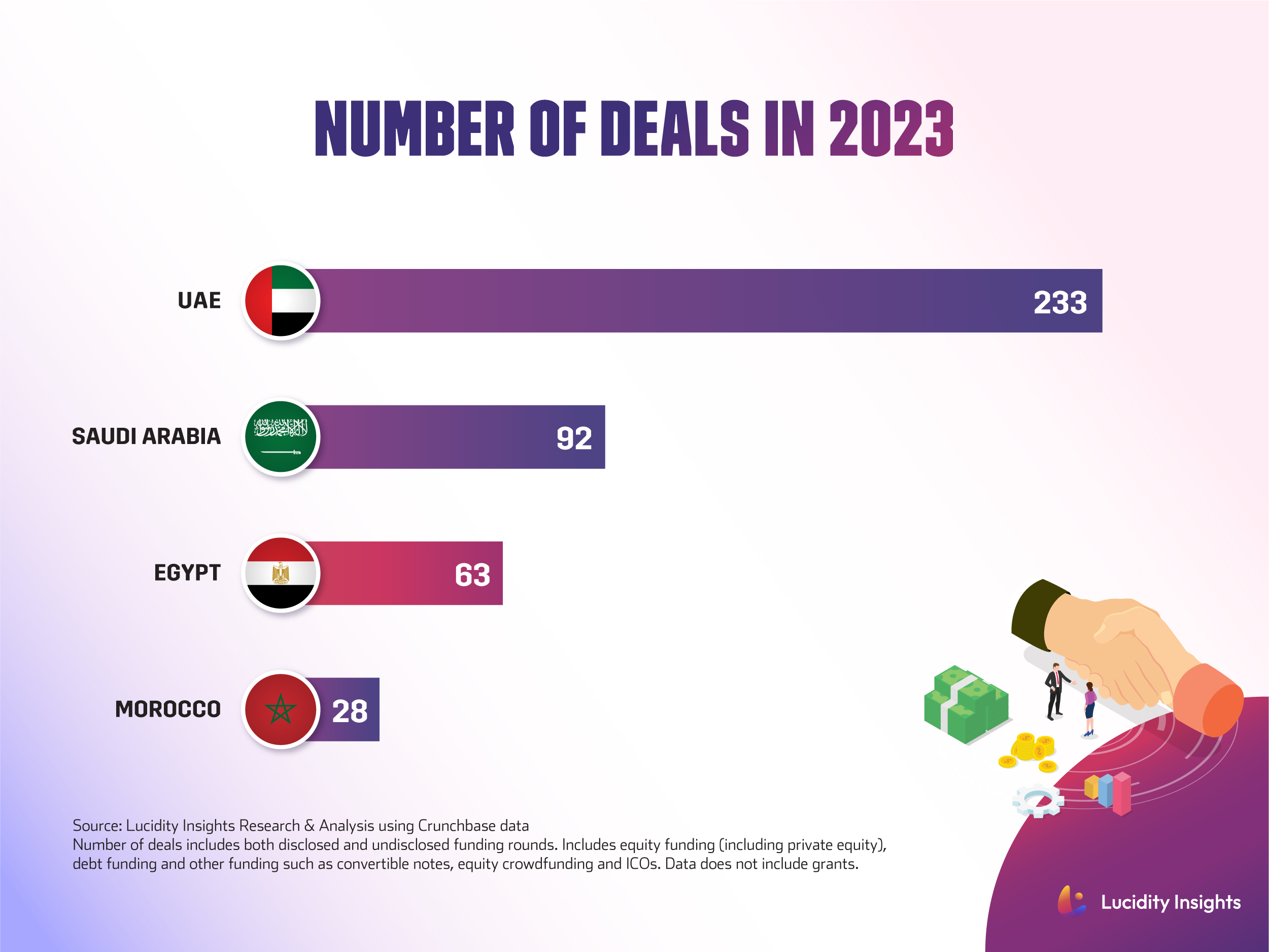

1. Egypt Ranked 3rd in terms of the Number of Funding Deals signed in MENA (excluding Israel)

Infobyte: MENA Number of Deals in 2023

Infobyte: MENA Number of Deals in 2023

Egypt usually ranks 2nd behind the UAE, in terms of the number of deals inked in MENA, however 2023 has been a difficult year and Egypt ranked 3rd behind both the UAE and Saudi Arabia. Morocco was the only other country in MENA (excluding Israel) that had more than 10 deals inked in 2023, as the VC winter set in across the world.

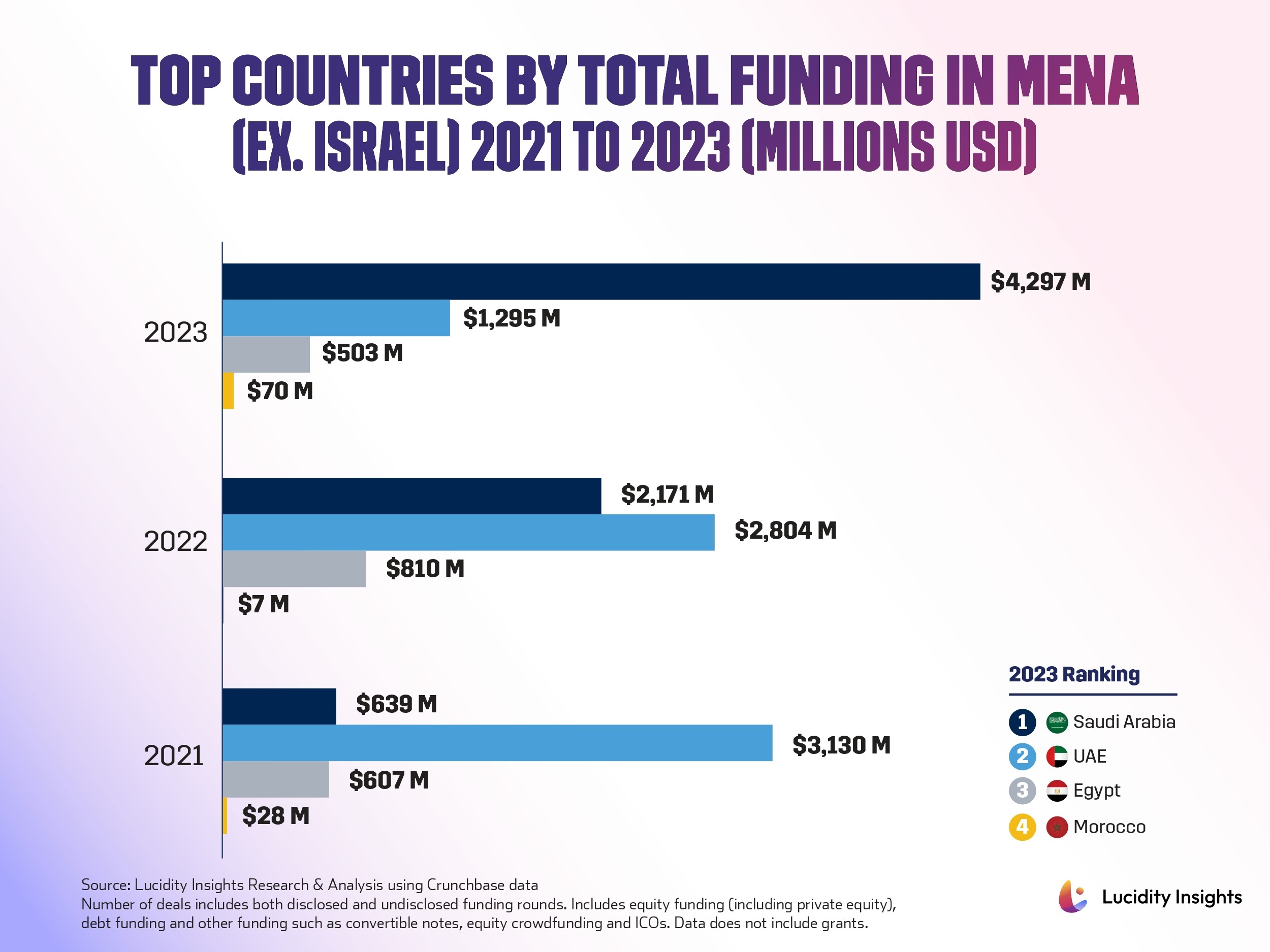

2. Egypt was 3rd (in value) across MENA for the past three years

Infobyte: Top Countries by Total Funding in MENA (Ex. Israel) 2021 to 2023 (Millions USD)

Infobyte: Top Countries by Total Funding in MENA (Ex. Israel) 2021 to 2023 (Millions USD)

The UAE has consistently witnessed funding over US$ 1 billion for the past three years and has maintained a top 2 position, along with Saudi Arabia. Saudi Arabia startups received the most funding in 2023 on the back of Tabby, a fintech solution offering customers to make purchases and pay for those in instalments. Egypt has been consistently ranking 3rd in terms of funding value, with 2023 seeing the lowest in the past three years.

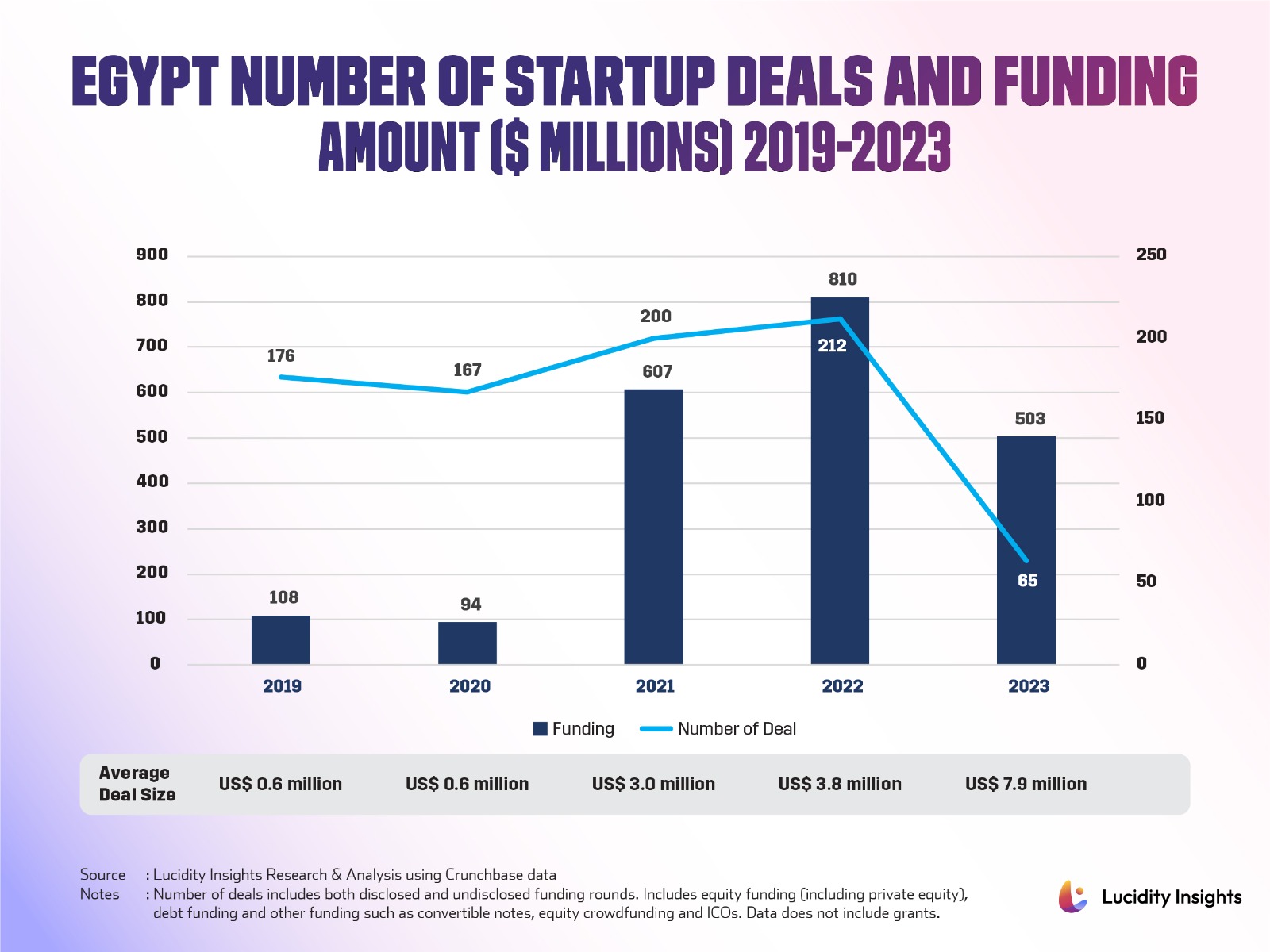

3. Egypt averaged 189 deals per year, prior to 2023’s 65 deals

Infobyte: Egypt Number of Startup Deals and Funding Amount (In Millions USD) 2019-2023

Infobyte: Egypt Number of Startup Deals and Funding Amount (In Millions USD) 2019-2023

Egypt’s tech ecosystem has consistently witnessed the signing of over 165 deals, annually, since 2019. Average ticket-sizes were low in 2019-2020, hovering at about $600,000 per deal. In 2021, everything jumped upwards: 200 deals were inked in a single year, the average cheque size jumped to $3 million, and Egypt went from a $100M per year funding market to startups raising $607 million in a single year. In 2022, Egypt continued to see growth - fundraising $810 million across 212 deals, with average cheque sizes growing again to $3.8 million.

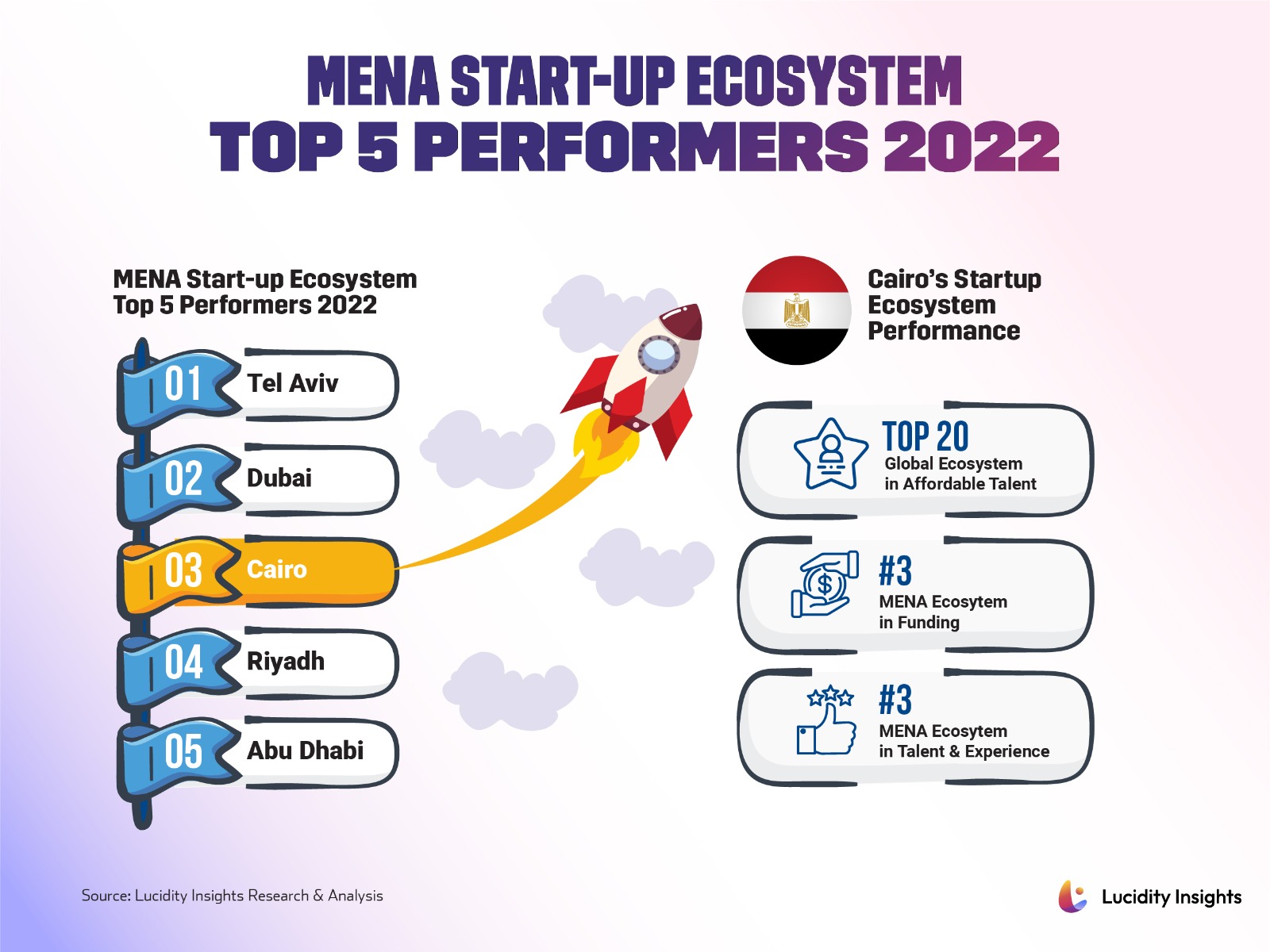

4. Cairo came in 3rd place in MENA’s Startup Ecosystem Rankings in 2022

Infobyte: MENA Start-up Ecosystem Top 5 Performers 2022

Infobyte: MENA Start-up Ecosystem Top 5 Performers 2022

While Cairo contributed to Egypt’s startup ecosystem getting ranked 1st in North Africa, the country ranked 3rd in the MENA startup ecosystem, behind Tel Aviv and Dubai, but ahead of Riyadh. The ecosystem has created US$ 8.3 billion worth of exits and startup valuations from 2nd half of 2020 to 2022.

Methodology for city ranking in the Startup Genome Global Startup Ecosystem Report 2023

Startup Genome is the world-leading policy advisory and research organization for public and private organizations committed to accelerating the success of their startup ecosystem. The rankings are based on a weighted average of a number of factors which calculate performance, funding, market reach, connectedness, talent & experience and knowledge. The factors use exits, estimated startup valuations, funding volumes, investor quality and activity, number of meetup group activities, number of accelerators and incubators, tech companies with secondary offices, talent quality and availability across STEM and Life Sciences, access to tech talent and cost, along with the patents and research publications.

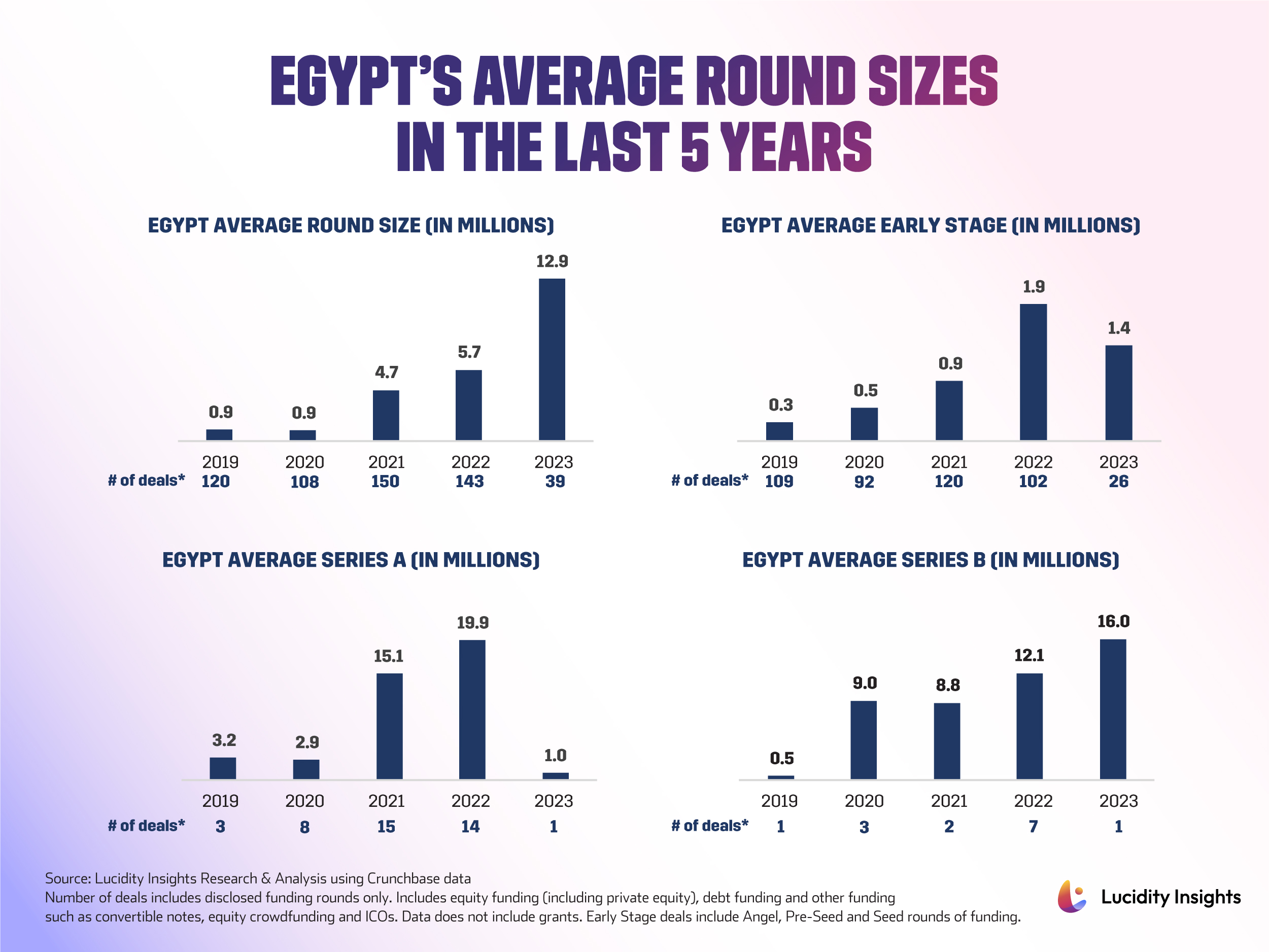

5. Average Round Sizes have been increasing over the past three years

Infobytes: Egypt’s Average Round Sizes in the Last 5 Years

Infobytes: Egypt’s Average Round Sizes in the Last 5 Years

Based on the number of deals that disclose a funding value, the average round size has been consistently increasing, however the growth is more pronounced in early-stage funding such as with angel, preseed and seed rounds of funding. Growth stage funding has been consistently increasing across both Series A and Series B rounds of funding. 2023 has been an abysmal year for many countries as startup funding has dried up, which is apparent with the number of deals having significantly dropped from the highs of 2021 and 2022.

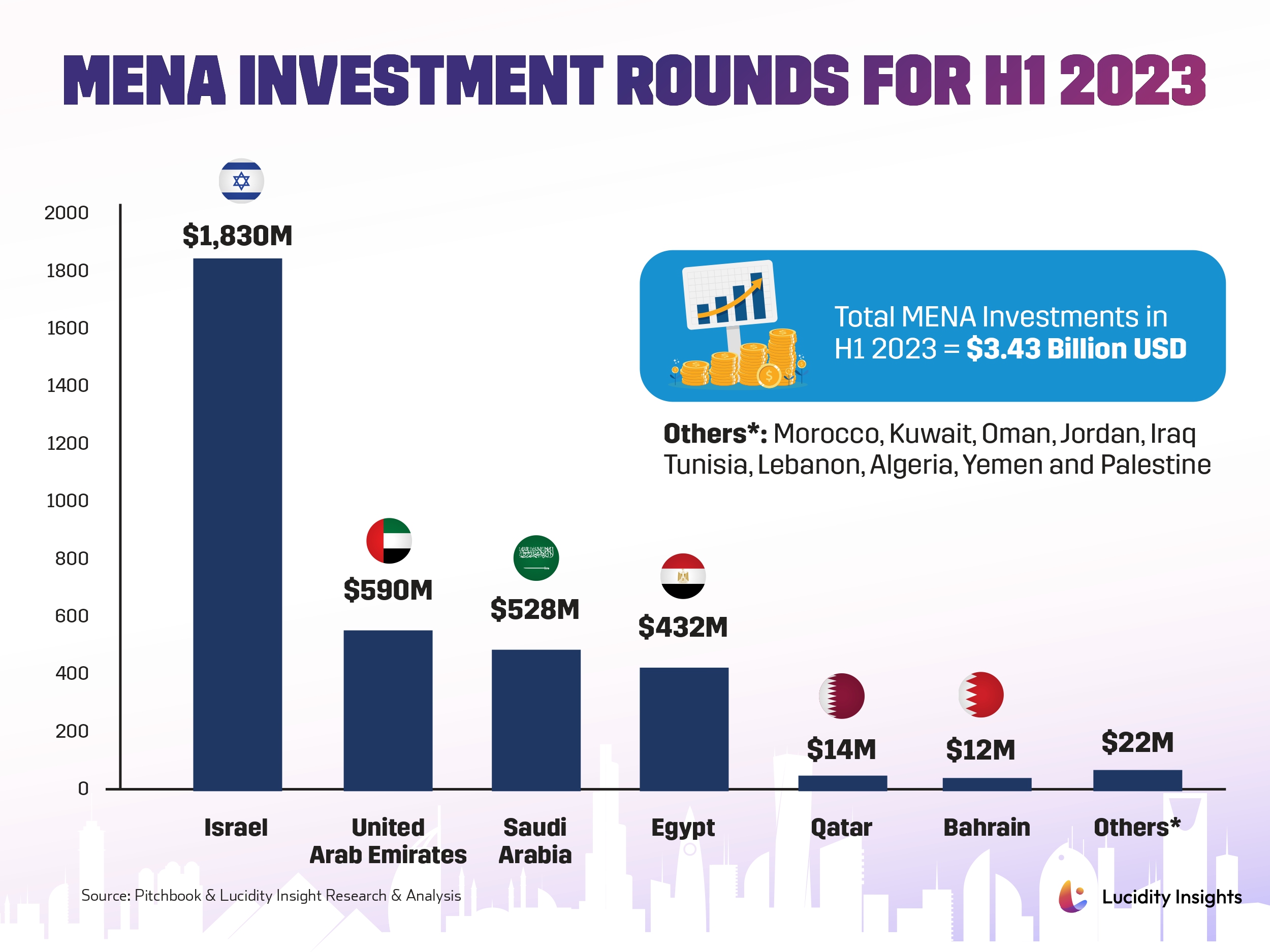

6. Egypt’s Startup Funding was bucking the global VC winter trend, and then H1 2023 happened

Infobyte: MENA Investment Rounds for H1 2023

Infobyte: MENA Investment Rounds for H1 2023

As of H1 2023, VC winter is apparent with noticeably smaller funds raised for each of these startup ecosystems, except Egypt. Israel still leads with $1.83 billion raised in H1 2023, but is on a crash course, as this is 80% lower than H1 2022’s $9.4 billion. UAE fundraised 16% less this H1 2023, with $590 million versus last year’s $699 million by this time. Saudi Arabia raised 10% less, with $528 million raised, versus last year’s $584 million.

Egypt, on the other hand, has raised 40% more this year than last year, having raised $432 million in H1 2023 versus $307 million in H1 2022. However considering 2023 full year performance tells a different story as final figures for Egypt stand at US$ 503 million implies that H2 2023 only saw another US$ 71 million in funding. Given that US$ 400 million is accounted for by MNT-Halan, the overall scenario goes to show that investors have been cautious in their investment approach in the country

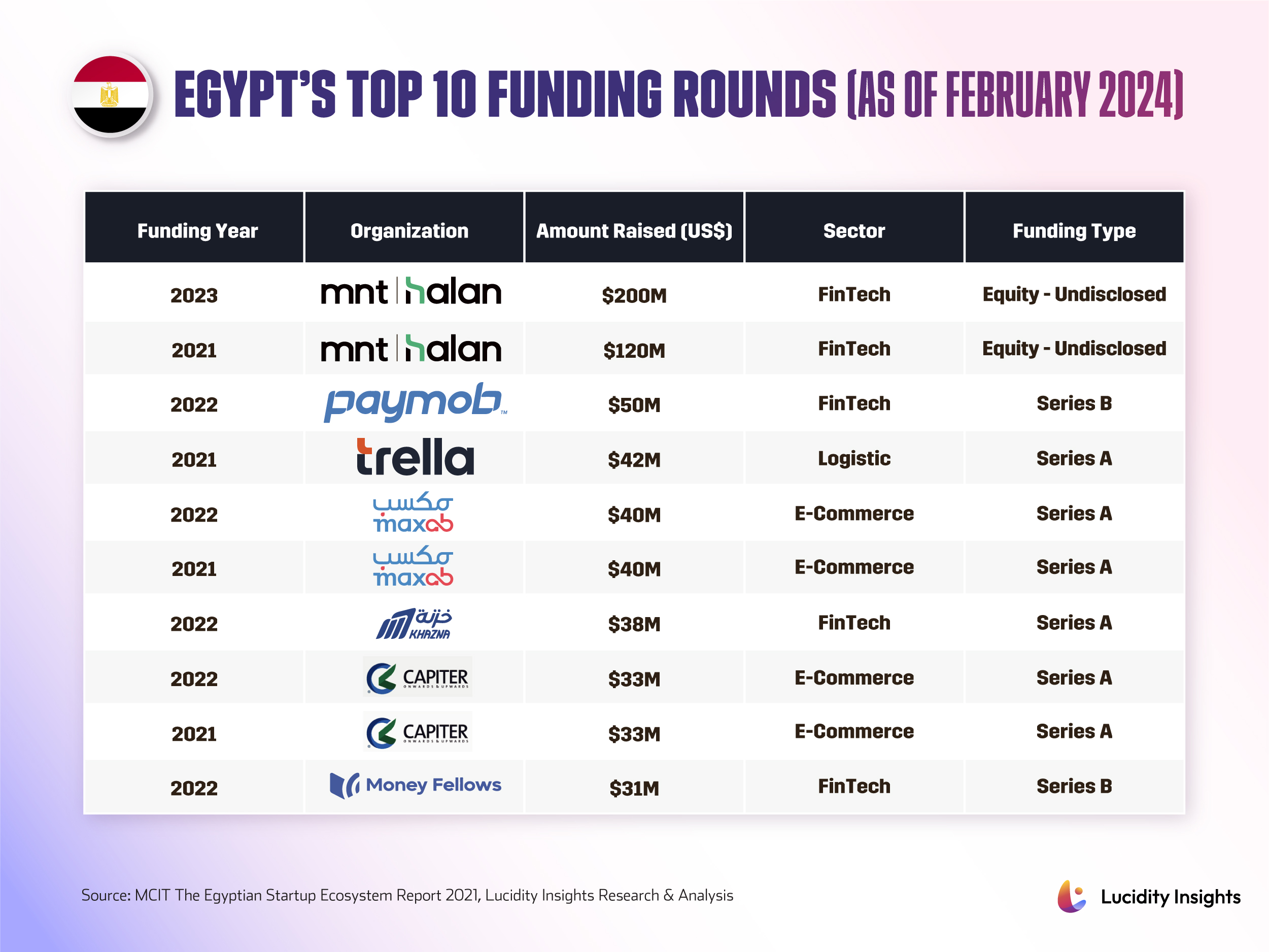

7. Egypt’s Largest Funding Rounds are all Fintech and E-commerce Players

Infobyte: Egypt’s Top 10 Funding Rounds to Date (As of February 2024)

Infobyte: Egypt’s Top 10 Funding Rounds to Date (As of February 2024)

FinTech and E-commerce dominate the largest funding rounds in Egypt, with mnt-Halan having the two largest equity funding rounds. mnt-Halan has gone onto raise an additional US$ 150 million including debt financing. The third largest is also a fintech player, Paymob, which is a digital payments enabler for enterprises to accept payments online and in-store.

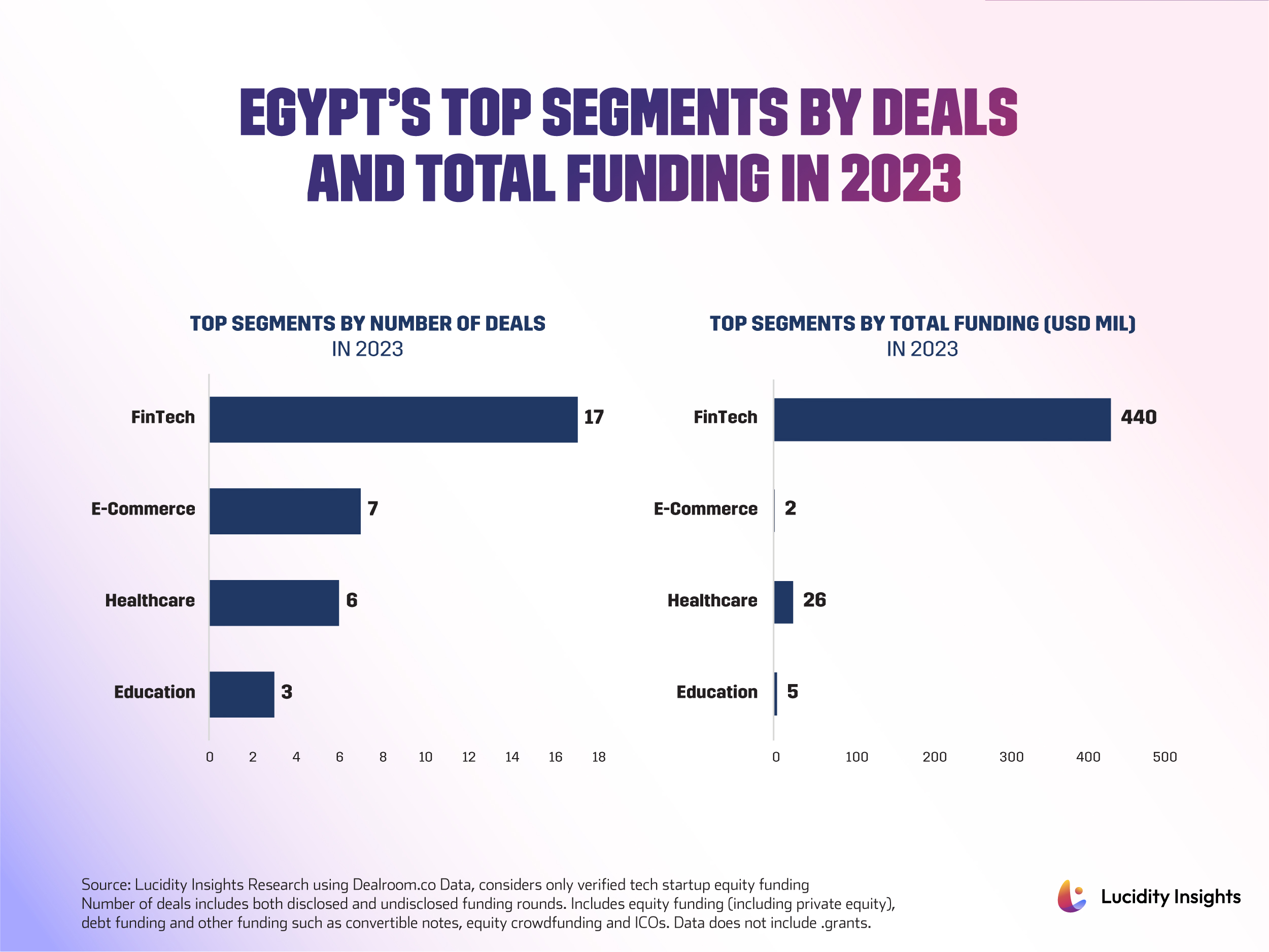

8. Fintech was by far the largest sector in 2023 for both deal count and value

Infobyte: Egypt’s Top Segments by Deals and Total Funding ($Mil) in 2023

Infobyte: Egypt’s Top Segments by Deals and Total Funding ($Mil) in 2023

FinTech startups dominated the funding landscape in Egypt during 2023. This is mainly on the back of funding received by mnt-Halan, which totaled US$ 400 million in 2023, in equity and debt funding. Fintech, invariably was also the highest in terms of deal count, followed by E-commerce. Healthcare was the third largest in terms of deal count, however the 2nd largest for funding value, at US$ 26 million. Healthcare funding was led by Yodawy, an online pharmacy marketplace and insurance benefits manager, which raised US$ 16 million in February 2023 and Chefaa, a healthcare startup focused on medicine and non-medicine delivery. 2023 has seen a major slowdown as Egypt has been grappling with the economic crisis, impacting startup funding as well.

9. Egypt produced Africa’s first unicorn and more

Infobyte: Egypt and Africa’s First Unicorn (and More)

Infobyte: Egypt and Africa’s First Unicorn (and More)

Egypt tech ecosystem has seen Fawry ‘s market capitalization touch US$ 1 billion after it listed on The Egyptian Exchange in August 2019. Egypt eventually does have a unicorn in mnt-Halan, when it achieved that status after raising upto US$ 400 million in equity and debt financing, in February 2023.

10. Egypt had a record 8 exits in 2022

Infobyte: Number of Exits in Egypt from 2019-2023

Infobyte: Number of Exits in Egypt from 2019-2023

Looking at the number of exits of VC-backed startups in the Egyptian tech ecosystem, we see that the market is still in the nascent stages but gaining momentum. In 2022, Egypt had a record 8 exits. In comparison with other Middle Eastern and African nations, Israel had a record 86 exits in 2021; the UAE had a record 15 exits in 2021; Turkey had a record 10 exits in 2023, and South Africa had a record 8 exits in 2023.

Next Read: Egypt’s Startup Ecosystem Highlights from 2023