Technology’s Role in Helping the Maritime Industry Become More Sustainable

Maritime trade has evolved technologically from the introduction of the steamships in the 1830s to adopting the latest communications technology to focusing on improvements in engine technology by replacing coal-based engines with diesel and oil-based ones.

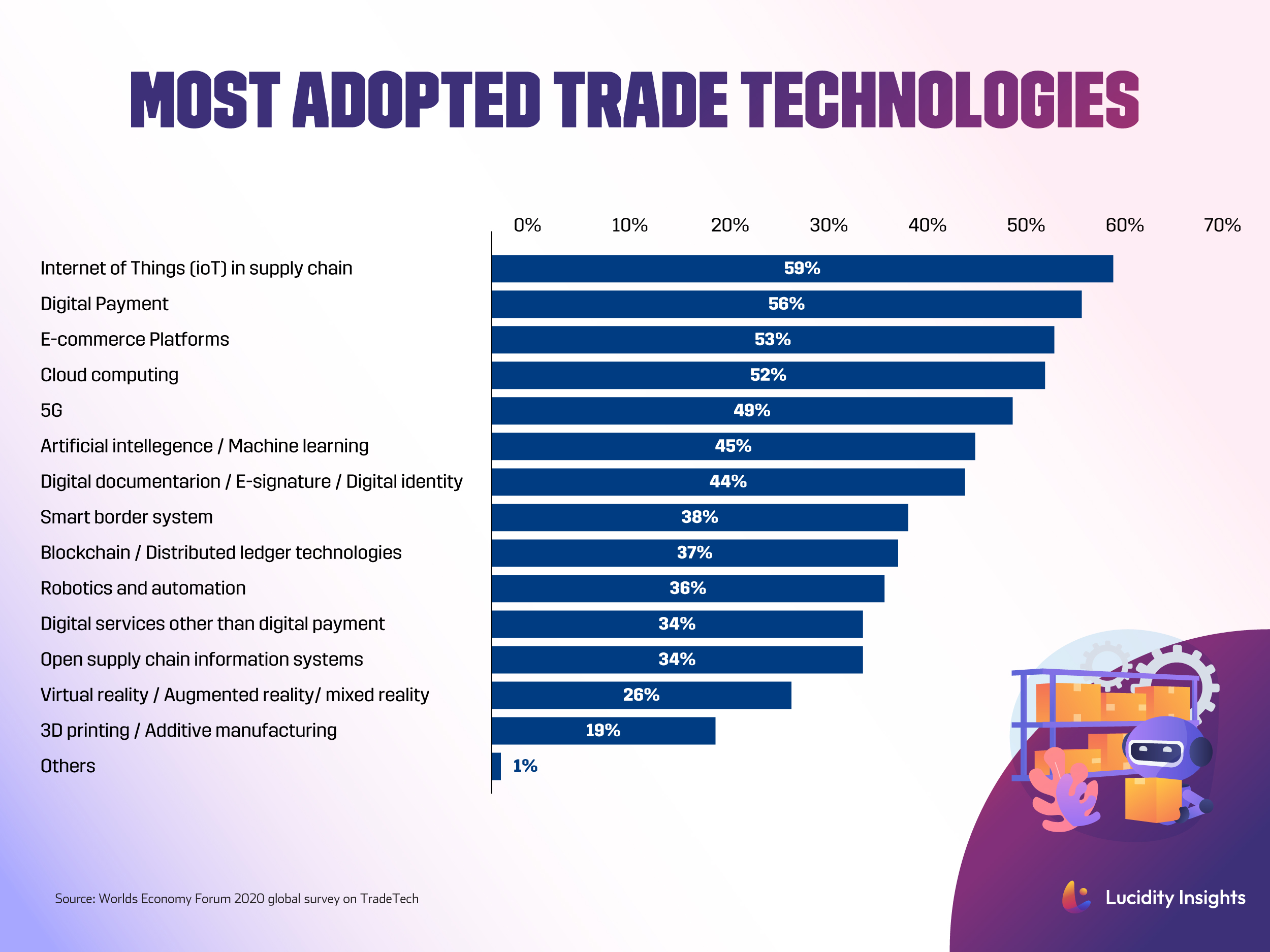

The next major breakthrough was in 1970s through containerization, which introduced a standardized way to transport goods. Now the global value chains have become dominant, accounting for 70% of all trade activities. The next phase in advancements in trade evolution is through digital technologies such as 5G, Artificial Intelligence, Blockchain, Internet of Things, and 3D Printing.

Technology is playing a crucial role in addressing both climate targets and improving efficiencies in the way trade is conducted across the globe. As covered in the report titled “Innovations in International Trade”, technological innovation is being witnessed across the value chain along with what their related impact is.

Read Lucidity Insights report on “Innovations in International Trade”, powered by DP World:

Infobyte: The 5 G's of Tradetech

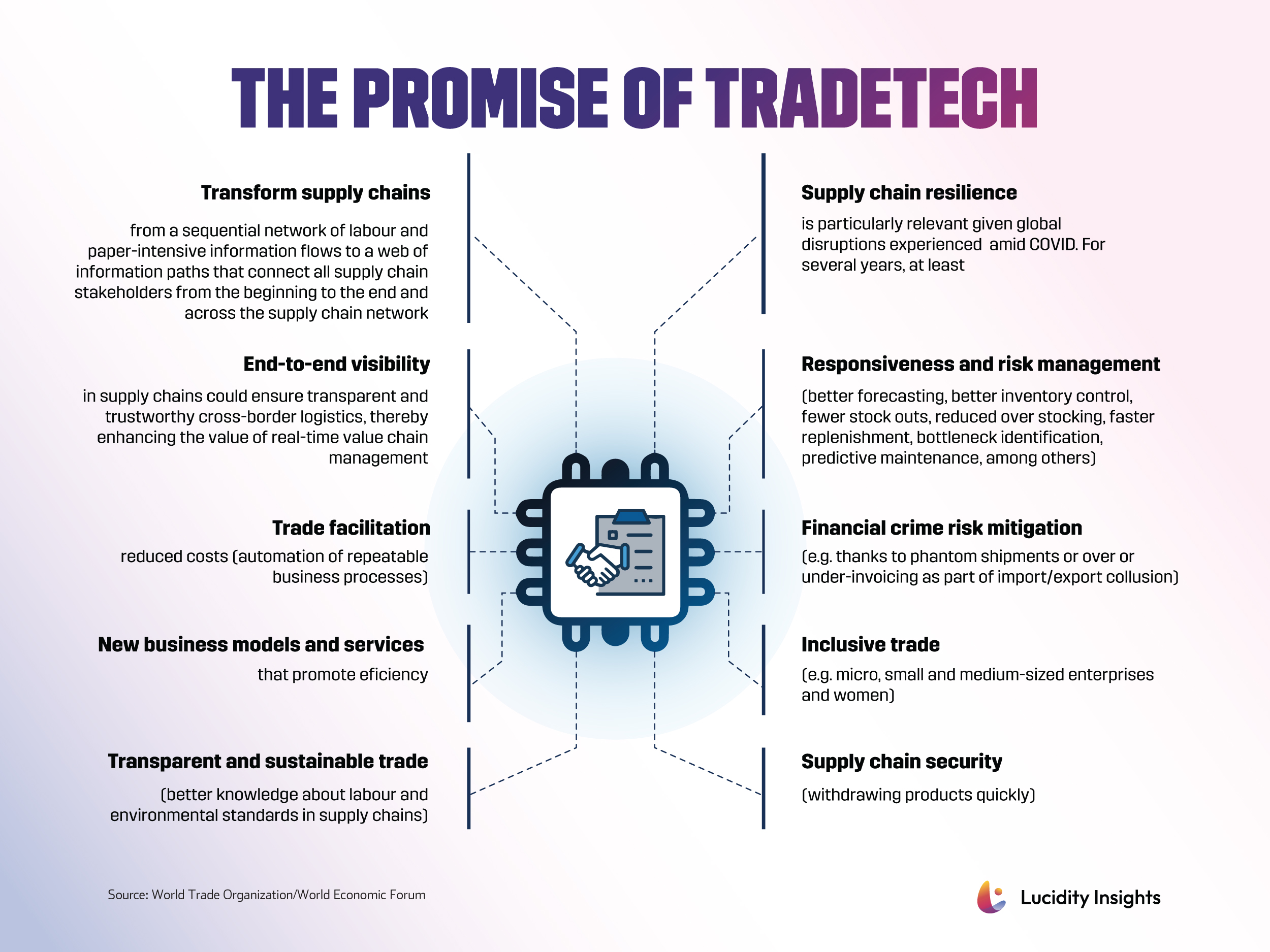

Two broad categories of climate tech and trade and maritime tech have risen in the past decade addressing the sustainability issues. There are multiple innovations occurring in both fields. Climate tech innovations include renewable energy solutions, sustainable agriculture, smart grids, green building technologies, carbon capture and storage and sustainable/renewable fuels. Some of the technologies are relevant for maritime trade especially renewable energy solutions and carbon capture and storage technologies. Over and above, TradeTech is another area which enables global trade to become more efficient, inclusive, and sustainable. There are five building blocks which play a critical role in supporting trade digitalization and wide-scale adoption of technology addressing trade, called the 5 Gs of TradeTech.

There are countries which are quite aggressive on prom oting TradeTech start-ups especially focused on marine tech. The few nations that stand out include Norway, Denmark, South Korea, and Singapore. Singapore has announced that it would be targeting 150 marine tech start-ups by 2025 and has ambitions to become the Silicon Valley of marine technology. The US and Netherlands are strong bases for TradeTech and maritime tech startups, as New York, Boston, and Rotterdam all are home to the busiest ports in the world.

Infobyte: The Promise of Tradetech

Infobyte: The Promise of Tradetech

TradeTech has the potential to transform the industry and even businesses think so as evidenced by the results in WEF’s global survey on TradeTech. 63% of respondents indicated that TradeTech will impact in lower trade costs and higher speed while 49% of respondents indicated positive environmental outcomes as a potential outcome. Clearly TradeTech holds a lot of promise.

Technologies such as artificial intelligence and autonomous robotics are emerging to optimize capacity and routing. IoT can contribute to tracking carbon emissions across supply chains. Freight forwarders and shippers can compare the environmental performance of carriers. 5G technology will improve the service experience and with AI and IoT, the combination of technologies is bound to make port operations, warehouse management and customs bonded supervision much easier and cost efficient. Blockchain is also being explored in trade-related sectors, from trade finance to customs and certification processes, insurance, logistics and distribution as well as supply chain traceability. 3D printing is also going to impact trade where physical trade flows will possibly shift from finished goods to 3D printing raw materials and trade in intermediate products will reduce.

More than 20 ports have installed equipment to automate some, or all, of their processes since 2015. Currently more than 40 ports have some level of autonomous equipment. The world’s first automated container terminal (Maasvlakte II) in Port of Rotterdam includes unmanned cranes and Electricpowered Automated Guided Vehicles and is only run by 10–15 staff each day. The Port of Newcastle has developed the concept for an automated container terminal development at its Mayfield site which has a capacity for a 2 million TEU per annum container terminal, coupled with a shipping channel that can accommodate vessels up to 10,000 TEU. The Port of Singapore will utilize technologies including automated wharf and yard functions and full-electric automated guided vehicles and aims to be the largest fully autonomous terminal in the world. After speaking to several port operators, many say they are ready to electrify and automate their ports tomorrow, but there are 6 months to 2 year waitlists for many of the autonomous equipment and vehicles making the transition challenging.

One other area which can immensely benefit from technological evolution in trade is trade finance. Globally demand is strong for supply chain finance and as the global value chains have increased along with technology providing access to increasing number of small & medium sized enterprises, this figure is expected to further increase. The trade finance gap was estimated at US$ 1.5 trillion, with most of the underserved businesses being in East Asia and the Pacific. Post pandemic, this figure has shot up to over US$ 2 trillion due to rising risk aversion and inflation eating into lending limits.

Infobyte: Most Adopted Trade Technologies

There are key stakeholders who are leading the charge for technology adoption including Port of Rotterdam, DP World (a leading maritime firm), Port of Singapore Authority, Eastern Pacific Shipping (through its EPS Ventures) are among the few which are investing in the maritime ecosystem. Leading companies also have their own venture capital and investment arms.

Technology has already started impacting the way trade functions and with the added responsibility of achieving sustainability targets, the maritime industry has already started the process of adopting different technologies, however a lot more must be done in order to achieve IMO’s target of reducing total annual GHG emissions from international shipping by at least 70% by 2040.